Job Costing makes it possible for the user to track employee hours under various levels. Job Costing is generally used in businesses where employee labor costs are of special interest when compared to the cost of finished goods such as manufacturing or production related organizations. Even though Job Costing adds a great deal of functionality to the InfiniTime Application it is not used by all companies and as such is disabled by default. Job Costing related fields such as Job and Task will not be displayed within the application if Job Costing is disabled.

In general Job Costing involves the tracking of three types of information - Internal Departments, Job / Customer, and Task as outlined below.

Internal Departments may refer to separate categories of activity within an organization. Tracking Internal Departments with Job Costing makes it possible for an organization to identify how labor costs are distributed throughout various categories within the company. Example Activity Categories are Administration, Installation, Construction, Electrical etc.

Job / Customer refer to individual Job Numbers or Customer accounts under which specific tasks are performed. Tracking Jobs / Customers with Job Costing makes it possible for an organization to clearly identify all labor related costs for a specific Customer or Job. Jobs / Customers are generally assigned an Invoice or Job Number which can be used within the organization to refer to the Job.

Tasks refer to actions performed by employees under a specific Activity Category or Job / Customer. Tracking Tasks makes it possible for an organization to clearly identify the amount of time generally required to perform a specific task. Once this is understood employees who take exceptionally long to perform a given task are easily identified. Tasks vary based upon the working environment. Example tasks for a Custom Cabinet Shop might include Framing, Sanding, Staining, Painting, and Installation.

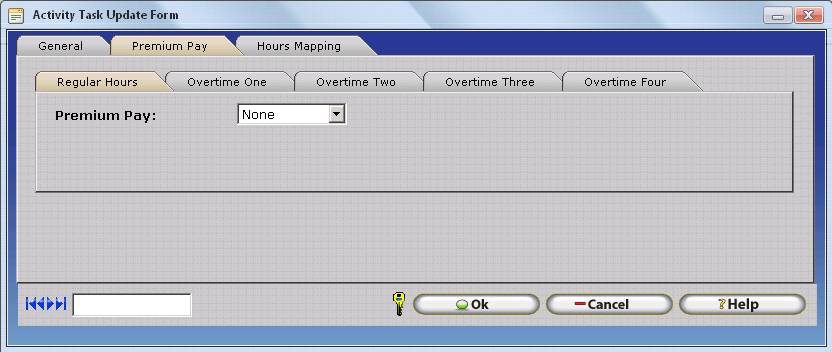

Premium Pay can be used to define Premiums, or bonuses in the form of an increased wage, which are paid to employees based upon the Shift, Department, Job, or Task the employee works on. Refer to the Pay Premium Introduction for more information.

While there are various benefits for tracking these items they may not be of interest to all companies. Customers may choose to track one, two, or all of these items.

Single Level: If only one of the above information types is of interest to your company Job Costing is not required. Simply configure Departments to represent the appropriate Internal Departments, Jobs / Customers, and Tasks within your organization. It is important to note employee activity can only be associated with one Department at a time.

Two Levels: If two of the above information types are of interest to your company both Departments and Jobs must be configured within the InfiniTime Application. It should be noted that InfiniTime Departments are required. All employee activity will be associated with a department. In a two level system the first level generally corresponds to Internal Departments or Jobs / Customers while the second level corresponds to Jobs. Departments are considered the first Job Costing Level within InfiniTime and should be configured with the appropriate information. For example, if Internal Departments such as Administration, Construction, Installation etc. are to be your first Job Costing Level then these items should be configured as Departments within the InfiniTime System. Alternatively Jobs / Customers may be used as your first Job Costing level. In this case Job Numbers or Customer Names should be configured as Departments within InfiniTime. Jobs are considered the second Job Costing Level within InfiniTime and should be configured with any Tasks that apply to your company such as Welding or Painting.

NOTE: In some scenarios only Jobs / Customers and Tasks or Internal Departments and Tasks are of interest to a specific company. However the company may use two levels of tasks. In this scenario three job costing levels are used for only two items of information. Jobs / Customers or Internal Departments would correspond to Departments within InfiniTime. The first task level would refer to Jobs within InfiniTime and the second task level would refer to Tasks within InfiniTime. The chart below shows an example of this configuration.

