Accruals make it possible to track various types of Paid Leave such as Sick Time, Vacation Time, and / or Personal Time. InfiniTime's Accrual Features can be used to:

Track Total Accrued Hours for various types of Paid Leave (IE: Sick Time, Vacation Time, Personal Time)

Track Remaining Hours for various types of Paid Leave (IE: Sick Time, Vacation Time, Personal Time)

Track Used Hours for various types of Paid Leave (IE: Sick Time, Vacation Time, Personal Time)

Provide employees with access to Accrual Balances

Provide employees with access to a detailed history for all types of Paid Leave, including specific dates on which hours were earned and used according to organizational policies.

InfiniTime includes two Accrual Packages, Basic Accruals and Accruals Plus. The Basic Accruals Package included with the InfiniTime Application is designed to meet the needs of most customers with support for up to two accrual buckets (IE: Vacation and Personal Time) and standard accrual functionality. Accruals Plus was developed for users who require a more robust solution for Accruals with support for extended features such as:

This document will address the Basic Accruals and Accruals Plus modules separately. Multiple tables are used throughout this section to facilitate the gathering of accrual related information. Blank forms for documenting your organizations accrual requirements are provided at the links below and may be printed as desired. Additionally, a process flow diagram is also provided which describes the high level procedure for configuring employee accruals for an enterprise organization.

Employee Accruals Tables 1 to 5

Employee Accruals Configuration Process Flow Diagram

In most scenarios difficulties with Accruals configuration are related to having an incomplete understanding of an organization’s accrual requirements. For this reason a detailed process has been established for gathering information required to properly document an organization’s accrual requirements. When attempting to identify accrual requirements it is often helpful to ignore specific features and options within InfiniTime and start by focusing on the needs of your organization. Once the organization’s accrual requirements are understood finding the appropriate options within InfiniTime is generally not a problem.

The procedure for configuring accruals is similar to the method used for configuring Policies and Holidays. Employee groups requiring different accrual settings must be identified before attempting to configure accruals within the InfiniTime Application. Keep in mind it is common for accrual benefits to change based upon the amount of time employees have been with a company. Because of this Classes and Tenures will likely be required. Remember, classes can be used to group multiple accrual types together and tenures are used to automatically move employees from one accrual type to the next based upon the length of time they have been with the company.

To setup accruals there are five main tasks that must be performed:

Use Employee Accruals Table 1 to identify groups of employees (Or individual employees) requiring different accrual settings.

For example ABC Company has the following personnel:

Employee Accruals Table 1 |

|

| Job Title | Pay Type |

Administration |

Salary |

| Cleaning Staff | Full Time |

| Front Desk Staff | Full Time |

| Kitchen | Full Time |

| Child Day Care | Part Time |

| Night Auditors | Part Time |

ABC Company Part Time employees do not receive benefits in the form of Vacation or Personal Time though they are eligible for Sick Time after they are with the company for a year. Salary and Full Time Employees must be employed for 90 days prior to accruing Vacation or Personal Time though they accrue Vacation and Personal Time Hours at different rates. After reviewing the employees and policies at ABC Company the following classes, or groups of employees, require different accrual settings:

Salary

Full Time

Part Time

Complete Employee Accrual Table 2 to identify each Accrual Calculation for which the previously listed classes are eligible for. One accrual calculation is required for each bucket of hours where Accrued Hours, Remaining Hours, and Used Hours must be tracked separately for employees. Remember, the basic accruals package can track a maximum of two Accrual Calculations for any given Accrual Type. If your organization tracks more than two Accrual Calculations, you will need the Accrual Plus Module. Your Inception Technologies Sales Representative can provide additional information on the Accrual Plus Module.

Employee Accruals Table 2 |

||

| Class | Accrual Calculation 1 | Accrual Calculation 2 |

Part Time |

Sick Time (After 1 Year of Employment) | |

| Full Time | Vacation Time | Personal Time |

| Salary | Vacation Time | Personal Time |

Review Employee Accruals Table 3 below and identify each point when accrual benefits change for each class for your organization. In most organizations, employee paid leave benefits increase based upon the amount of time the employee has spent with the company. It is not unusual for different classes, or groups of employees, to receive additional benefits at different milestones. In some circumstances, employee paid leave benefits for a specific type of paid leave may increase at different milestones when compared with other types of paid leave in a single accrual class. This scenario requires the Accrual Plus Accrual Calculation Tenures feature and is only supported by the Accrual Plus Module. The example below assumes all types of paid leave for each single accrual class receive additional benefits at uniform, or equally divisible, milestones.

For example, Part Time Employees at ABC Company receive 2 Days (16 Hours) of Paid Sick Time after their first year of employment. This benefit does not increase for part time employees based upon the amount of time they have been with the company. ABC Company rewards Full Time and Salary employees with additional Vacation and Personal Time benefits at the following milestones: After 3 Years, After 5 Years, and After 10 Years of Employment. With this in mind, ABC Company requires the following tenure ranges for each class:

Employee Accruals Table 3 |

|

| Accrual Class: Part Time Employee Accruals | |

Tenure Min |

Tenure Max |

0 Years |

1 Year |

| 1 Year | 99 Years |

Employee Accruals Table 3 |

|

| Accrual Class: Full Time Employee Accruals | |

Tenure Min |

Tenure Max |

0 Years |

3 Years |

| 3 Years | 5 Years |

| 5 Years | 10 Years |

| 10 Years | 99 Years |

Employee Accruals Table 3 |

|

| Accrual Class: Salary Employee Accruals | |

Tenure Min |

Tenure Max |

0 Years |

3 Years |

| 3 Years | 5 Years |

| 5 Years | 10 Years |

| 10 Years | 99 Years |

Complete Employee Accruals Table 4 for each group of employees or individual employees requiring different accrual settings using the Classes, Accrual Calculations, and Tenure Ranges identified in Steps 1 to 3. At this point, you may wish to refer to the Basic Accruals Module Features and Settings Section of this document to familiarize yourself with the Accrual Calculation options available within InfiniTime. This will help with completing the ‘Settings’ column of Employee Accruals Table 4. As you fill out the table, keep the following rules in mind:

Employee Accruals Table 4 |

|||

| Accrual Name: Part Time Employee Accruals | Employee Group (Accrual Class): Part Time | ||

| Tenure Min | Tenure Max |

Accrual Calculation | Settings |

0 Years |

1 Year | NONE | Reset Type: N/A Calculation Method(s): None Calculation Modifiers: None |

| 1 Year | 99 Years | Sick Time | Reset Type: Calendar Year Calculation Method(s): Start at 16 Hours Calculation Modifiers: None |

Employee Accruals Table 4 |

|||

| Accrual Name: Full Time Employee Accruals | Employee Group (Accrual Class): Full Time | ||

| Tenure Min | Tenure Max |

Accrual Calculation | Settings |

0 Years |

3 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 40 Hours Calculation Modifiers: None |

| 3 Years | 5 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 80 Hours Calculation Modifiers: None |

| 5 Years | 10 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 96 Hours Calculation Modifiers: None |

| 10 Years | 99 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 120 Hours Calculation Modifiers: None |

0 Years |

3 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 16 Hours Calculation Modifiers: None |

| 3 Years | 5 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 32 Hours Calculation Modifiers: None |

| 5 Years | 10 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 48 Hours Calculation Modifiers: None |

| 10 Years | 99 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 64 Hours Calculation Modifiers: None |

Employee Accruals Table 4 |

|||

| Accrual Name: Salary Employee Accruals | Employee Group (Accrual Class): Salary | ||

| Tenure Min | Tenure Max |

Accrual Calculation | Settings |

0 Years |

3 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 48 Hours Calculation Modifiers: Carry Over |

| 3 Years | 5 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 88 Hours Calculation Modifiers: Carry Over |

| 5 Years | 10 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 104 Hours Calculation Modifiers: Carry Over |

| 10 Years | 99 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 128 Hours Calculation Modifiers: Carry Over |

0 Years |

3 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 32 Hours Calculation Modifiers: Carry Over |

| 3 Years | 5 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 48 Hours Calculation Modifiers: Carry Over |

| 5 Years | 10 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 64 Hours Calculation Modifiers: Carry Over |

| 10 Years | 99 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 72 Hours Calculation Modifiers: Carry Over |

Configure Accrual Types as necessary for each employee group using the completed tables. When properly completed, Employee Accruals Table 3 has one row for each Accrual Type required for your organization.

Configure Accrual Calculations for each Accrual Type using Employee Accruals Table 4. When properly completed, Employee Accruals Table 4 has one row for each Accrual Calculation required for your organization. The procedure for configuring accrual types and accrual calculations is outlined below in the Employee Accruals Configuration Process Flow Diagram.

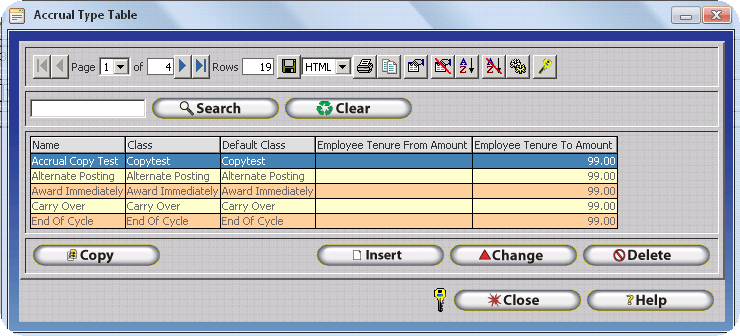

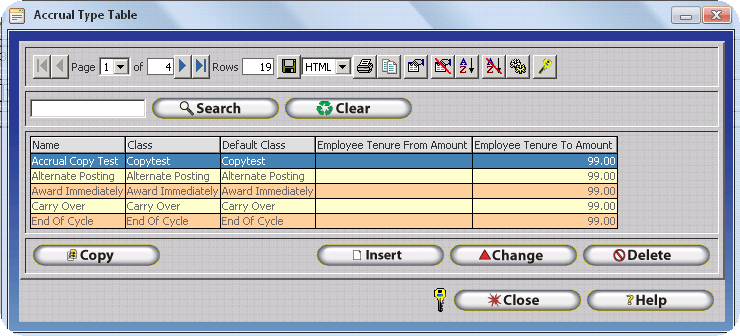

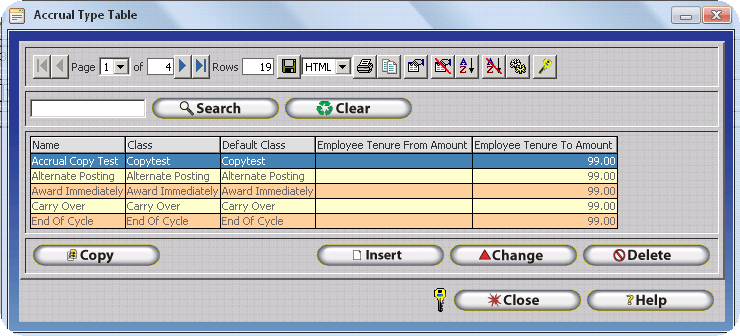

The Accrual Types Table will be displayed. The Accrual Types Table displays all accrual types in the InfiniTime Database, for all Accrual Classes and Tenure ranges.

Login to the Manager Module as an Administrator

Click on Lookups

Click on Calculations Setup

Click on Accrual Types

The Accrual Types Table will be displayed

Click Insert to access the Accrual Type Update Form

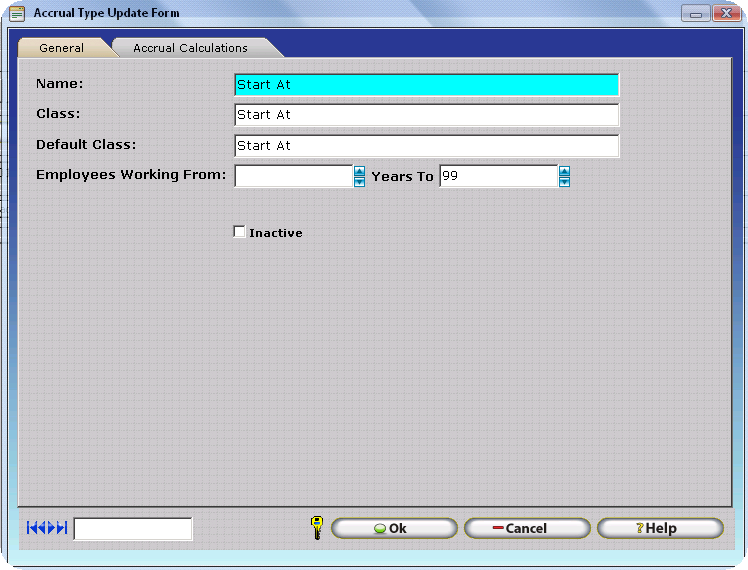

The Accrual Types Update Form is used to create accrual types. As detailed in the Basic Accruals Overview section, one accrual type is required for each row in Employee Accruals Table 3.

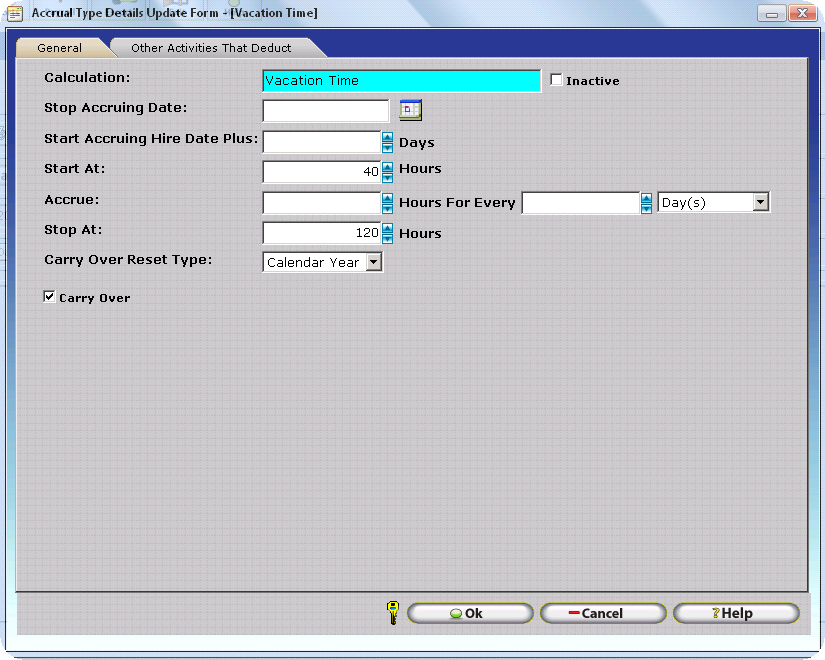

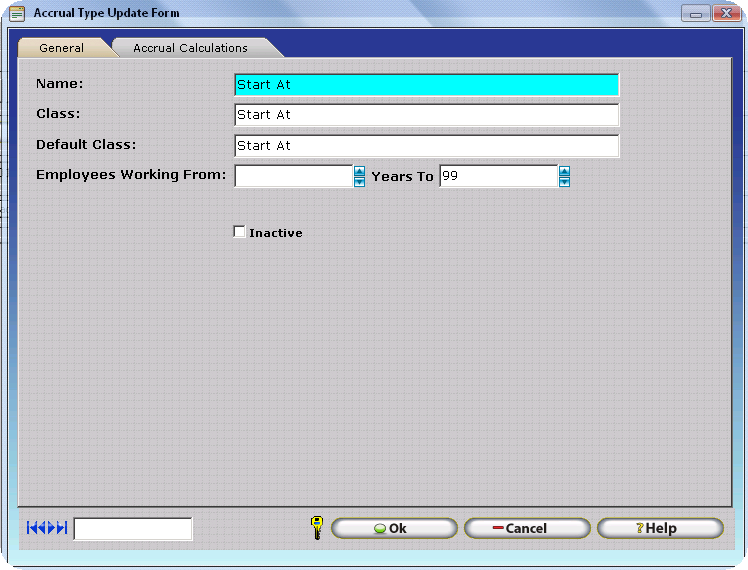

Accrual Type Update Form General Tab:

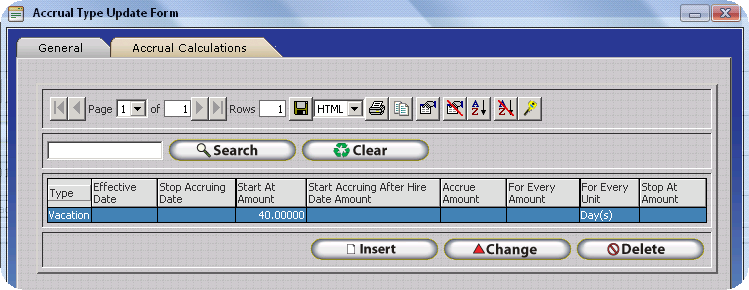

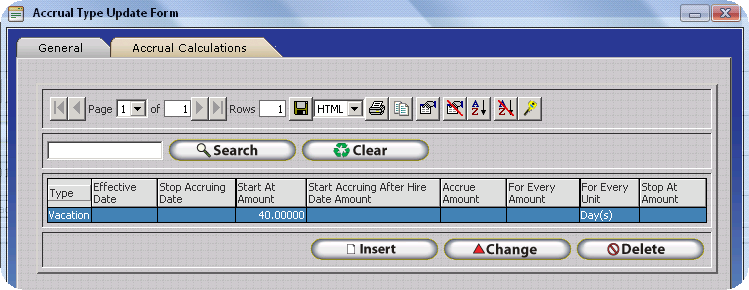

Accrual Type Update Form Accrual Calculations Tab:

Login to the Manager Module as an Administrator

Click on Lookups

Click on Calculations Setup

Click on Accrual Types

The Accrual Types Table will be displayed.