Job / Customer (Configured As InfiniTime Departments) |

Task 1 (Configured as InfiniTime Jobs) |

Task 2 (Configured as InfiniTime Tasks) |

Invoice 1160072 |

Installation |

Old Cabinet Removal |

Invoice 1160072 |

Installation |

Hang Wall Cabinets |

Invoice 1160072 |

Installation |

Install Base Cabinets |

Three Levels: If all three of the above information types are of interest to your company Departments, Jobs, and Tasks must be configured within the InfiniTime Application however the type of information configured within Departments, Jobs, and Tasks differs from company to company. It is important to recognize Departments are required within InfiniTime. All employee activity is associated with a department. For this reason most companies choose to configure Internal Departments as Departments within InfiniTime. Example job costing configurations using Three Levels with Internal Departments, Job / Customers, and Tasks are provided below.

Internal Department (Configured As InfiniTime Departments) |

Customer (Configured as InfiniTime Jobs) |

Task (Configured as InfiniTime Tasks) |

Frame Construction |

Gilbert's Crab Boats |

Welding |

Hull Construction |

Gilbert's Crab Boats |

Sanding |

Assembly |

Gilbert's Crab Boats |

Assembly |

Internal Department (Configured As InfiniTime Departments) |

Job Number (Configured as InfiniTime Jobs) |

Task (Configured as InfiniTime Tasks) |

Frame Construction |

17251 |

Welding |

Hull Construction |

17251 |

Sanding |

Assembly |

17251 |

Assembly |

Three Levels w/ Internal Departments, Customers, & Jobs: In some scenarios Tasks are not of interest while both Customers and individual Jobs must be tracked. With this configuration the first level generally corresponds to Internal Departments while the second and third levels correspond to Customers and Jobs respectively. Remember all activity is associated with a department within InfiniTime. An example of this configuration is shown below.

Internal Department (Configured As InfiniTime Departments) |

Customer (Configured as InfiniTime Jobs) |

Job Number (Configured as InfiniTime Tasks) |

Custom Programming |

Jan's Software |

100235 |

Custom Reports |

Wellington School District |

200257 |

Technical Support |

Wellington School District |

300987 |

Three levels w/ Two Levels as Tasks: In some scenarios Customers / Jobs are not of interest while Internal Departments and multiple task levels must be tracked. With this configuration the first level generally corresponds to Internal Department while the second and third levels correspond to tasks. An example of this configuration is shown below.

Internal Department (Configured As InfiniTime Departments) |

Task 1 (Configured InfiniTime Jobs) |

Task 2 (Configured as InfiniTimeTasks) |

Cabinets |

Installation |

Old Cabinet Removal |

Cabinets |

Installation |

Hang Wall Cabinets |

Cabinets |

Installation |

Install Base Cabinets |

Administration |

Auditing |

Taxes |

Ultimately the type of information tracked using Departments, Jobs, and Tasks is up to the user. Simply because they are referred to as 'Departments' or 'Jobs' does not mean they must be used for internal departments and job numbers. When configuring Job Costing users must first identify what types of information will be tracked by job costing. Once the information to be tracked has been identified a hierarchy is generally evident when looking at how the items relate to each other. This hierarchy can then be used to organize the items into three levels. The highest level should be configured as departments within InfiniTime, the next as Jobs, and the last as Tasks. While a maximum of three levels are available it is not necessary to use all three levels. For two level systems InfiniTime Departments correspond to the first Job Costing Level while Jobs correspond to the second Job Costing Level.

Three methods are available for transferring between Departments, Jobs, and Tasks depending on the chosen solution for gathering employee activity. Two methods are available for choosing from Departments, Jobs, and Tasks using a hardware terminal. The method used for selecting a specific Department, Job, or Task differs depending on terminal model. A list of the method supported by each terminal is provided below. The first method for selecting Departments, Jobs, and Tasks is a simple list format. All available Departments, Jobs, or Tasks are displayed in a list. Employees can scroll up and down the list using buttons on the reader to select the desired item. The second method for selecting Departments, Jobs, and Tasks is by Item Number. In this case an item refers to a specific Department, Job, or Task. The item number corresponds to the Department Number for Departments, the Job Number for Jobs, and the Task Number for Tasks. When employees press the Labor Switching or Transfer Button they will be prompted to enter the Department Number to select the Department they wish to work under followed by the Job and Task number if applicable. When many items are available Transferring by Item Number is the most efficient transfer method though steps must be taken to ensure it is configured appropriately.

1.) Identify the number of Departments, Jobs, and or Tasks which will be tracked for Job Costing Purposes. This information is invaluable when designing a numbering system for Departments, Tasks and Jobs.

2.) Determine item number length. Item Numbers for Departments and Tasks generally range between 2 and 4 digits while Job numbers range from 4 to 8 digits. The number of Departments, Jobs, or Tasks to be tracked can be used to determine item number length requirements. for example a one digit Department number has a maximum of ten values. (0 to 9) It would not be possible to track 12 departments with a one digit department number as the department number must be unique. Future growth should also be accounted for when designing a numbering system. A company with 8 departments would do well to use a two digit department number to allow for a maximum of 100 departments. (0 to 99)

3.) List all active Departments, Jobs, and Tasks and assign each an Item Number with the chosen length. Refer to this list when configuring Departments, Jobs, and Tasks within InfiniTime. Ensure each item has a unique item number. Note: All Department Numbers, Job Numbers, and Task Numbers must be unique though they are independent of each other. For example a Department, Job, and Task with an item number of 10 can be created. In this example the Department Number, Job Number, and Task Number would simply all be set to 10.

Example Item List: ABC Carpentry & Contractors

Item |

Type |

Item Number |

Construction |

Department |

10 |

Electrical |

Department |

20 |

Philly Mae Pizzeria |

Job |

10000 |

Suzzies Pizzeria |

Job |

10001 |

Framing |

Task |

1001 |

Drywall |

Task |

1002 |

Wiring |

Task |

2010 |

Engineering |

Task |

2011 |

The above example shows a subset of all Tasks, Departments, and Customers currently active at ABC Carpentry & Contractors. From the examples the chosen item number lengths are evident:

Department Numbers - 2 Digits

Job Numbers - 5 Digits

Task Numbers - 4 Digits

A pattern also exists in the Task Numbers for readability and ease of use. This is an optional design concept which may be useful in some organizations. ABC Carpentry and Contractors employees a variety of employees from Electrical Engineers and Contractors to Carpenters. Some tasks are specific to a particular department and include the department number inside of the task number to show this relationship. IE: Wiring, #2010 is related to the Electrical Department #20. Overall, the most important idea when designing a numbering system for Departments, Jobs, and Tasks is to ensure numbering remains consistent.

Item Lookup, the third method for transferring between Departments, Jobs, and Tasks, is only available within the InfiniTime Employee and Punch Modules. Employees can type the first few letters of the Department, Job, or Task name and the remaining characters will be automatically filled. They also have the option of using the Lookup Tool which displays all available Departments, Jobs, or Tasks in a searchable list.

Data Collection Terminal |

Supported Labor Transfer Method |

Athena |

Item List |

Juno |

Item List |

Luna |

Item List |

Scout |

Transfer by Item Number |

Thor |

Transfer by Item Number |

Zephyr |

Item List |

InfiniTime Employee & Punch Modules |

Item Lookup |

Note: Allow PC Punch Labor Switching must be checked before employees will be able to choose their Department, Task, or Job from the InfiniTime Employee & Punch Modules

For information regarding what types of information can be entered into Departments, Jobs, and Tasks for Job Costing purposes please refer to the Job Costing Introduction. Remember any combination of Internal Departments, Jobs / Customers, and Tasks can generally be used within these areas of InfiniTime.

Departments within InfiniTime are used as the first Job Costing Level. It should be noted that departments are a required field within the application and as such all employee activity will be associated with a Department. It is important to keep this information in mind when using Departments for Job Costing purposes. Since all employee activity will be associated with a Department steps should be taken to ensure InfiniTime Departments correspond to the highest level of Job Costing information.

For example many office companies consider Internal Departments the highest Job Costing Level in order to ensure all employee activity is related to a specific category of work such as Payroll, Shipping, Technical Support, and Programming. Manufacturing may prefer to use Customers or Job Numbers as the highest level in order to ensure all employee activity is related to a Customer or Job.