Click on an existing Accrual Type and click Change.

Click on the Accrual Calculations Tab.

Click Insert to access the Accrual Calculations Update Form.

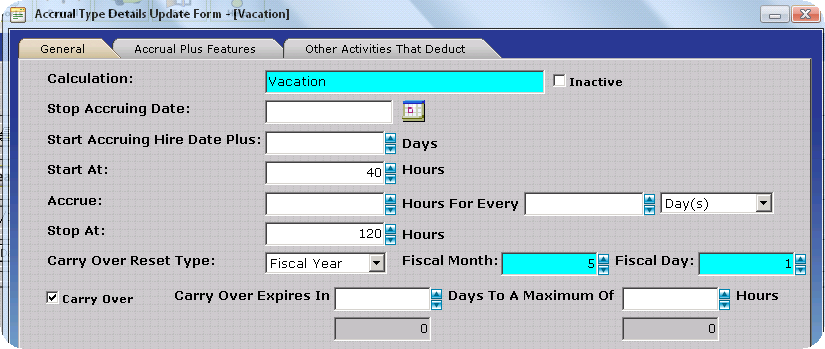

Accrual Calculation Update Form General Tab:

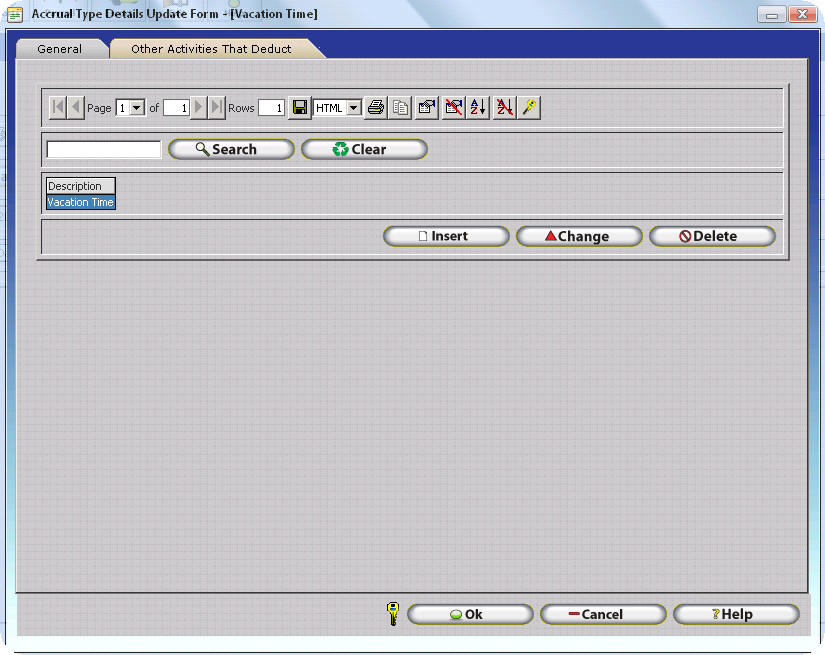

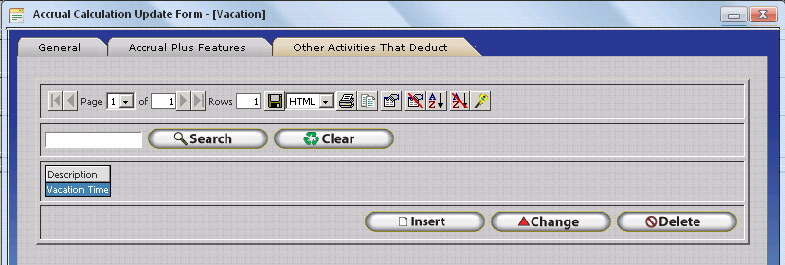

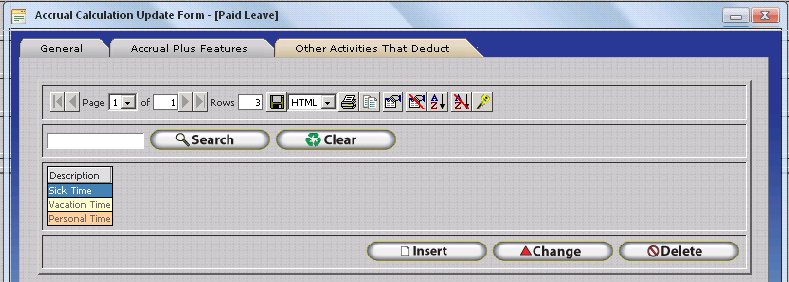

Accrual Calculation Update Form Other Activities That Deduct Tab:

The Accrual Calculations Update Form is used to create accrual calculations for a specific Accrual Type. As detailed in the Basic Accruals Overview section, one accrual calculation is required for each row in Employee Accruals Table 4. It should be noted that the Basic Accrual Module supports a maximum of two Accrual Calculations per Accrual Type.

InfiniTime Accrual Calculations are comprised of three separate types of features and settings:

Reset Type

Calculation Method(s)

Calculation Modifiers

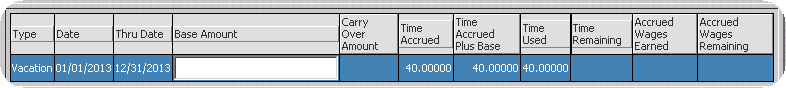

The Basic Accruals Module supports two Reset Types which determine the Accrual Period Date Range and the date on which employee accrual hours are carried forward or reset. The ‘Calendar Year’ Reset Type uses the Calendar Year (January 1st – December 31st) as the basis for Employee Accrual Periods. Calculation Modifiers are then applied as appropriate. For example, an accrual calculation configured as shown below will carry over unused hours as of December 31st into the next accrual period. Additionally, Employees will be awarded 40 additional hours for the new accrual period every year on January 1st.

Carry Over Reset Type: Calendar Year

Calculation Method(s): Start at 40 Hours

Calculation Modifiers: Carry Over

The ‘Anniversary’ Reset Type uses each individual employee’s Hire Date as the basis for Employee Accrual Periods. Calculation Modifiers are then applied as appropriate. For example, an accrual calculation configured as shown below for an employee hired on May 6th 2012 will award 40 hours to the employee after 90 days of employment, carry unused hours as of May 5th 2013 forward into the next accrual period beginning on May 6th 2013 and award an additional 40 hours on May 6th 2013.

Carry Over Reset Type: Anniversary

Calculation Method(s): Start at 40 Hours

Calculation Modifiers: Carry Over, Start Accruing Hire Date Plus 90 Days

The Basic Accruals Module supports two Calculation Methods for awarding accrual hours to employees. The ‘Start At’ Calculation Method makes hours available for use by the employee immediately at the start of each Accrual Period where as the ‘Accrue’ Calculation Method adds a specified amount to available hours at regular intervals. The first task when configuring accrual calculations within the Basic Accruals Module is to identify the accrual method which meets customer requirements, afterwards any additional options can be configured as necessary. It should be noted that a single Accrual Calculation can use one or more Calculation Methods, though at least one Calculation Method must be configured.

Calculation Modifiers are optional rules and features which alter the way Calculation Method(s) award hours. The Basic Accruals Module includes a limited number of Calculation Modifiers which provide support for simplistic Employee Accrual Calculations. Calculation Modifiers supported by the Basic Accruals Module are listed below. More advanced Employee Accrual Calculations and feature sets are supported with Calculation Modifiers available in the Accruals Plus module. A complete description of how each Calculation Modifier alters Calculation Method(s) is provided below.

Basic Accruals Module Calculation Modifiers |

|

| Stop Accruing Date | Carry Over |

| Start Accruing Hire Date Plus | Stop At |

Remember: Calculation Methods permit the user to define the exact calculation and frequency used to award hours to employees. A single Accrual Calculation can have one or more calculation methods. InfiniTime will display a warning if you attempt to save an Accrual Calculation without configuring at least one calculation method.

The ‘Start At’ Calculation Method awards hours to employees on the First Day of each accrual period. Hours awarded by the Start At Calculation method are available for immediate use and is intended for use employees have a given amount of hours available during the accrual period which can be used as needed. For example the ‘Start At’ calculation method would be used if employees have 40 Vacation Hours to use as needed throughout the year. Alternatively, the ‘Accrue’ calculation method would be used if employees received .769 hours for every seven days of employment.

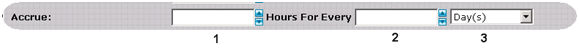

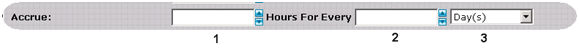

Using the ‘Accrue’ Calculation Method awards a predefined number of hours to employees at a set interval over time. The ‘Accrue’ Calculation Method is based on a three part formula as illustrated below.

1 – Accrue Amount - Enter the number of hours to be awarded to employees at each interval in this field. This field supports up to six decimals accuracy. IE: 14.123456

2 – Accrual Interval Amount - For the Day(s) or Month(s) Accrual Interval Unit, enter the number of Days or Months to define the length of the Accrual Interval. Employees will be awarded hours at the last day of every accrual interval. Alternatively, for the Hour(s) Worked Accrual Interval Unit enter the number of Hours that employees must work before hours will be awarded. Employees will be awarded hours on each date successive date on which they accumulate this number of hours.

3 – Accrual Interval Unit - Choose Days, Hours, or Months from the drop down to set the Accrual Interval unit. The Accrual Interval Unit determines the frequency at which hours will be awarded to employees.

Day(s) – Bases the accrual interval on a number of days after the beginning of the accrual period.

Hour(s) – Bases the accrual interval on the number of hours worked by the employee.

Month(s) – Bases the accrual interval on the number of months after the beginning of the accrual period.

An example of each Accrual Interval Unit, and how hours are awarded, is provided below. For example the settings below accrue 1.538462 Hours for every two weeks employees are employed by the company for a total of approx. 40 hours per year.

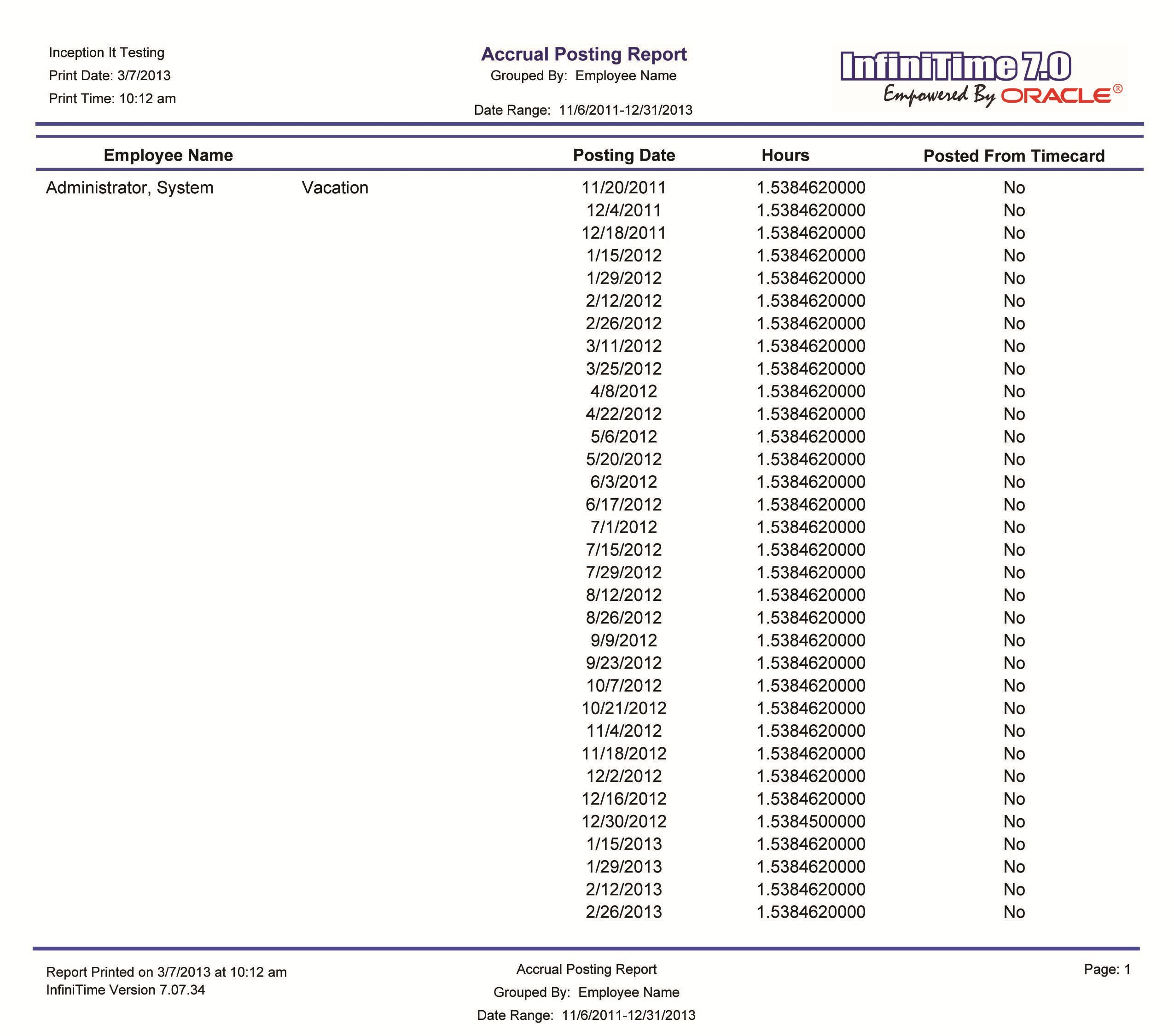

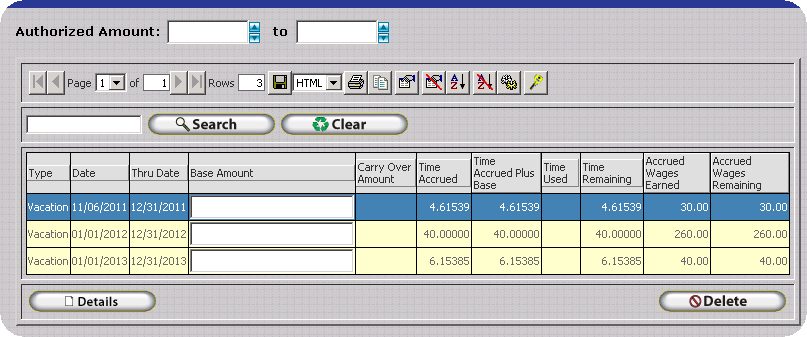

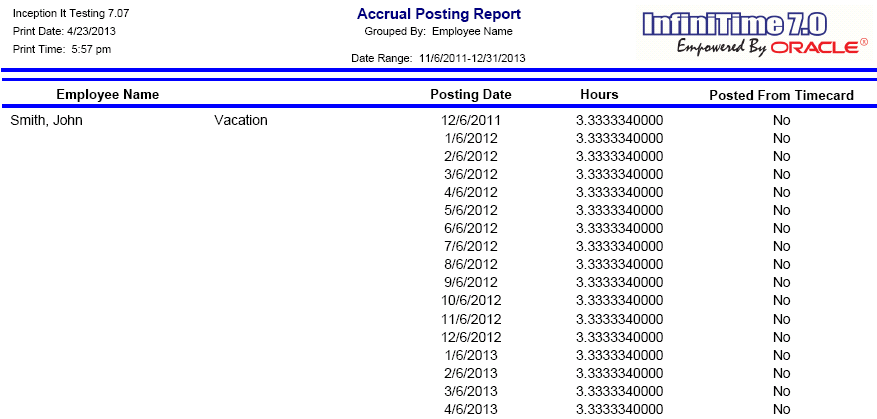

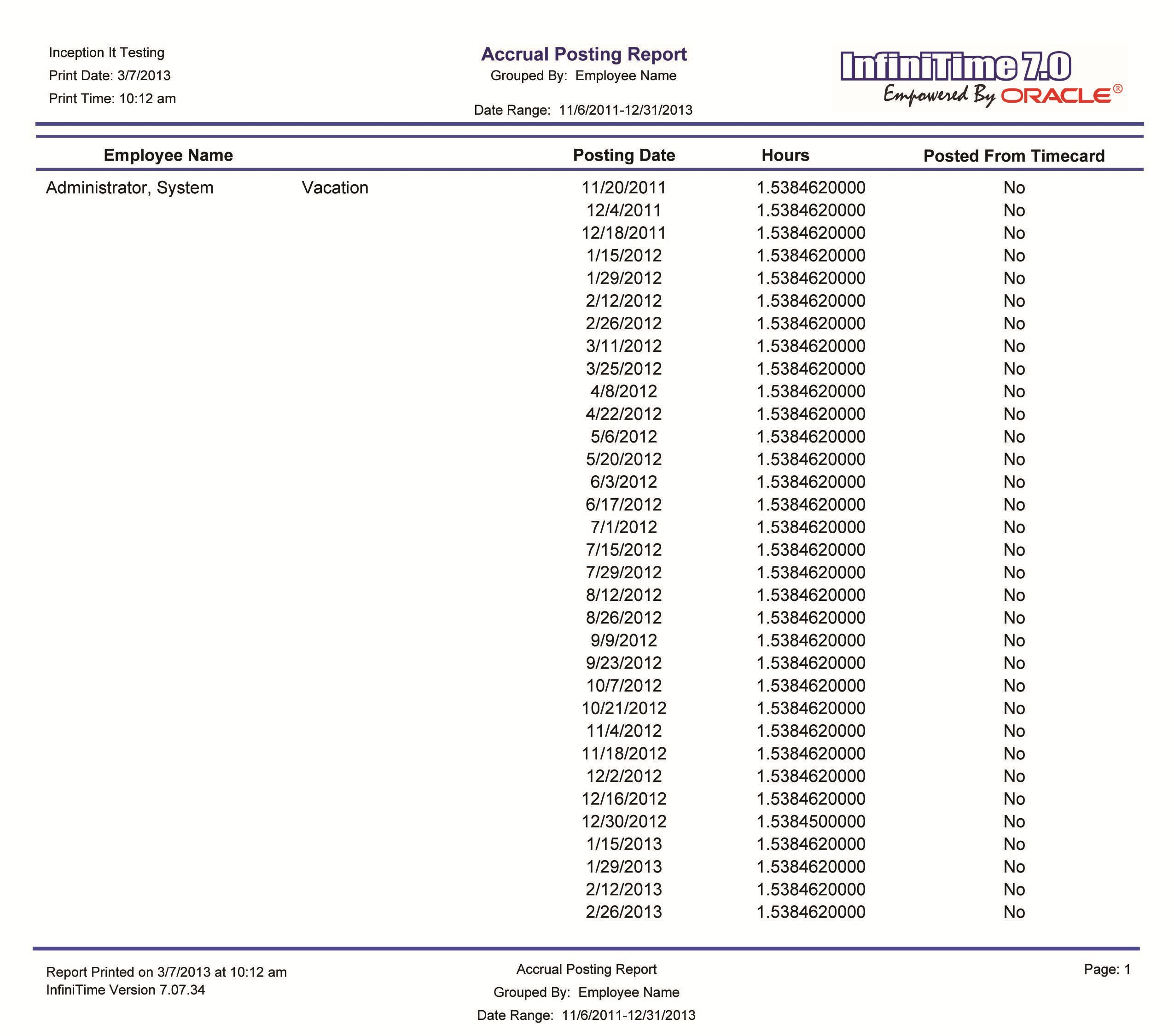

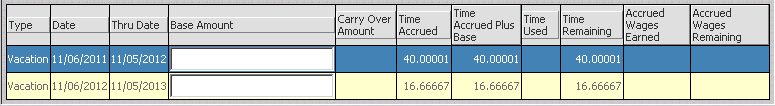

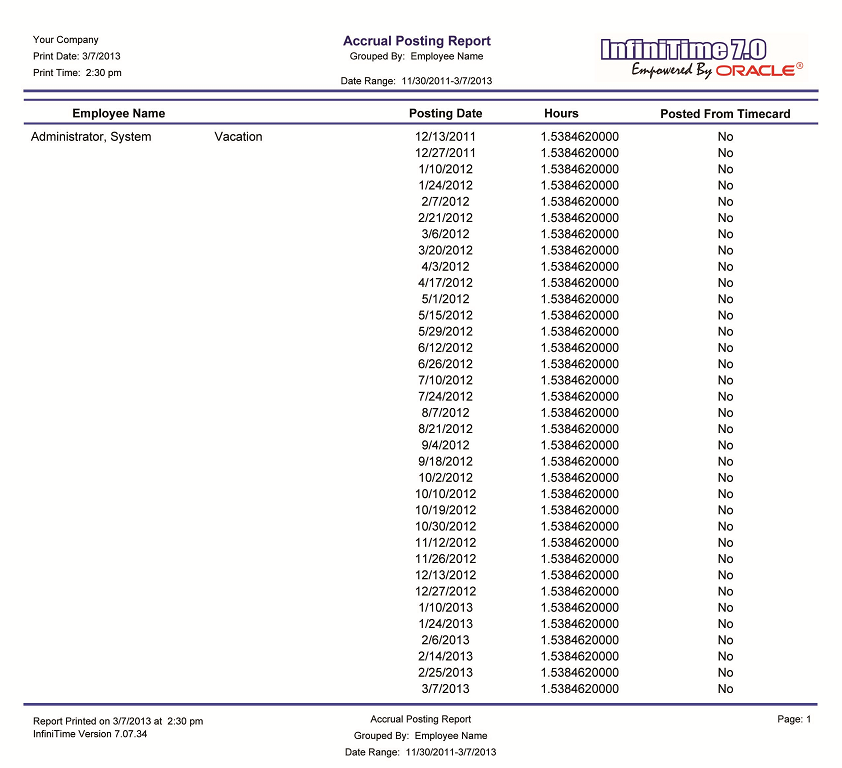

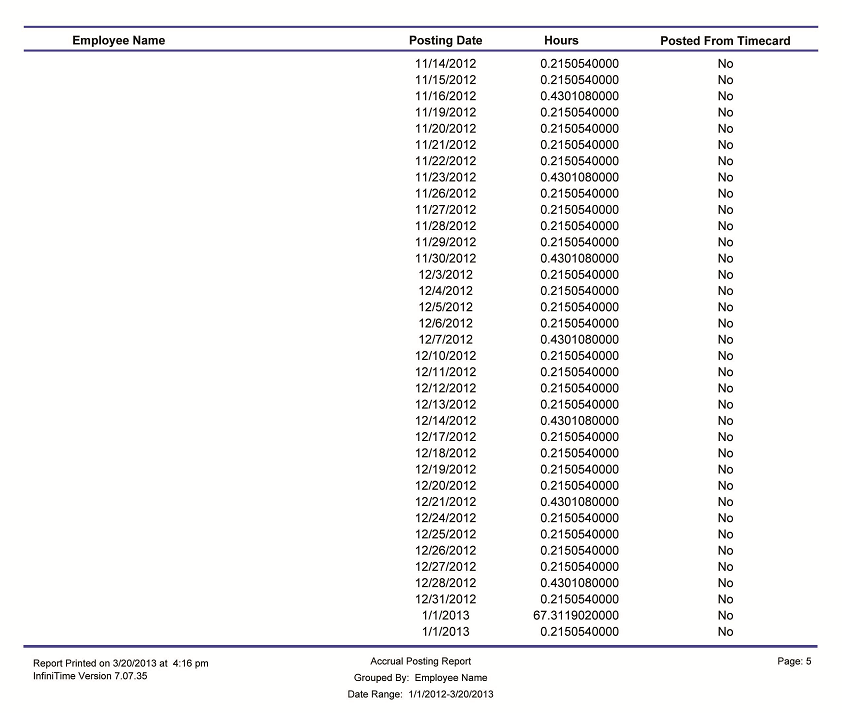

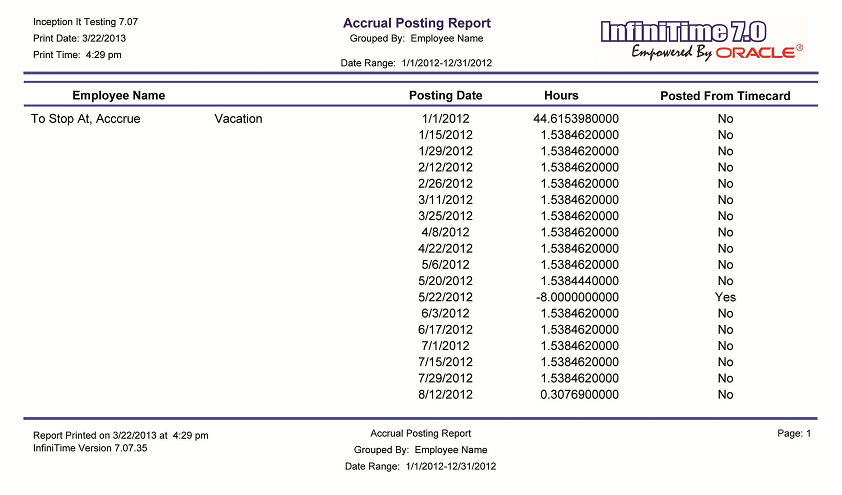

The Accrual Calculation and related settings below show an example of how Employee Accrual Hours are awarded for the Accrual Calculation Method under the Day(s) Accrual Interval. Notice how the Accrual Interval Amount defines the length of the accrual interval where as the Accrue Amount determines the number of hours awarded for each accrual interval. In this example, the Employee is awarded 1.53846 hours every 14 days for a total of 40 hours per Calendar Year Accrual Period.

Employee Hire Date: 11/06/2011

Accrual Reset Type: Calendar Year

Stop At: 40

The screenshot below shows each date on which accruals are awarded for the employee. Note that with the Basic Accruals Module, progress toward the next Accrual Interval starts over at the end of the accrual period. Any progress toward the next accrual interval on the last day of the Accrual Period is lost. This can be observed at the end of the 2011 and 2012 accrual periods as shown in the report below. For example, the last date in 2011 for which Vacation Hours are awarded is 12/18/11. The first date in 2012 for which Vacation Hours are awarded is 1/15/2012. Only 13 calendar days exist between 12/18/2011 to 12/31/2011, which is 1 day short of the 14 day Interval. On 1/1/2012 the progress toward the next interval is reset, resulting in the employee being awarded hours on 1/15/2012, after the 14th day of employment has passed in the new accrual period. After 1/15/2012, the employee is awarded hours every 14 days.

NOTE: Accrual Intervals can be forced to persist through accrual periods, such that progress toward the next accrual interval is not lost at the end of the Accrual Period, with the ‘Accrual Interval Persists through Accrual Periods’ Accrual Plus Feature.

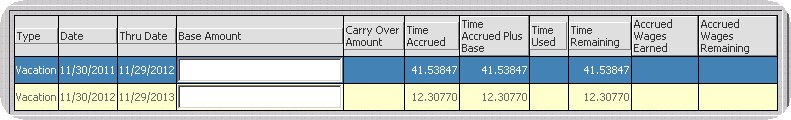

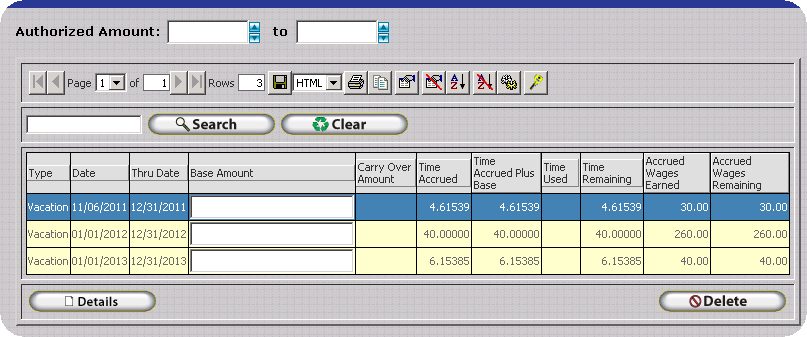

As of 3/7/13, based on the Accrual Settings detailed above and the resulting Employee Accrual Posting Records, the employee will receive a total of 4.61539 Vacation Hours in 2011, 40 Vacation Hours in 2012, and 6.15385 Vacation Hours in 2013.

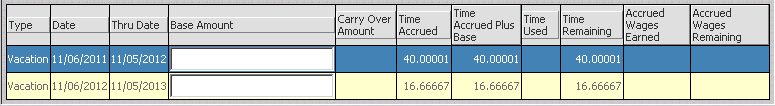

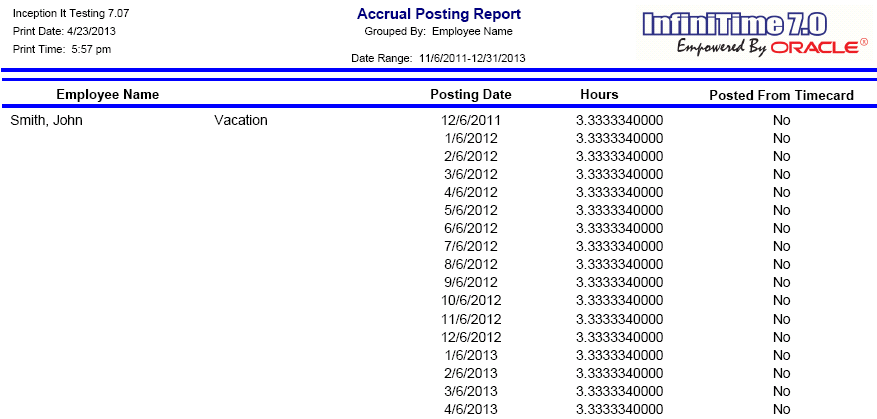

The Accrual Calculation and related settings below show an example of how Employee Accrual Hours are awarded for the Accrual Calculation Method under the Month(s) Accrual Interval. Notice how the Accrual Interval Amount defines the length of the accrual interval where as the Accrue Amount determines the number of hours awarded for each accrual interval. In this example, the Employee is awarded 3.333334 hours every month for a total of 40 hours per Calendar Year Accrual Period.

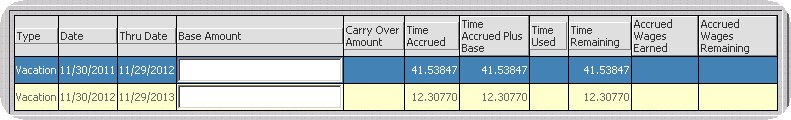

Employee Hire Date: 11/06/2011

Accrual Reset Type: Anniversary

Stop At: 40

The screen shot below shows each date on which accruals are awarded for the employee. Notice how hours are awarded each month, on the same day of the month as the employee was hired except for where the day on which the employee was hired does not exist for that month. In that case, hours are awarded on the last day of the month. For example, in the example below the employee was hired on 11/06/2011. Notice how hours are awarded on the 6th day of each month. If the employee were hired on 10/31/2011, the employee would be awarded hours on the 31st day of the month for those months with 31 days and on the last day of the month for all months with less than 31 days. In this way, employees are awarded hours every month.