To Configure Departments within InfiniTime for use with Job Costing:

1.) Identify the type of information which will be tracked in InfiniTime Departments.

2.) It often helps to create a list all current items under the chosen type of information. For example if Job Numbers are to be used as the first Job Costing Level list all current Job Numbers and any related information. Depending on the information being tracked within InfiniTime the list should contain the following:

Information Type |

Department Description Field |

Department Cost Center Field |

Department Number Field |

Internal Departments |

Department Name |

Alphanumeric Code or other Payroll Identifier |

Department Number |

Customers / Jobs |

Customer or Job Name |

Alphanumeric Code or other Payroll Identifier |

Customer / Job Number |

Tasks |

Task Name |

Alphanumeric Code or other Payroll Identifier |

Task Number |

3.) Create one department for each listed item. Ensure the Cost Center and Department Numbers are configured appropriately.

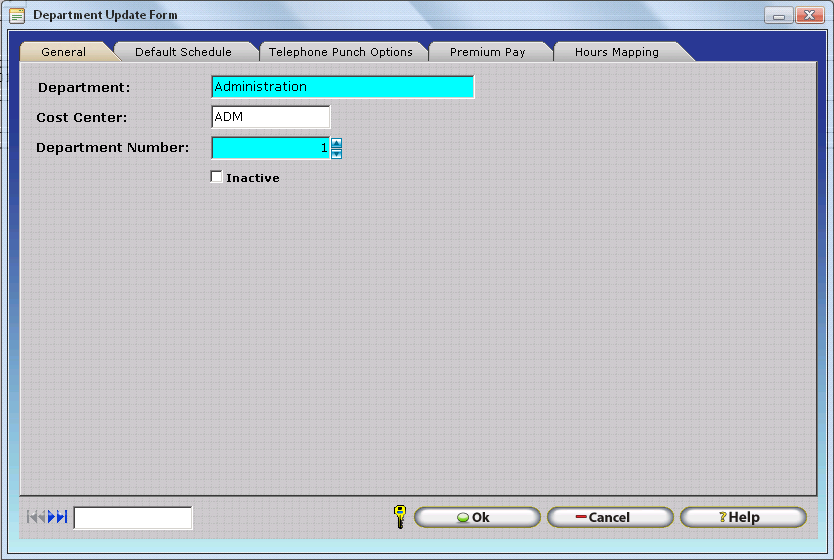

The Department Table displays a list of all Departments configured in the software. Departments are used to separate employee hours performed under different disciplines and / or types of activity. Employees can punch into and out of departments in order to track hours worked under separate departments such as Programming, Technical Support, or Shipping or separate tasks such as Welding, Painting, or Finish Work. Initially, it is important to understand the following concepts regarding InfiniTime Departments and Job Costing:

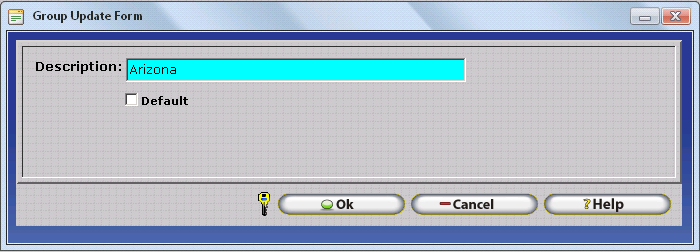

Insert - Clicking the Insert button opens the Department Update Form to create a new department. Add as many departments as needed.

Change - Displays the Department Update Form for the selected the Department. The InfiniTime Administrator may then make changes as desired.

Delete - Clicking the Delete button will remove the highlighted department from the list.

Department - Enter the given name of a department within the organization.

Cost Center - Some Accounting Packages and Payroll Services require this field in order to import InfiniTime data. If it is not required, this field may be left blank. Your Inception Technologies Implementation Specialist can help you determine if the Department Cost Center field is required for any specific payroll export. Using the same cost center for multiple departments will cause activity from both departments to be lumped together into a single cost center or pay code when the activity is exported to payroll.

Department Number - Assign a department number as an additional identifier for Departments. No two departments may have the same department number.

Inactive - Selecting this check box will cause the department not to appear as a selection in InfiniTime nor will any hours worked within this department show up on reports.