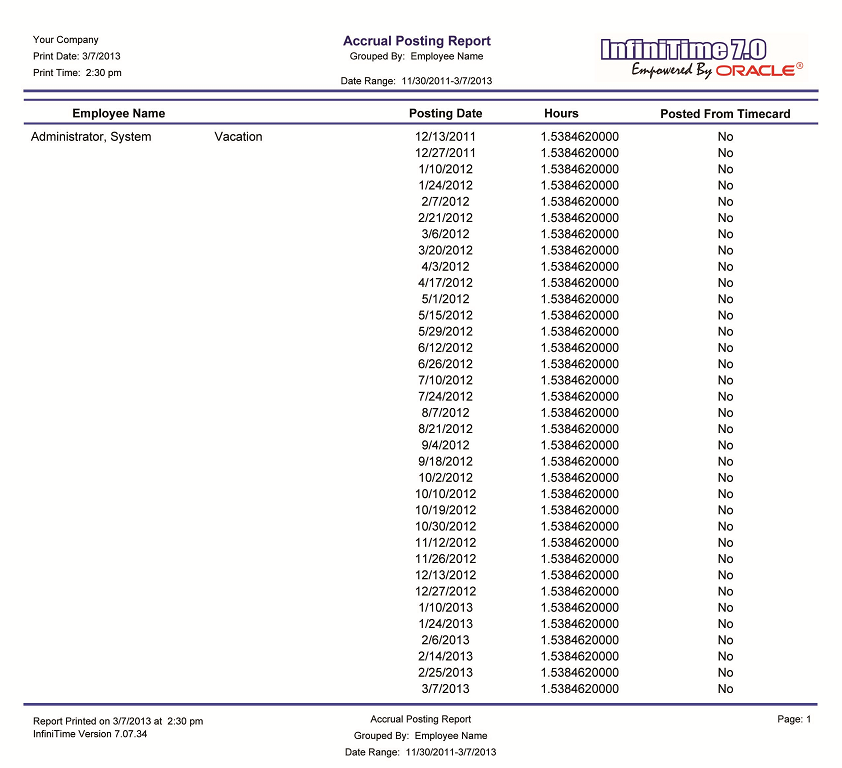

The Accrual Calculation and related settings below show an example of how Employee Accrual Hours are awarded for the Accrual Calculation Method under the Hour(s) Accrual Interval. In this example, the Accrual Interval Amount determines the number of hours that must be worked in order for the employee to be awarded additional hours. In this example, the Employee is awarded 1.538462 hours for every 80 hours worked from their date of hire forward.

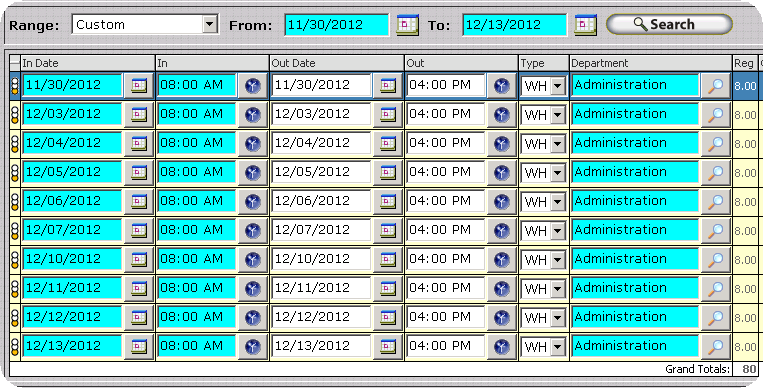

Employee Hire Date: 11/30/2011

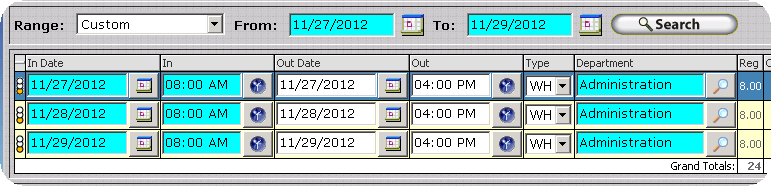

Accrual Reset Type: Anniversary

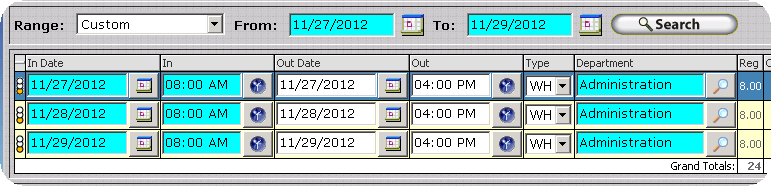

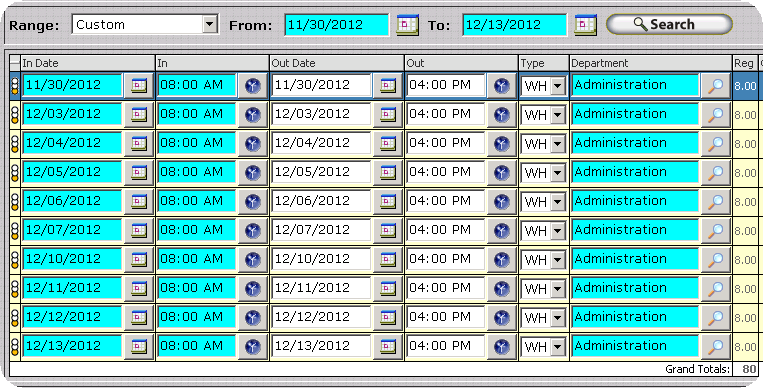

The screen shot below shows each date on which accruals are awarded for the employee. Note that with the Basic Accruals Module, progress toward the next Accrual Interval starts over at the end of the accrual period. Any progress toward the next accrual interval on the last day of the Accrual Period is lost. This can be observed at the end of the 2011 and 2012 accrual periods as shown in the report below. For example, the last date in the 11/30/11 – 11/29/12 Accrual Period for which Vacation Hours are awarded is 11/26/12. The first date in 11/30/2012 – 11/29/13 Accrual Period for which Vacation Hours are awarded is 12/13/2012. The employee works 24 hours from 11/27/2012 to 11/29/2012, which is 56 hours short of the 80 Hours Accrual Interval Amount. On 11/30/2012 the progress toward the next interval is reset, resulting in the employee being awarded hours on 12/13/2012, when the employee hits a total of 80 hours in the new accrual period. After 1/15/2012, the employee is awarded hours every 80 hours worked.

As of 3/7/13, based on the Accrual Settings detailed above and the resulting Employee Accrual Posting Records, the employee will receive a total of 41.53847 Vacation Hours for the Accrual Period starting 11/30/2011 and 12.30770 Vacation Hours for the Accrual Period Starting 11/30/2012.

For clarity, Timecards for the employee from 11/27/12 to 11/29/12 are shown below. Remember, progress toward the next Accrual Interval starts over at the end of the accrual period. Any progress toward the next accrual interval on the last day of the Accrual Period is lost.

For clarity, Timecards for the employee from 11/30/12 to 12/13/12 are shown below. Remember, progress toward the next Accrual Interval starts over at the end of the accrual period. Any progress toward the next accrual interval on the last day of the Accrual Period is lost. This is clearly illustrated below. December 13th 2012 is the first date in the 11/30/12 to 11/29/13 Accrual Period on which the employee accumulated 80 hours worked in the new accrual period.

Calculation – Enter a descriptive name for the Accrual Calculation such as ‘Vacation Time’ or ‘Sick Time.’ All Accrual Calculations in an Accrual Class with multiple tenure ranges should have the same Calculation Name across all accrual types and accrual calculations in the Accrual Class as illustrated in the provided examples.

Stop Accruing Date – Employees will no longer accrue hours for the accrual type as of the date set in this field.

Start Accruing Hire Date Plus – This setting is intended for use with new hires and should only be configured on accrual types with a minimum tenure of 0. The number entered in this field represents a number of days after the employee’s Date of Hire during which InfiniTime will not calculate accruals. It helps to think of this as a probation period, in days, during which employees will not automatically accrue hours.

Stop At – Sets the maximum amount of hours which may be available for the Accrual Type. InfiniTime will stop accruing additional hours if the amount of available hours reaches this value.

Carry Over Reset Type – Determines the start and end of the accrual period. The exact behavior of the chosen carry over reset type depends on the method Calculation Method(s) chosen for making accrual hours available to employees.

‘Start at’ Calculation Method – Available hours for the accrual type will reset to the start at amount at the beginning of a new accrual period. If carry over is not checked any hours unused from the prior period will be lost. If carry over is checked any hours unused from the prior period will be brought forward and added to the start at amount.

‘Accrue’ Calculation Method – Available hours for the accrual type will reset to zero at the beginning of a new accrual period. If carry over is not checked any hours unused from the prior period will be lost. If carry over is checked any hours unused from the prior period will be brought forward and added to the remaining amount.

Anniversary – Defines the start of the accrual period as the employee’s hire date. Employee accruals will reset accordingly on the employee’s hire date each year.

Calendar Year – Defines the start of the accrual period as January 1st of each year. Employee accruals will reset accordingly on this date.

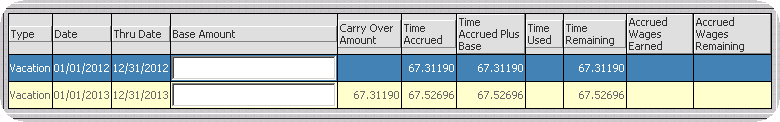

Carry Over – Available hours unused during the prior period will be brought forward to the new accrual period if this option is checked. If this option us unchecked unused hours during the prior period will not be brought forward and are lost.

The Other Activities that Deduct Tab is used to configure other activity types that can be used to deduct from available accrual hours. For example the Vacation Other Activity Type is often associated with a Vacation Accrual Type. In this way vacation hours will automatically be deducted from available accrual hours when employees take vacation. Each Accrual Type should have at least one Other Activity Type associated with it in order to deduct vacation, sick, or personal time from the accrual bucket automatically.

In most scenarios difficulties with Accruals configuration are related to having an incomplete understanding of an organization’s accrual requirements. For this reason a detailed process has been established for gathering information required to properly document an organization’s accrual requirements. When attempting to identify accrual requirements it is often helpful to ignore specific features and options within InfiniTime and start by focusing on the needs of your organization. Once the organization’s accrual requirements are understood finding the appropriate options within InfiniTime is generally not a problem.

The procedure for configuring accruals is similar to the method used for configuring Policies and Holidays. Employee groups requiring different accrual settings must be identified before attempting to configure accruals within the InfiniTime Application. Keep in mind it is common for accrual benefits to change based upon the amount of time employees have been with a company. Because of this Classes and Tenures will likely be required. Remember, classes can be used to group multiple accrual types together and tenures are used to automatically move employees from one accrual type to the next based upon the length of time they have been with the company.

To setup accruals there are five main tasks that must be performed:

Use Employee Accruals Table 1 to identify groups of employees (Or individual employees) requiring different accrual settings.

For example ABC Company has the following personnel:

Employee Accruals Table 1 |

|

| Job Title | Pay Type |

Administration |

Salary |

| Cleaning Staff | Full Time |

| Front Desk Staff | Full Time |

| Kitchen | Full Time |

| Child Day Care | Part Time |

| Night Auditors | Part Time |

ABC Company Part Time employees do not receive benefits in the form of Vacation or Personal Time though they are eligible for Sick Time after they are with the company for a year. Salary and Full Time Employees must be employed for 90 days prior to accruing Vacation or Personal Time though they accrue Vacation and Personal Time Hours at different rates. After reviewing the employees and policies at ABC Company the following classes, or groups of employees, require different accrual settings:

Salary

Full Time

Part Time

Complete Employee Accrual Table 2 to identify each Accrual Calculation for which the previously listed classes are eligible for. One accrual calculation is required for each bucket of hours where Accrued Hours, Remaining Hours, and Used Hours must be tracked separately for employees. The Accrual Plus Module supports an unlimited number of Accrual Calculations for each accrual type.

Employee Accruals Table 2 |

||

| Class | Accrual Calculation 1 | Accrual Calculation 2 |

Part Time |

Sick Time (After 1 Year of Employment) | |

| Full Time | Vacation Time | Personal Time |

| Salary | Vacation Time | Personal Time |

Review Employee Accruals Table 3 below and identify each point when accrual benefits change for each class for your organization. In most organizations, employee paid leave benefits increase based upon the amount of time the employee has spent with the company. It is not unusual for different classes, or groups of employees, to receive additional benefits at different milestones. In some circumstances, employee paid leave benefits for a specific type of paid leave may increase at different milestones when compared with other types of paid leave in a single accrual class. This scenario requires the Accrual Plus Accrual Calculation Tenures feature and is only supported by the Accrual Plus Module. The example below assumes all types of paid leave for each single accrual class receive additional benefits at uniform, or equally divisible, milestones.

For example, Part Time Employees at ABC Company receive 2 Days (16 Hours) of Paid Sick Time after their first year of employment. This benefit does not increase for part time employees based upon the amount of time they have been with the company. ABC Company rewards Full Time and Salary employees with additional Vacation and Personal Time benefits at the following milestones: After 3 Years, After 5 Years, and After 10 Years of Employment. With this in mind, ABC Company requires the following tenure ranges for each class:

Employee Accruals Table 3 |

|

| Accrual Class: Part Time Employee Accruals | |

Tenure Min |

Tenure Max |

0 Years |

1 Year |

| 1 Year | 99 Years |

Employee Accruals Table 3 |

|

| Accrual Class: Full Time Employee Accruals | |

Tenure Min |

Tenure Max |

0 Years |

3 Years |

| 3 Years | 5 Years |

| 5 Years | 10 Years |

| 10 Years | 99 Years |

Employee Accruals Table 3 |

|

| Accrual Class: Salary Employee Accruals | |

Tenure Min |

Tenure Max |

0 Years |

3 Years |

| 3 Years | 5 Years |

| 5 Years | 10 Years |

| 10 Years | 99 Years |

Complete Employee Accruals Table 4 for each group of employees or individual employees requiring different accrual settings using the Classes, Accrual Calculations, and Tenure Ranges identified in Steps 1 to 3. At this point, you may wish to refer to the Accruals Plus Module Features and Settings Section of this document to familiarize yourself with the Accrual Calculation options available within InfiniTime. This will help with completing the ‘Settings’ column of Employee Accruals Table 4. As you fill out the table, keep the following rules in mind:

Employee Accruals Table 4 |

|||

| Accrual Name: Part Time Employee Accruals | Employee Group (Accrual Class): Part Time | ||

| Tenure Min | Tenure Max |

Accrual Calculation | Settings |

0 Years |

1 Year | NONE | Reset Type: N/A Calculation Method(s): None Calculation Modifiers: None |

| 1 Year | 99 Years | Sick Time | Reset Type: Calendar Year Calculation Method(s): Start at 16 Hours Calculation Modifiers: None |

Employee Accruals Table 4 |

|||

| Accrual Name: Full Time Employee Accruals | Employee Group (Accrual Class): Full Time | ||

| Tenure Min | Tenure Max |

Accrual Calculation | Settings |

0 Years |

3 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 40 Hours Calculation Modifiers: None |

| 3 Years | 5 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 80 Hours Calculation Modifiers: None |

| 5 Years | 10 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 96 Hours Calculation Modifiers: None |

| 10 Years | 99 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 120 Hours Calculation Modifiers: None |

0 Years |

3 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 16 Hours Calculation Modifiers: None |

| 3 Years | 5 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 32 Hours Calculation Modifiers: None |

| 5 Years | 10 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 48 Hours Calculation Modifiers: None |

| 10 Years | 99 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 64 Hours Calculation Modifiers: None |

Employee Accruals Table 4 |

|||

| Accrual Name: Salary Employee Accruals | Employee Group (Accrual Class): Salary | ||

| Tenure Min | Tenure Max |

Accrual Calculation | Settings |

0 Years |

3 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 48 Hours Calculation Modifiers: Carry Over |

| 3 Years | 5 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 88 Hours Calculation Modifiers: Carry Over |

| 5 Years | 10 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 104 Hours Calculation Modifiers: Carry Over |

| 10 Years | 99 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 128 Hours Calculation Modifiers: Carry Over |

0 Years |

3 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 32 Hours Calculation Modifiers: Carry Over |

| 3 Years | 5 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 48 Hours Calculation Modifiers: Carry Over |

| 5 Years | 10 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 64 Hours Calculation Modifiers: Carry Over |

| 10 Years | 99 Years | Personal Time | Reset Type: Calendar Year Calculation Method(s): Start at 72 Hours Calculation Modifiers: Carry Over |

Configure Accrual Types as necessary for each employee group using the completed tables. When properly completed, Employee Accruals Table 3 has one row for each Accrual Type required for your organization.

Configure Accrual Calculations for each Accrual Type using Employee Accruals Table 4. When properly completed, Employee Accruals Table 4 has one row for each Accrual Calculation required for your organization. The procedure for configuring accrual types and accrual calculations is outlined in the Employee Accruals Configuration Process Flow Diagram.

The Accrual Type Table will be displayed. The Accrual Type Table displays all accrual types in the InfiniTime Database and is used to add additional Accrual Types to the software.

Copy - Permits the InfiniTime Administrator to copy an existing accrual type by selecting an accrual type and clicking the copy button. A copied accrual type will have the same configuration and Accrual Calculations as the selected accrual type.

Insert - Permits the InfiniTime Administrator to create a new Accrual Type. Opens the Accrual Type Update Form.

Change - Opens the Accrual Type Update Form for the selected Accrual Type. The InfiniTime Administrator may then alter the accrual type's settings as desired.

Delete - Removes the selected Accrual Type from the database.

Login to the Manager Module as an Administrator

Click on Lookups

Click on Calculations Setup

Click on Accrual Types

The Accrual Types Table will be displayed

Click Insert to access the Accrual Type Update Form

The Accrual Types Update Form is used to create accrual types. The Basic Accruals Overview and Accruals Plus Overview sections of this document provide step by step instructions and examples of how to determine the Accrual Types and related settings required to configure InfiniTime Accruals to meet the needs of your organization.

Accrual Type Update Form General Tab:

The General Tab of the Accrual Type Update Form includes basic settings related to an accrual type, such as the Accrual Type Name, the Accrual Type Class, and the tenures for which the Accrual Type applies.

Accrual Type Update Form Accrual Calculations Tab:

The Accrual Calculations Tab of the Accrual Type Update Form lists all accrual calculations defined for the respective accrual type. All employees assigned to the accrual type will accrue hours in accordance with the settings on each accrual calculation.

Login to the Manager Module as an Administrator

Click on Lookups

Click on Calculations Setup

Click on Accrual Types

The Accrual Types Table will be displayed.

Click on an existing Accrual Type and click Change.

Click on the Accrual Calculations Tab.

Click Insert to access the Accrual Calculations Update Form.

The Accrual Calculations Update Form is used to create accrual calculations. Through use of Accrual Calculation Methods and Accrual Calculation Modifiers, an accrual calculation defines the exact conditions under which employees are awarded paid leave benefits. The Basic Accruals Overview and Accruals Plus Overview sections of this document provide step by step instructions and examples of how to determine the Accrual Types and related settings required to configure InfiniTime Accruals to meet the needs of your organization. Additional details regarding the individual Reset Types, Accrual Calculation Methods, and Calculation Modifiers can be found at the sections referenced below. Additionally, each individual Calculation Modifier is listed in the Table of Contents for ease of reference.

The Accrual Calculations Update Form is used to create accrual calculations for a specific Accrual Type. As detailed in the Accrual Plus Overview section, one accrual calculation is required for each row in Employee Accruals Table 4. The Accrual Plus module supports an unlimited number of Accrual Calculations for each Accrual Type.

InfiniTime Accrual Calculations are comprised of three separate types of features and settings:

The Accrual Plus Module supports three Reset Types which determine the Accrual Period Date Range and the date on which employee accrual hours are carried forward or reset.

The ‘Calendar Year’ Reset Type uses the Calendar Year (January 1st – December 31st) as the basis for Employee Accrual Periods. Calculation Modifiers are then applied as appropriate. For example, an accrual calculation configured as shown below will carry over unused hours as of December 31st into the next accrual period. Additionally, Employees will be awarded 40 additional hours for the new accrual period every year on January 1st.

Carry Over Reset Type - Calendar Year

Calculation Method(s) - Start at 40 Hours

Calculation Modifiers - Carry Over

The ‘Anniversary’ Reset Type uses each individual employee’s Hire Date as the basis for Employee Accrual Periods. Calculation Modifiers are then applied as appropriate. For example, an accrual calculation configured as shown below for an employee hired on May 6th 2012 will award 40 hours to the employee after 90 days of employment, carry unused hours as of May 5th 2013 forward into the next accrual period beginning on May 6th 2013 and award an additional 40 hours on May 6th 2013.

Reset Type - Anniversary

Calculation Method(s) - Start at 40 Hours

Calculation Modifiers - Carry Over, Start Accruing Hire Date Plus 90 Days

The ‘Fiscal Year’ Reset Type is comparable to the Calendar Year Reset type, though it allows the user to set the date on which Employee Accrual Periods will start and end. The ‘Fiscal Year’ Reset Type is ideal for organizations who wish to award employee accrual hours based on the corporation’s Fiscal Calendar. Calculation Modifiers will then be applied as appropriate. For example, an accrual calculation configured as shown below will carry over unused hours as of April 30th into the next accrual period. Additionally, Employees will be awarded 40 additional hours for the new accrual period every year on May 1st.

Reset Type - Fiscal Year, Fiscal Period Start Date: May 1st

Calculation Method(s) - Start at 40 Hours

Calculation Modifiers - Carry Over

The Accrual Plus Module supports five Calculation Methods for awarding accrual hours to employees as listed below.

| Calculation Method | Calculation Functionality |

| ‘Start At’ | Awards Hours to employees immediately at the start of each accrual period. Generally, employees may then use the hours as needed throughout the accrual period. |

| ‘Accrue’ | Awards a specified amount of hours to employees at regular intervals over time. |

| ‘End of Cycle Bonus’ | Awards Hours to employees at the end of the Accrual Period. Generally, employees may then use the hours as needed throughout the following accrual period.

NOTE: Carry Over must be enabled for hours awarded by the ‘End of Cycle Bonus’ Calculation Method to be carried forward into subsequent accrual periods. |

| ‘Alternate Posting’ | Alternate Posting permits worked hours types to be posted to an accrual bucket in lieu of payment. Often referred to as ‘Comp Time’ this feature is especially useful for tracking worked overtime hours for Salary Employees. Employees may then use earned hours as needed. |

| ‘Rate Mapping’ | Intended for use alongside the Accrue Calculation Method, Rate Mapping makes it possible for the Accrue Amount awarded at each Accrual Interval to be scaled based on the number of units (IE: Total Hours Worked for the Hour(s) Accrue Interval Unit) elapsed during the accrual period. |

The first task when configuring individual accrual calculations within the Accruals Plus Module is to identify the accrual calculation method which meets customer requirements, afterwards any additional options can be configured as necessary. It should be noted that a single Accrual Calculation can use one or more Calculation Methods, though at least one Calculation Method must be configured.

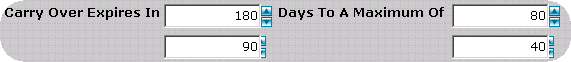

Calculation Modifiers are optional rules and features which alter the way Calculation Method(s) award hours. The Accrual Plus Module includes a number of Calculation Modifiers which provide support for both simplistic and complex Employee Accrual Calculations. Calculation Modifiers supported by the Accrual Plus Module are listed below. A complete description of how each Calculation Modifier alters the available Calculation Method(s) is provided below.

Accrual Plus Module Calculation Modifiers |

|||

| Stop Accruing Date | Carry Over | Carry Over One Expiration | Carry Over One Maximum |

| Start Accruing Hire Date Plus | Stop At | Carry Over Two Expiration | Carry Over Two Maximum |

| Effective Date | Overflow | Accrual Calculation Tenure – Minimum & Maximum | Hours Needed to Qualify – Minimum & Maximum |

| Maximum Negative Accrual | Do Not Allow Accrued Time to Be used | Do Not Allow Accrued Time to Be Used in Year Accrued | Continue to Accrue to Stop At Amount After Time is Used |

Award Immediately |

Accrue Hours as if Hired at the Start of the First Accrual Interval | Accrual Interval Persists Through Accrual Periods | |

Remember: Calculation Methods permit the user to define the exact calculation and frequency used to award hours to employees. A single Accrual Calculation can have one or more calculation methods. InfiniTime will display a warning if you attempt to save an Accrual Calculation without configuring at least one calculation method.

The ‘Start At’ Calculation Method awards hours to employees on the First Day of each accrual period. Hours awarded by the Start At Calculation method are available for immediate use and is intended for use employees have a given amount of hours available during the accrual period which can be used as needed. For example the ‘Start At’ calculation method would be used if employees have 40 Vacation Hours to use as needed throughout the year. Alternatively, the ‘Accrue’ calculation method would be used if employees received .769 hours for every seven days of employment.

Using the ‘Accrue’ Calculation Method awards a predefined number of hours to employees at a set interval over time. The ‘Accrue’ Calculation Method is based on a three part formula as illustrated below.

1 – Accrue Amount - Enter the number of hours to be awarded to employees at each interval in this field. This field supports up to six decimals accuracy. IE: 14.123456

2 – Accrual Interval Amount - For the Day(s) or Month(s) Accrual Interval Unit, enter the number of Days or Months to define the length of the Accrual Interval. Employees will be awarded hours at the last day of every accrual interval. Alternatively, for the Hour(s) Worked Accrual Interval Unit enter the number of Hours that employees must work before hours will be awarded. Employees will be awarded hours on each date successive date on which they accumulate this number of hours.

3 – Accrual Interval Unit - Choose Days, Hours, or Months from the drop down to set the Accrual Interval unit. The Accrual Interval Unit determines the frequency at which hours will be awarded to employees.

Day(s) – Bases the accrual interval on a number of days after the beginning of the accrual period.

Hour(s) – Bases the accrual interval on the number of hours worked by the employee.

Month(s) – Bases the accrual interval on the number of months after the beginning of the accrual period.

An example of each Accrual Interval Unit, and how hours are awarded, is provided below. For example the settings below accrue 1.538462 Hours for every two weeks employees are employed by the company for a total of approx. 40 hours per year.

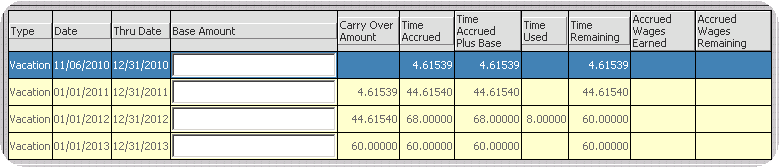

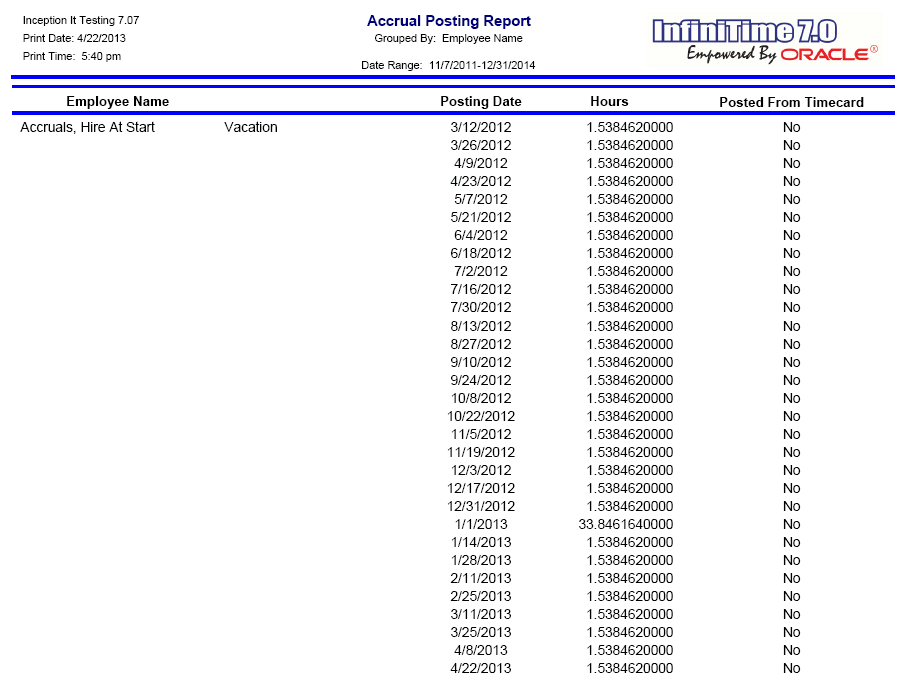

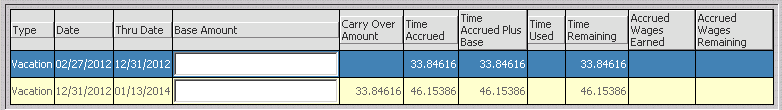

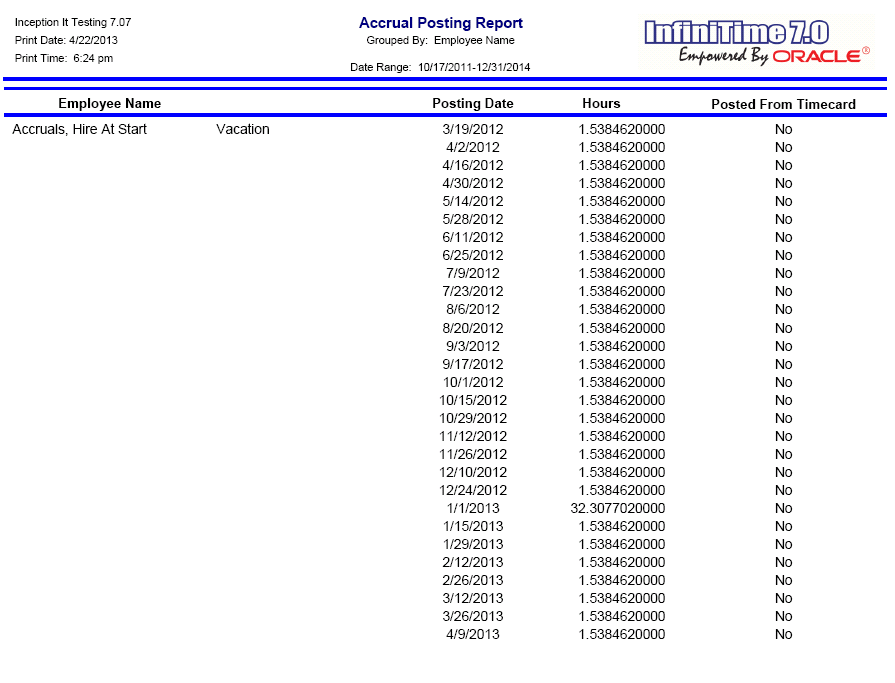

The Accrual Calculation and related settings below show an example of how Employee Accrual Hours are awarded for the Accrual Calculation Method under the Day(s) Accrual Interval. Notice how the Accrual Interval Amount defines the length of the accrual interval where as the Accrue Amount determines the number of hours awarded for each accrual interval. In this example, the Employee is awarded 1.53846 hours every 14 days for a total of 40 hours per Calendar Year Accrual Period.

Employee Hire Date: 11/06/2011

Accrual Reset Type: Calendar Year

Stop At: 40

The screen shot below shows each date on which accruals are awarded for the employee. Note that with the Basic Accruals Module, progress toward the next Accrual Interval starts over at the end of the accrual period. Any progress toward the next accrual interval on the last day of the Accrual Period is lost. This can be observed at the end of the 2011 and 2012 accrual periods as shown in the report below. For example, the last date in 2011 for which Vacation Hours are awarded is 12/18/11. The first date in 2012 for which Vacation Hours are awarded is 1/15/2012. Only 13 calendar days exist between 12/18/2011 to 12/31/2011, which is 1 day short of the 14 day Interval. On 1/1/2012 the progress toward the next interval is reset, resulting in the employee being awarded hours on 1/15/2012, after the 14th day of employment has passed in the new accrual period. After 1/15/2012, the employee is awarded hours every 14 days.

NOTE: Accrual Intervals can be forced to persist through accrual periods, such that progress toward the next accrual interval is not lost at the end of the Accrual Period, with the ‘Accrual Interval Persists through Accrual Periods’ Accrual Plus Feature.