Default - InfiniTime permits one department to be set as the Default Department. The default department will automatically be assigned to new employees when they are created..

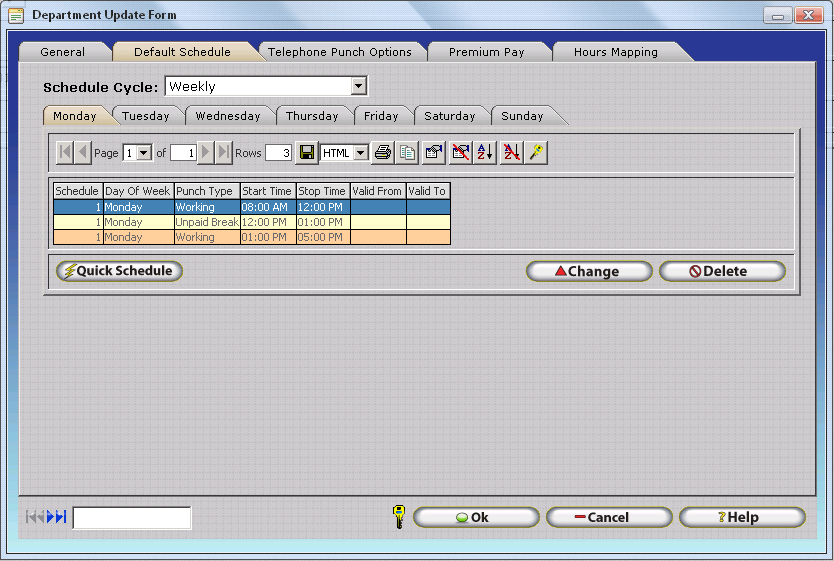

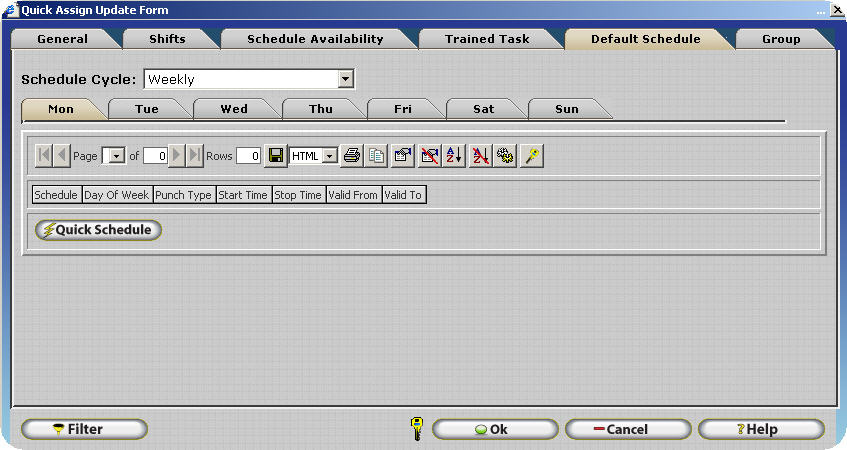

The default schedule within a department record is used to enter a schedule that is used for all employees assigned to the department. It is important to note that this schedule is not required, but may be used for scheduling purposes and is subject to the schedule hierarchy. Schedule entries assigned to employees take precedence over each other depending on their place in the schedule hierarchy as outlined below. The hierarchy is arranged by schedule priority from top to bottom.

For example, the default schedule defined on an employee’s policy would be ignored if a default schedule was configured for the employee in their employee or department record.

Quick Schedule - Opens the Quick Default Schedule Tool which permits InfiniTime Administrators to define a default schedule for all employees assigned to the respective department. Additional details on use of the Quick Default Schedule Tool can be found in the Scheduling Section of this document.