As of 3/7/13, based on the Accrual Settings detailed above and the resulting Employee Accrual Posting Records, the employee will receive a total of 4.61539 Vacation Hours in 2011, 40 Vacation Hours in 2012, and 6.15385 Vacation Hours in 2013.

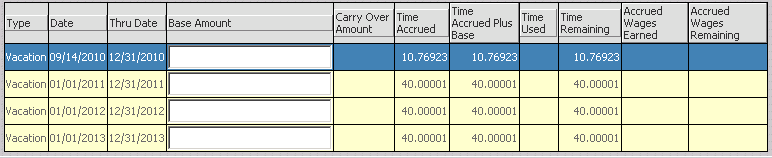

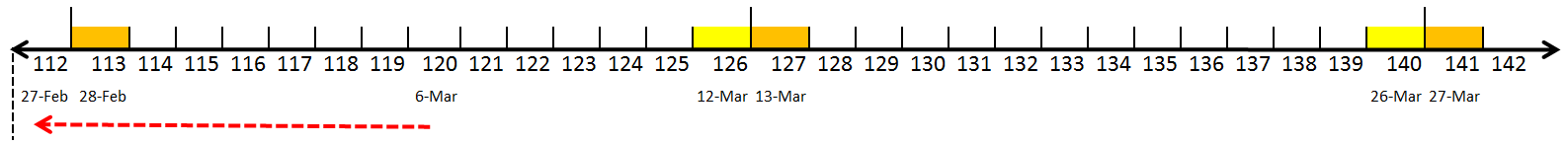

The Accrual Calculation and related settings below show an example of how Employee Accrual Hours are awarded for the Accrual Calculation Method under the Month(s) Accrual Interval. Notice how the Accrual Interval Amount defines the length of the accrual interval where as the Accrue Amount determines the number of hours awarded for each accrual interval. In this example, the Employee is awarded 3.333334 hours every month for a total of 40 hours per Calendar Year Accrual Period.

Employee Hire Date: 11/06/2011

Accrual Reset Type: Anniversary

Stop At: 40

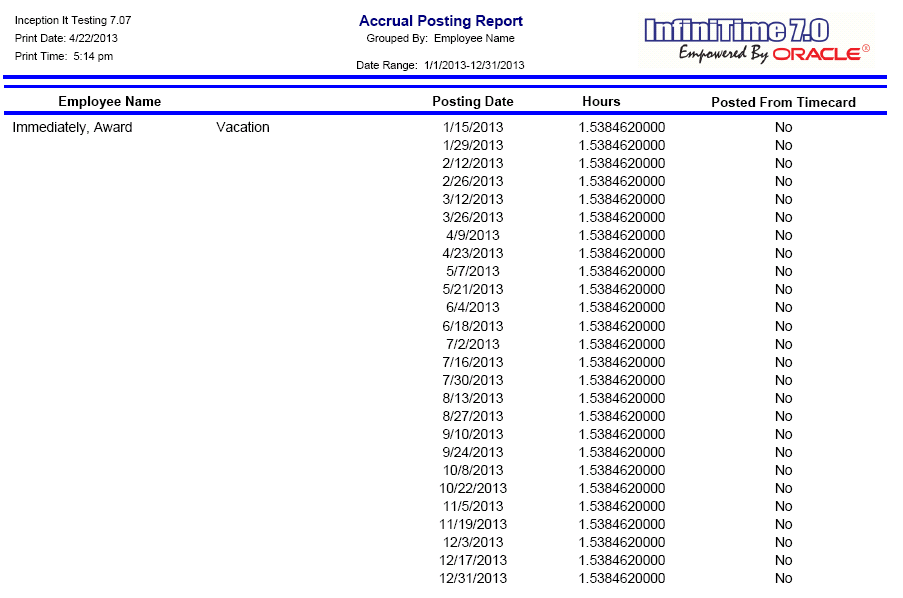

The screen shot below shows each date on which accruals are awarded for the employee. Notice how hours are awarded each month, on the same day of the month as the employee was hired except for where the day on which the employee was hired does not exist for that month. In that case, hours are awarded on the last day of the month. For example, in the example below the employee was hired on 11/06/2011. Notice how hours are awarded on the 6th day of each month. If the employee were hired on 10/31/2011, the employee would be awarded hours on the 31st day of the month for those months with 31 days and on the last day of the month for all months with less than 31 days. In this way, employees are awarded hours every month.

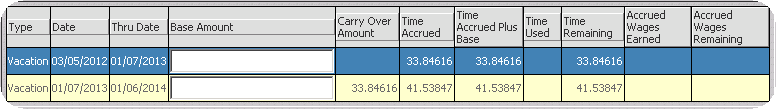

The Accrual Calculation and related settings below show an example of how Employee Accrual Hours are awarded for the Accrual Calculation Method under the Hour(s) Accrual Interval. In this example, the Accrual Interval Amount determines the number of hours that must be worked in order for the employee to be awarded additional hours. In this example, the Employee is awarded 1.538462 hours for every 80 hours worked from their date of hire forward.

Employee Hire Date: 11/30/2011

Accrual Reset Type: Anniversary

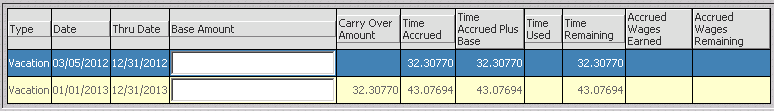

The screen shot below shows each date on which accruals are awarded for the employee. Note that by default, progress toward the next Accrual Interval starts over at the end of the accrual period. Any progress toward the next accrual interval on the last day of the Accrual Period is lost. This can be observed at the end of the 2011 and 2012 accrual periods as shown in the report below. For example, the last date in the 11/30/11 – 11/29/12 Accrual Period for which Vacation Hours are awarded is 11/26/12. The first date in 11/30/2012 – 11/29/13 Accrual Period for which Vacation Hours are awarded is 12/13/2012. The employee works 24 hours from 11/27/2012 to 11/29/2012, which is 56 hours short of the 80 Hours Accrual Interval Amount. On 11/30/2012 the progress toward the next interval is reset, resulting in the employee being awarded hours on 12/13/2012, when the employee hits a total of 80 hours in the new accrual period. After 1/15/2012, the employee is awarded hours every 80 hours worked.

NOTE: Accrual Intervals can be forced to persist through accrual periods, such that progress toward the next accrual interval is not lost at the end of the Accrual Period, with the ‘Accrual Interval Persists through Accrual Periods’ Accrual Plus Feature.

As of 3/7/13, based on the Accrual Settings detailed above and the resulting Employee Accrual Posting Records, the employee will receive a total of 41.53847 Vacation Hours for the Accrual Period starting 11/30/2011 and 12.30770 Vacation Hours for the Accrual Period Starting 11/30/2012.

For clarity, Timecards for the employee from 11/27/12 to 11/29/12 are shown below. Remember, progress toward the next Accrual Interval starts over at the end of the accrual period. Any progress toward the next accrual interval on the last day of the Accrual Period is lost.

For clarity, Timecards for the employee from 11/30/12 to 12/13/12 are shown below. Remember, progress toward the next Accrual Interval starts over at the end of the accrual period. Any progress toward the next accrual interval on the last day of the Accrual Period is lost. This is clearly illustrated below. December 13th 2012 is the first date in the 11/30/12 to 11/29/13 Accrual Period on which the employee accumulated 80 hours worked in the new accrual period.

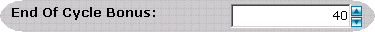

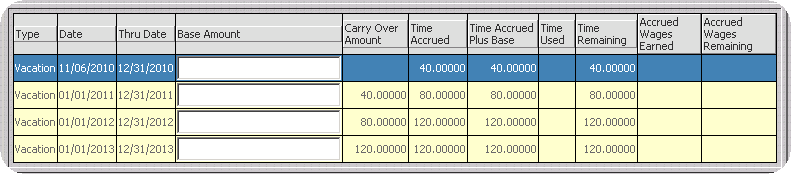

The ‘End of Cycle Bonus’ calculation method awards hours to employees on the last day of each accrual period. With this in mind, the Carry Over Calculation Modifier must be configured in order to carry accrued hours forward into subsequent accrual periods. The End of Cycle Bonus calculation method is intended for use when employees are not permitted to use their hours immediately at the start of a new accrual period. The End of Cycle Bonus requires employee to remain employed for the duration of their first accrual period before they are awarded hours. For new hires, the exact duration of the first accrual period depends upon the chosen reset type as detailed below. Regardless of the reset type chosen, End of Cycle Bonus always awards hours to employees on the last day of each accrual period.

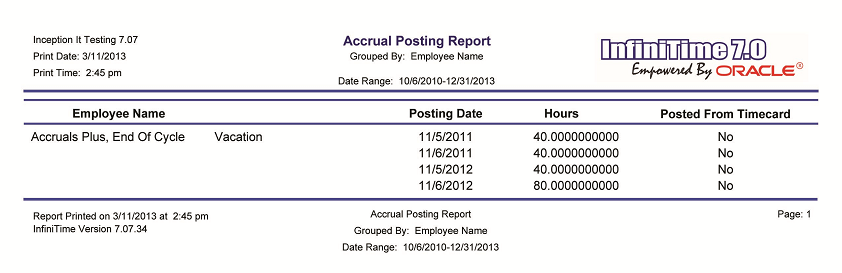

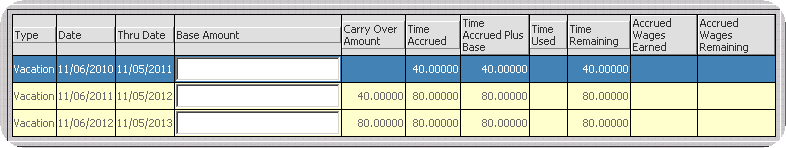

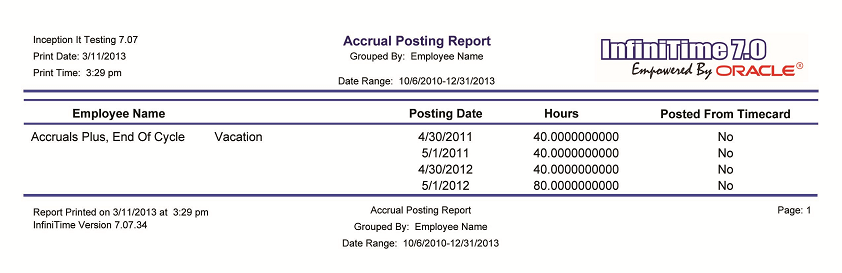

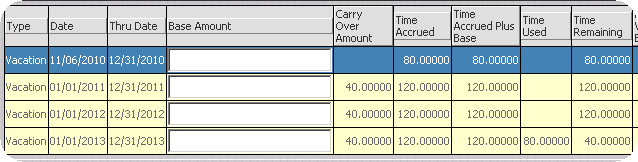

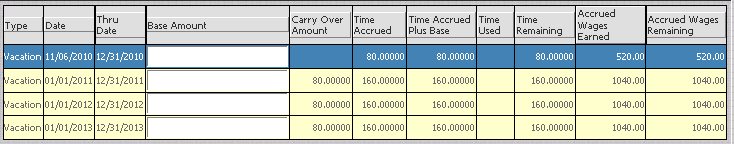

With the Anniversary Reset Type, the accrual period resets on the employee’s hire date each year. With the Anniversary Reset Type and the End of Cycle Bonus Calculation Method, new hires will not be awarded hours until the end of their first accrual period. For example, an employee hired on 11/6/2010 would not be awarded hours until 11/5/2011, as shown on the Example Accruals Posting Report shown below.

Employee Hire Date - 11/06/2010

Accrual Reset Type - Anniversary

Stop At - 120 Hours

Carry Over -

End of Cycle Bonus -

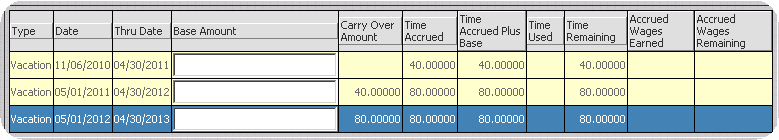

Notice how employee hours are accrued on the last day of the Accrual Period and carried forward for use in subsequent accrual periods.

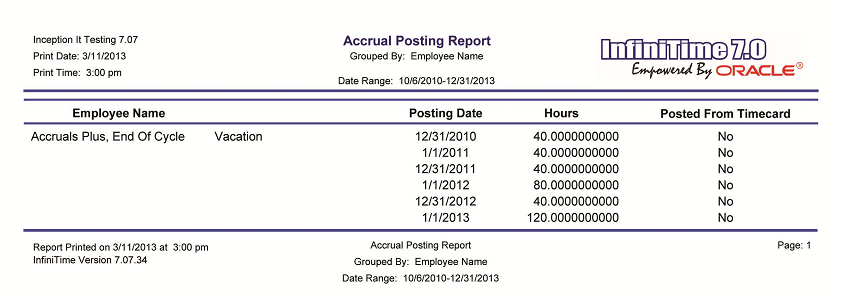

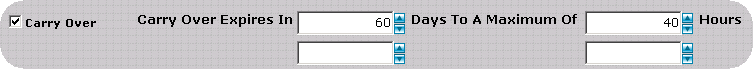

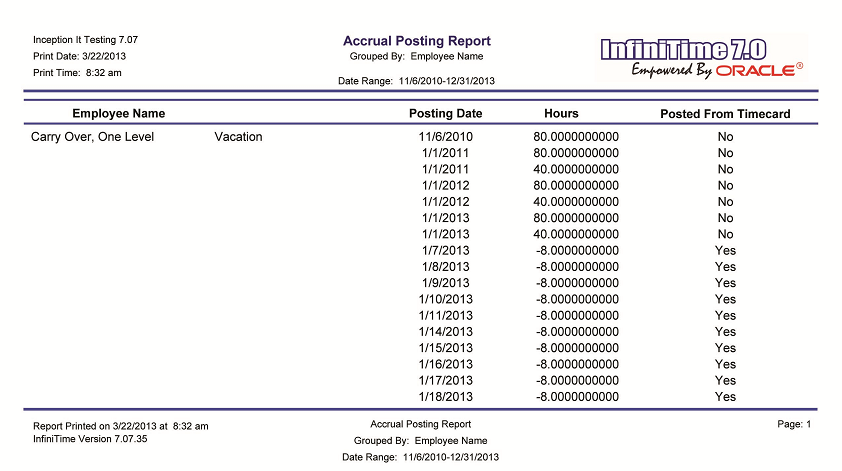

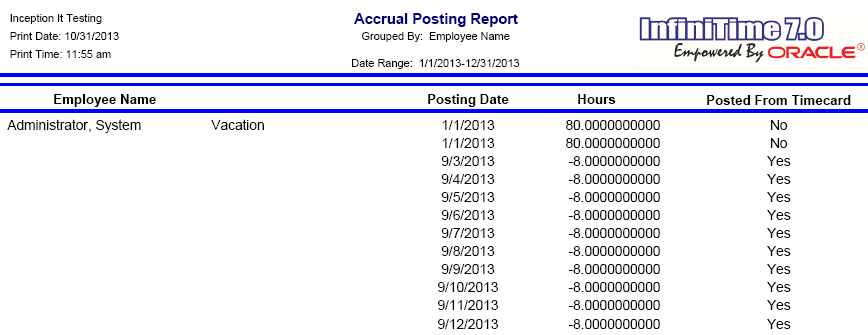

With the Calendar Year Reset Type, the accrual period resets according to the calendar Year. With the Calendar Year Reset Type and the End of Cycle Bonus Calculation Method, new hires will not be awarded hours until the end of the Calendar Year during which they were hired, regardless of when the employee was hired during the calendar year. For example, an employee hired on 11/6/2010 would not be awarded hours until 12/31/2010, as shown on the Example Accruals Posting Report shown below. Similarly, an employee hired on 1/30/2010 would not be awarded hours until 12/31/2010.

Employee Hire Date - 11/06/2010

Accrual Reset Type - Calendar Year

Stop At - 120 Hours

Carry Over -

End of Cycle Bonus -

Notice how the employee is awarded 40 hours on 12/31/2010 for the first time, which are carried forward to the 2011 accrual period. The employee is then awarded hours on the last day of each subsequent accrual period until the Stop At Amount is reached.

With the Fiscal Year Reset Type, the accrual period resets according to the Fiscal Year. With the Fiscal Year Reset Type, a Fiscal Period Start Date of May 1st, and the End of Cycle Bonus Calculation Method, new hires will not be awarded hours until the end of the Fiscal Year during which they were hired, regardless of when the employee was hired during the fiscal year. For example, an employee hired on 11/6/2010 would not be awarded hours until 4/30/2011, as shown on the Example Accruals Posting Report shown below. Similarly, an employee hired on 5/20/2010 would not be awarded hours until 4/30/2011.

Employee Hire Date - 11/06/2010

Accrual Reset Type - Fiscal Year, Fiscal Period Start Date: May 1st

Stop At - 120 Hours

Carry Over -

End of Cycle Bonus -

Notice how the employee is awarded 40 hours on 4/30/2011 for the first time, which are carried forward to the 2011 accrual period starting 5/1/11. The employee will then be awarded hours on the last day of each subsequent accrual period until the Stop At Amount of 120 hours is reached.

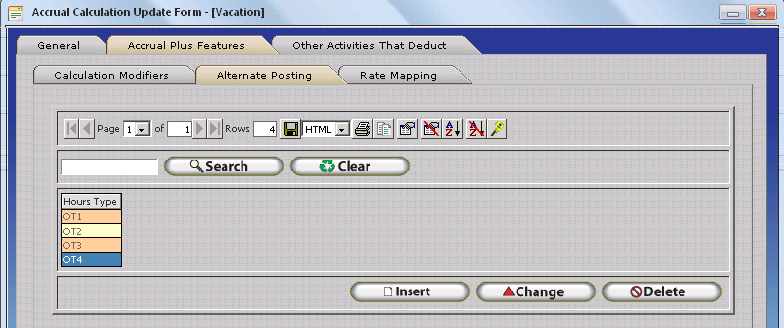

The ‘Alternate Posting’ Calculation Method permits worked hours types such as Regular Hours, Overtime One Hours, Overtime Two Hours, Overtime Three Hours, and Overtime Four Hours to be posted to an Accrual Bucket. InfiniTime Policy Settings determine the exact scenarios whereby employee hours are posted to Regular and Overtime Hours Types. Additional information on configuring Overtime Rules for employee policies can be found here. Alternate Posting is often used for tracking specific types of hours and awarding those hours to employees as paid leave to be used at the employee’s request in lieu of payment. To configure alternate posting, the desired Hours Type(s) must simply be added to the Alternate Posting Tab of the Accrual Calculation. Employee Hours in the selected Hours Type will then automatically post to the Accrual Calculation. It is important to note that employee hours for Hours Types configured for alternate posting will not be totaled or displayed in the timecard. An example is shown below.

Insert - Opens the Accrual Type Alternate Posting Update Form, which permits the user to select hours types which will post to the respective Accrual Calculation.

Change - Opens the Accrual Type Alternate Posting Update form for the selected Hours Type. The user may then alter the selected hours type as desired.

Delete - Deletes the selected hours type. The hours type will no longer post to the respective accrual type.

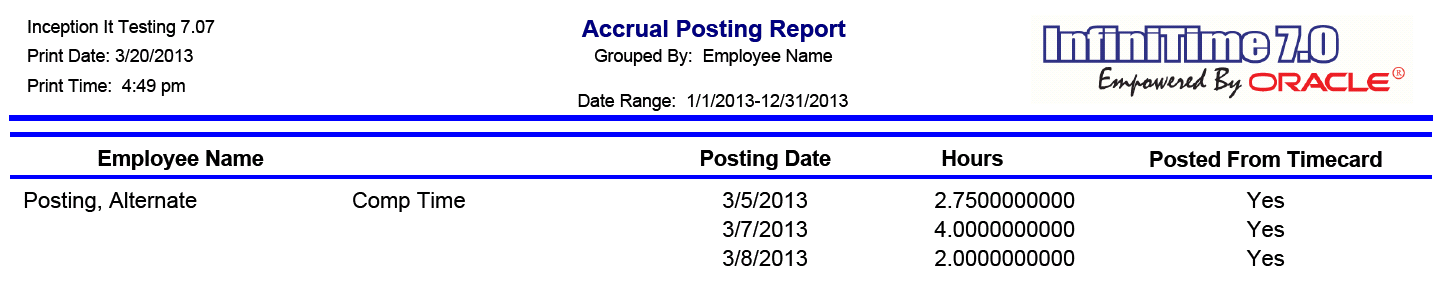

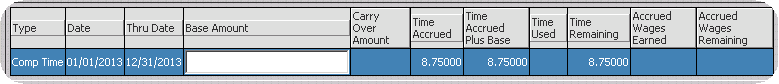

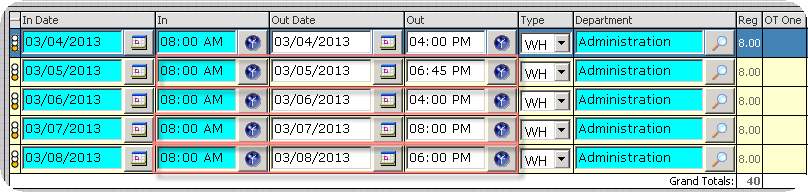

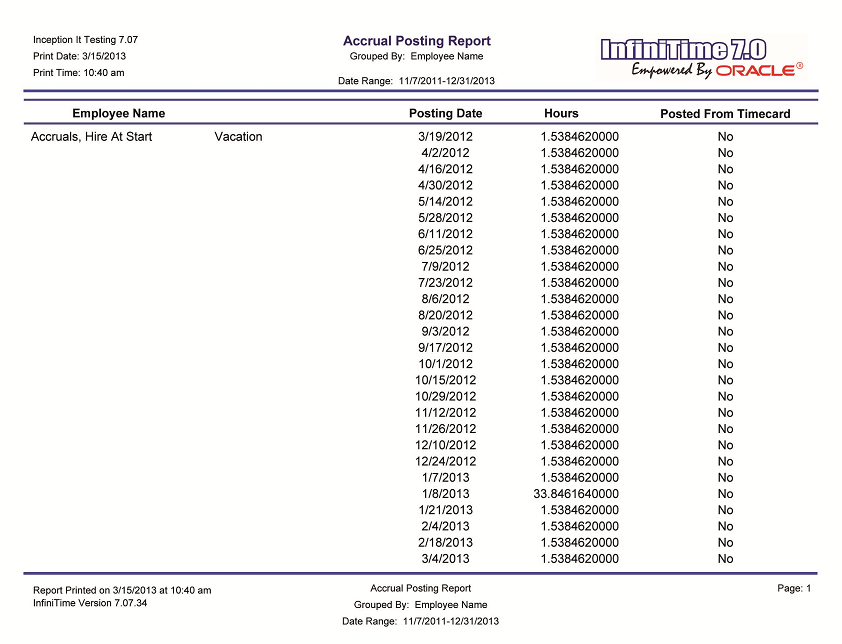

Example Alternate Posting Configuration:

Employee Hire Date - 11/06/2010

Accrual Reset Type - Calendar Year

Stop At - 120 Hours

Carry Over -

Alternate Posting -

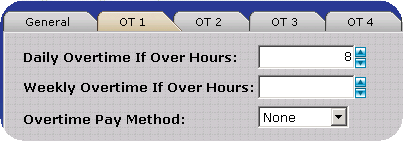

Policy Overtime One Settings -

Notice how Overtime 1 Hours are posted directly to the Comp Time Accrual Calculation. When Alternate Posting is enabled for a specific type of worked hours, those hours will not total in the Timecard. In this example, the employee works OT1 hours on 3/5, 3/7, and 3/8 as shown by the timecards and the Accrual Posting Report above.

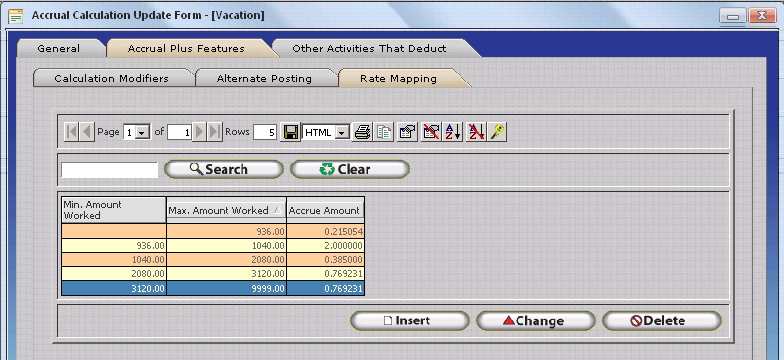

The Rate Mapping Calculation Method is intended for use alongside the Accrue Calculation Method. Rate Mapping makes it possible for the Accrue Amount awarded at each Accrual Interval to be scaled based on the number of units elapsed during the accrual period.

Insert - Opens the Accrual Type Alternate Posting Update Form, which permits the user to select hours types which will post to the respective Accrual Calculation.

Change - Opens the Accrual Type Alternate Posting Update form for the selected Hours Type. The user may then alter the selected hours type as desired.

Delete - Deletes the selected hours type. The hours type will no longer post to the respective accrual type.

The unit, and the method for determining the number of elapsed units during the accrual period, varies based on the Accrual Interval Unit as illustrated by the table below.

| Accrual Interval Unit | Rate Mapping Unit |

| Day(s) | Number of Days elapsed from the Accrual Period Start Date to the ‘End Date’* |

| Month(s) | Number of Months elapsed from the Accrual Period Start Date to the ‘End Date’* |

| Hour(s) | Total Hours Worked for respective Employee from the Accrual Period Start Date to the ‘End Date’*+ |

*NOTE: In this scenario, with Rate Mapping and the Accrue Calculation Methods configured, ‘End Date’ refers to the Current Date (IE: Today) for the current accrual period. For accrual periods in the past, the ‘End Date’ refers to the Accrual Period End Date which varies according to the chosen Carry Over Reset Type (IE: 12/31 for Calendar Year).

+For Rate Mapping Purposes, Total Hours Worked refers to all hours worked by employees and all Other Activity Hours for Other Activity Types set to ‘Count as Regular Hours’

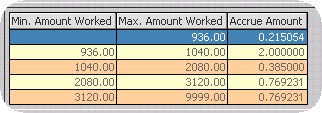

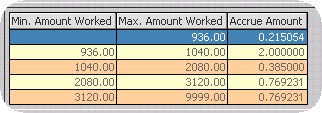

InfiniTime permits an unlimited number of Rate Mapping Records for an Accrual Calculation, allowing for complete flexibility and control over how the Accrue Amount is scaled based on the number of elapsed units. Each Rate Mapping Record includes three values Min Elapsed Unit, Max Elapsed Unit, and Accrue Amount as shown by the example rate mapping records below.

As the number of elapsed units during the accrual period increases, the Accrue Amount awarded at each Accrual Interval is automatically adjusted according to the Accrue Amount defined on the corresponding Rate Mapping record. It is important to note that the number of elapsed units starts over at 0 for each accrual period. An example rate mapping configuration for the Hour(s) Accrual Interval Unit is provided below.

ABC Agriculture employs a wide range of individuals, from under age farm hands to full time dairy employees, each of which are eligible for Vacation Hours according to the number of hours worked throughout the year. The tables below were compiled by ABC Agriculture Management to represent each group of employees working for the organization and to determine the Accrue Amount for each Rate Mapping range.

| Employee Group | Hours / Day | Hours / Week | Total Annual Desired Accrual |

Underage |

< 4 |

18 |

20 |

Part Time |

4 |

20 |

40 |

Full Time |

8 |

40 |

80 |

12 Hour |

12 |

60 |

160 |

> 12 Hour |

> 12 |

> 60 |

160+ |

The table above illustrates each group of employees at ABC Agriculture, along with the total number of hours each group should receive on an annual basis if employees work their scheduled hours each day.

| Range # | Employee Group | Min Hrs / Yr | Max Hours / Yr

[Hours / Wk * 52] |

Total Hours for Range

[Max Hrs / Yr - Min Hrs / Yr] |

Accrual Interval |

| 1 | Underage | 0 | 936 | 936 | Every 10 Hours |

| 2 | Part Time | 936 | 1040 | 104 | Every 10 Hours |

| 3 | Full Time | 1040 | 2080 | 1040 | Every 10 Hours |

| 4 | 12 Hour | 2080 | 3120 | 1040 | Every 10 Hours |

| 5 | > 12 Hour | 3120 | 9999 | 6879 | Every 10 Hours |

The table above illustrates each group of employees at ABC Agriculture, along with the total number of hours employees in each group can be expected to work on an annual basis. For example, underage farm hands can be expected to put in between 0 and 936 hours per year. The total number of hours for each range is then calculated for use in the next table.

| Range # | Number of Accrual Intervals for Range |

Desired Accrual For Range | Accrue Amount

[Desired Accrual For Range / Number of Accrual Intervals for Range] |

Total Accrual for Accrual

Period

[Cumulative Total of Accrue Amount * Whole Integer Value of Number of Accrual Intervals] |

| 1 | 93.6 | 20 | 0.215054 | 20.000022 |

| 2 | 10.4 | 20 | 2 | 40.000022 |

| 3 | 104 | 40 | 0.384616 | 80.000086 |

| 4 | 104 | 80 | 0.769231 | 160.00011 |

| 5 | Up to 687.9 | NA | 0.769231 | 160+ |

The table above is used to calculate the total number of Accrual Intervals for each period. The Accrue Amount for each Range is then calculated from the Desired Accrual Total for each range and the number of accrual intervals for the range as shown. For checks and balances purposes, the final column ‘Total Accrual For Accrual Period’ is used to calculate the total number of hours that will be awarded if employees in each group work their max scheduled hours. The Min Hours, Max Hours, and Accrue Amount for each range can then be used to complete the Rate Mapping Records as shown below.

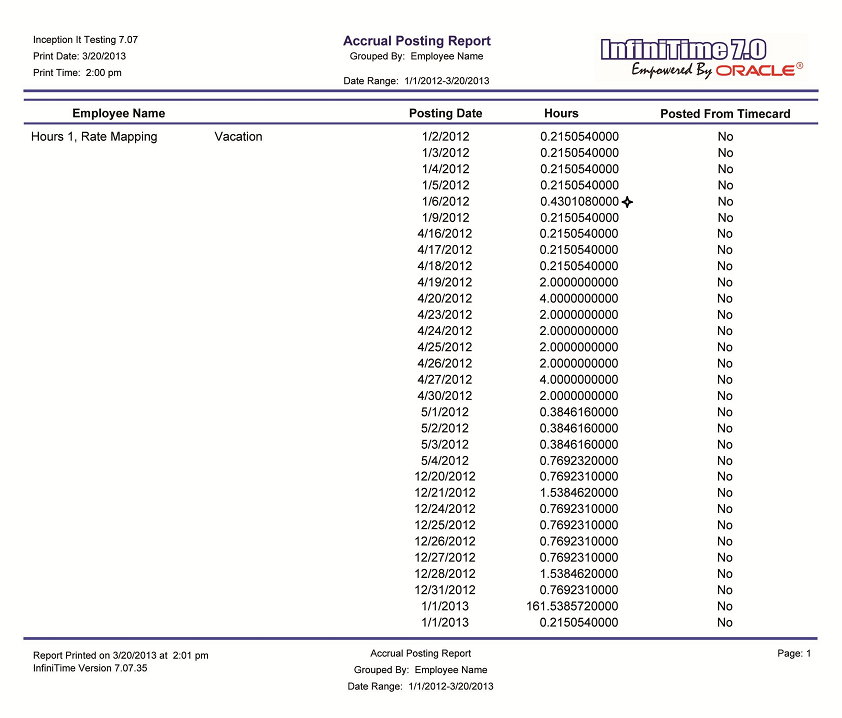

Employee Hire Date - 11/06/2010

Accrual Reset Type - Calendar Year

Stop At - 200 Hours

Carry Over -

In order to fit the most relevant records from the Accrual Posting Report on this page for example purposes, the image below was edited to show records from different parts of 2012. The image below does not represent all dates on which hours were posted for the Employee.

Notice that the Accrue Amount increases throughout the year as the total number of hours worked by the employee crosses each Min Elapsed Unit value defined on the Rate Mapping records. For example, as an employee who works 60 hour weeks at 12 hours per day, the employee hits 936 hours on 4/18/12. The employee’s next day of work, 4/19/12, awards 2 hours according to the Rate Mapping Configuration. The Accrue Amount for each Accrual Interval continues to scale according to the Rate Mapping Records as the employee works throughout the year. Notice that the employee’s first day in 2013 reverts to the original Accrue Amount of 0.215054 hours since the total number of elapsed units (IE: Worked Hours) is reset for the 2013 Accrual Period.

![]() As a

60 Hour / Week Employee, the employee shown worked 12 hours per day M

– F throughout 2012. In this way, every fifth day of work the employee

will hit the 10 hour threshold twice. Specifically, the first two hours

on the fifth day of each week will award vacation hours for reaching the

5th 10 hour accrual interval for the week, and the 12th hour of work will

award vacation hours for reaching 6th 10 Hour accrual interval for the

week.

As a

60 Hour / Week Employee, the employee shown worked 12 hours per day M

– F throughout 2012. In this way, every fifth day of work the employee

will hit the 10 hour threshold twice. Specifically, the first two hours

on the fifth day of each week will award vacation hours for reaching the

5th 10 hour accrual interval for the week, and the 12th hour of work will

award vacation hours for reaching 6th 10 Hour accrual interval for the

week.

Calculation – Enter a descriptive name for the Accrual Calculation such as ‘Vacation Time’ or ‘Sick Time.’ All Accrual Calculations in an Accrual Class with multiple tenure ranges should have the same Calculation Name across all accrual types and accrual calculations in the Accrual Class as illustrated in the provided examples.

Stop Accruing Date – Employees will no longer accrue hours for the accrual calculation as of the date set in this field.

Start Accruing Hire Date Plus – This setting is intended for use with new hires and should only be configured on accrual calculations assigned to accrual types with a minimum tenure of 0. The number entered in this field represents a number of days after the employee’s Date of Hire during which InfiniTime will not calculate accruals. It helps to think of this as a probation period, in days, during which employees will not accrue or award hours to the employee.

Stop At – Sets the maximum amount of hours which may be available for the Accrual Type. InfiniTime will stop accruing additional hours if the amount of available hours reaches this value.

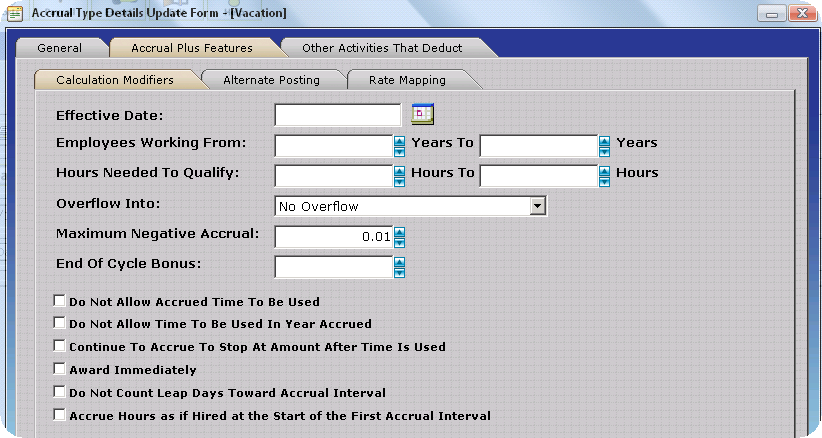

Effective Date – The effective date defines the first day employees will accrue hours for the accrual calculation. Employees assigned to the accrual type prior to the effective date will not accrue hours until the effective date. If the Effective Date is on an Accrual Calculation for a single Accrual Type, the Effective Date should be set to the same value for the respective Accrual Calculation across all Accrual Types in the respective Accrual Class as shown below.

| Accrual Name: ABC Company Full Time Employee Accruals | Employee Group (Accrual Class): Full Time | ||

| Tenure Min. | Tenure Max. | Accrual Calculation | Settings |

| 0 Years | 3 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 40 Hours Calculation Modifiers: Effective Date = 01/01/2010 |

| 3 Years | 5 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 80 Hours Calculation Modifiers: Effective Date = 01/01/2010 |

| 5 Years | 10 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 96 Hours Calculation Modifiers: Effective Date = 01/01/2010

|

| 10 Years | 99 Years | Vacation Time | Reset Type: Calendar Year Calculation Method(s): Start at 120 Hours Calculation Modifiers: Effective Date = 01/01/2010

|

The Table Above clearly shows that ABC Company began tracking the Vacation Time Accrual Calculation within InfiniTime on 01/01/2010. InfiniTime will begin accruing Vacation Hours as of 01/01/2010 for all employees assigned to an Accrual Type on the Full Time Class who were hired prior to 01/01/2010.

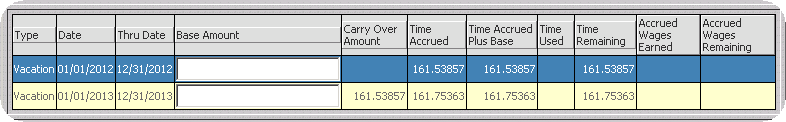

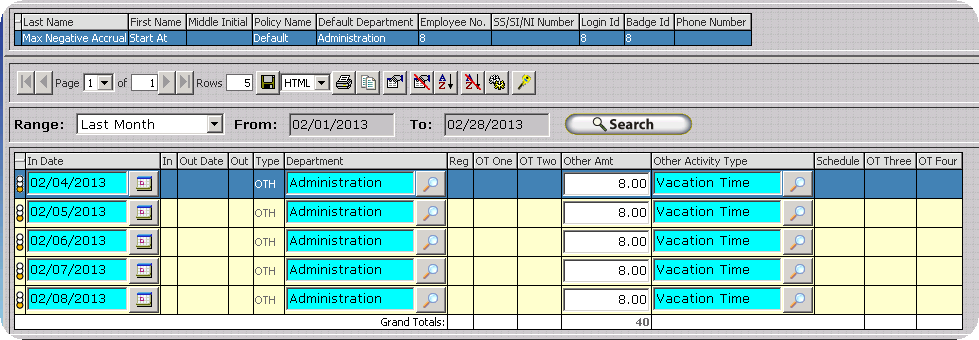

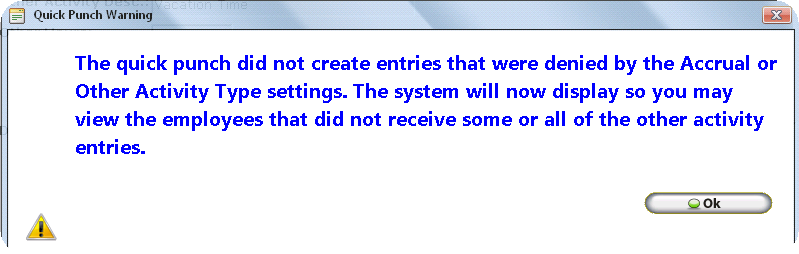

Maximum Negative Accrual – The Maximum Negative Accrual feature allows the InfiniTime Administrator to define the maximum negative balance for an accrual calculation. In other words – the number of hours employees can use beyond their accrued hours – is controlled by this setting. If the Maximum Negative Accrual field is blank, Supervisors must use discretion when approving employee requests for time off. If the Maximum Negative Accrual Field is filled, InfiniTime will prevent Other Activity Hours from being inserted throughout the InfiniTime Application such that an employee’s remaining accrual balance would exceed the maximum negative accrual amount. An example is provided below.

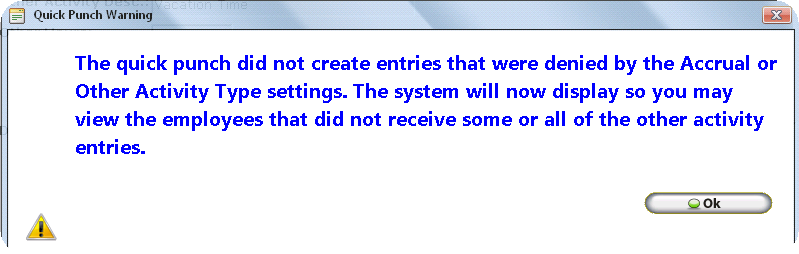

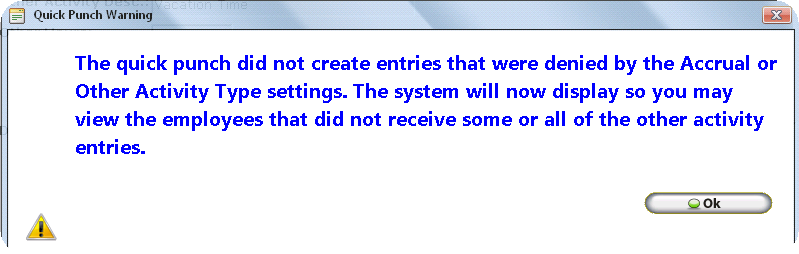

The following areas of the InfiniTime Software will specifically warn users and prevent the attempted action if an employee’s remaining accrual balance would exceed the maximum negative accrual amount due to the attempted action:

In Line Edit on the Company Timecard, Employee Timecard, and Employee Module Timecard

Insertion of Other Activity Hours using Quick Punch on the Company Timecard, Employee Timecard, or Employee Module Timecard

Approval of Time Off Requests

NOTE: Other Activity Hours Entered by supervisors or employees at a Hardware Terminal such as the Thor are automatically polled and posted to employee timecards within the InfiniTime Software. When Maximum Negative Accrual is enabled, care should be taken when inserting Other Activity Hours at hardware terminals. Hardware Terminals such as the Thor do not have the ability to alert users when the entry of Other Activity Hours would cause an employee’s remaining accrual balance to exceed the maximum negative accrual amount.

Employee Hire Date - 11/06/2010

Accrual Reset Type - Calendar Year

Start At - 120 Hours

Maximum Negative Accrual - 0.01 Hours

Notice how the employee took five business days of vacation time from 2/04/13 to 2/08/13 for a total of 40 Vacation Hours. This exhausted the employee’s accrued hours leaving the employee with 0 hours remaining. If a user or supervisor should attempt to insert additional vacation time for the employee using Quick Punch or by approving a Time Off Request Message, a warning will be displayed informing the user that the attempted entry was declined as shown above.

In many cases, Accrual Benefits are scaled according to the number of years an employee has been with an organization in a uniform basis across all Accrual Calculations for a group of employees. Yet, in some circumstances, benefits for a specific accrual calculation (or type of paid leave) may increase at different milestones when compared with other accrual calculations (or types of paid leave) in a single accrual class. The examples below illustrate the different ways employee benefits can be scaled according to the length of time an employee is with an organization, and how those benefits can be configured within InfiniTime using Accrual Type Tenures and Accrual Calculation Tenures.

NOTE: With the Accrual Plus Module, Accrual Calculations assigned to an Accrual Type with a From Tenure must have Accrual Calculation Tenures Defined. To reflect this requirement, Accrual Calculation Tenures are shown as blue required fields on the Accrual Calculation Update Form when the related Accrual Type has a From Tenure set.

Part Time Employees at ABC Company receive 2 Days (16 Hours) of Paid Sick Time after their first year of employment. This benefit does not increase for part time employees based upon the amount of time they have been with the company. ABC Company rewards Full Time and Salary employees with additional Vacation and Personal Time benefits at the following milestones: After 3 Years, After 5 Years, and After 10 Years of Employment. With this in mind, ABC Company requires the following tenure ranges for each class:

Employee Accruals Table 5 |

||

| Accrual Class: Part Time Employee Accruals | ||

| Tenure Min | Tenure Max |

Accrual Calculation & Settings for Respective Tenure |

0 Years |

1 Year | None |

1 Year |

99 Years | Sick Time: 1 - 99 Years |

Employee Accruals Table 5 |

||

| Accrual Class: Full Time Employee Accruals | ||

| Tenure Min | Tenure Max |

Accrual Calculation & Settings for Respective Tenure |

0 Years |

3 Years | Vacation Time: 0 – 3 Years Personal Time: 0 – 3 Years |

3 Years |

5 Years | Vacation Time: 3 – 5 Years Personal Time: 3 – 5 Years |

5 Years |

10 Years | Vacation Time: 5 – 10 Years Personal Time: 5 – 10 Years |

10 Years |

99 Years | Vacation Time: 10 – 99 Years Personal Time: 10 – 99 Years |

Employee Accruals Table 5 |

||

| Accrual Class: Salary Employee Accruals | ||

| Tenure Min | Tenure Max |

Accrual Calculation & Settings for Respective Tenure |

0 Years |

3 Years | Vacation Time: 0 – 3 Years Personal Time: 0 – 3 Years |

3 Years |

5 Years | Vacation Time: 3 – 5 Years Personal Time: 3 – 5 Years |

5 Years |

10 Years | Vacation Time: 5 – 10 Years Personal Time: 5 – 10 Years |

10 Years |

99 Years | Vacation Time: 10 – 99 Years Personal Time: 10 – 99 Years |

Notice how each Accrual Class has Accrual Calculations which scale employee benefits in a uniform manner at exactly the same milestones. This configuration is supported by both the Basic Accruals Module and the Accrual Plus Module with one difference – the Basic Accruals Module does not require entry of Accrual Calculation Tenures where as the Accrual Plus Module does.

XYZ Company employs only Salary Employees who receive Vacation Time and Sick Time. XYZ Salary Employees are not eligible for Vacation Time until their first year of employment is complete, though they do receive 16 Sick Time Hours after a probationary period of 90 days. Sick Time Hours awarded to salary employees are then increased on the employee’s first, second, and third anniversary by a total of 8 Hours. After one year of employment, Salary Employees are awarded 40 hours of vacation. Additionally, Salary employees are awarded with additional Vacation Time benefits at the following milestones: 60 Hours / Year after 3 Years, 70 Hours / Year after 5 Years, and 80 Hours / Year after 10 Years of Employment. XYZ Company does not carry hours forward from accrual period to accrual period for either Sick Time or Vacation Time. These rules result in the following milestones at which benefits are altered for each accrual calculation:

Sick Time: 1 Year, 2 Years, 3 Years

Vacation Time: 1 Year, 3 Years, 5 Years, 10 Years

Individually, this results in the following tenure ranges for each accrual calculation:

Sick Time: 0 -1 Year, 1 - 2 Years, 2 - 3 Years, 3 – 99 Years

Vacation Time: 0 - 1 Year, 1 - 3 Years, 3 - 5 Years, 5 - 10 Years, 10 – 99 Years

Notice that the two year duration from 1 to 3 Years for Vacation Time can be evenly divided into two one year periods: 1 – 2 Years and 2 – 3 Years to match the same tenures as required for Sick Time. The key to understanding this when configuring Accrual Calculations is that Vacation Time Benefits will simply not change for these tenure ranges as shown in the table below. Additionally, the 3 – 99 Year duration can be split into three separate tenure ranges, 3 – 5 Years, 5 – 10 Years, and 10 – 99 Years because benefits for Sick Time Hours no longer change after the 3rd year.

With this in mind, the following accrual type tenures and accrual calculations can be used to accurately represent the required accrual calculations:

Employee Accruals Table 5 |

||

| Accrual Class: Salary Employee Accruals | ||

| Tenure Min | Tenure Max |

Accrual Calculation & Settings for Respective Tenure |

0 Years |

1 Years | Sick Time: 0 to 1 Years, Start At 16 Hours, Hire Date Plus 90 Days. Anniversary Reset. |

1 Years |

2 Years | Sick Time: 1 to 2 Years, Start At 24 Hours, Anniversary Reset. Vacation Time: 1 to 2 Years, Start at 40 Hours, Anniversary Reset. |

2 Years |

3 Years | Sick Time: 2 to 3 Years, Start At 32 Hours, Anniversary Reset. Vacation Time: 2 to 3 Years, Start at 40 Hours, Anniversary Reset. |

3 Years |

5 Years | Sick Time: 3 to 5 Years, Start At 40 Hours, Anniversary Reset. Vacation Time: 3 to 5 Years, Start at 60 Hours, Anniversary Reset. |

5 Years |

10 Years | Sick Time: 5 to 10 Years, Start At 40 Hours, Anniversary Reset. Vacation Time: 5 to 10 Years, Start at 70 Hours, Anniversary Reset. |

10 Years |

99 Years | Sick Time: 10 to 99 Years, Start At 40 Hours, Anniversary Reset. Vacation Time: 10 to 99 Years, Start at 80 Hours, Anniversary Reset. |