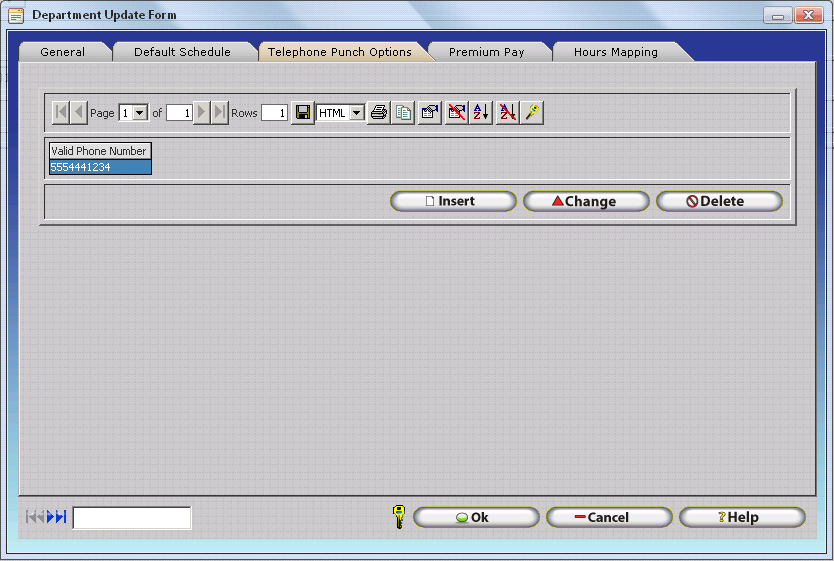

The Telephone Punch Options Tab of the Department Update Form permits entry of specific phone numbers which are permitted to perform a Department Transfer into the respective department. In this way, the InfiniTime Administrator can control which departments employees are permitted to transfer to. This feature is especially useful for organizations who use Department Pay Premiums. The Telephone Punch Options tab will only be displayed on the Department Update Form if the customer's InfiniTime Software License includes the Telephone Punch Module.

Insert - Opens the Department Valid Telephone Number Update Form which can be used to add individual Valid Telephone Numbers to the Department Update Form. Valid Telephone Numbers should be entered in a 10 digit format including the area code without dashes.

Change - Opens the Department Valid Telephone Number Update Form for the selected Valid Telephone Number. The InfiniTime Administrator may then make changes to the Valid Telephone Number as desired.

Delete - Deletes the selected Valid Telephone Number from the Valid Telephone Number Tab. Keep in mind, employees will be permitted to transfer to the respective department only if the phone number they are calling from is present in the list.

Note: If no Valid Telephone Numbers are defined for a given department, employees may transfer to the department from any telephone number.

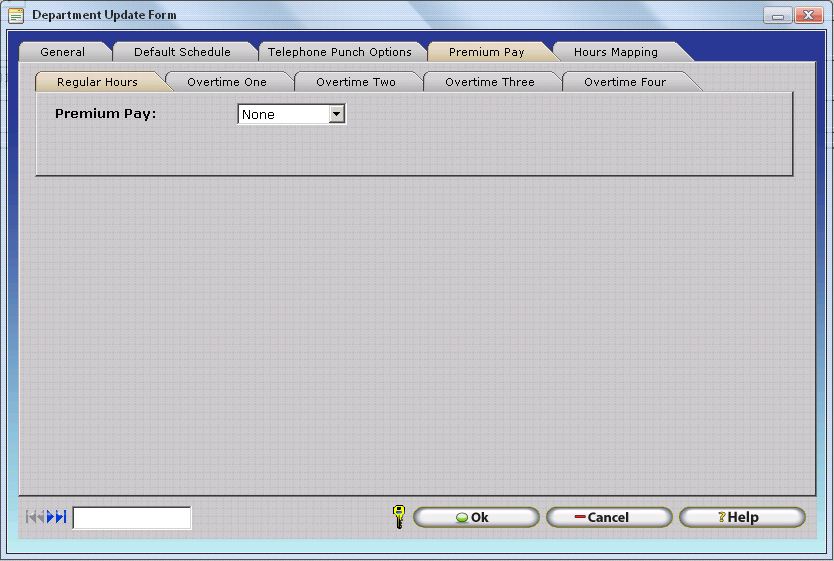

Premium Pay makes it possible to define Premiums, or bonuses in the form of an increased wage. Department premiums are paid when employees work in a given department which has premiums configured. Premiums can be configured separately for the Regular, Overtime One, Overtime Two, Overtime Three, and Overtime Four hour types. This flexibility makes it possible to meet the needs of a variety of special payment premiums. Refer to the Pay Premium Introduction section of this document for more information on how Pay Premiums are calculated and how to configure them.

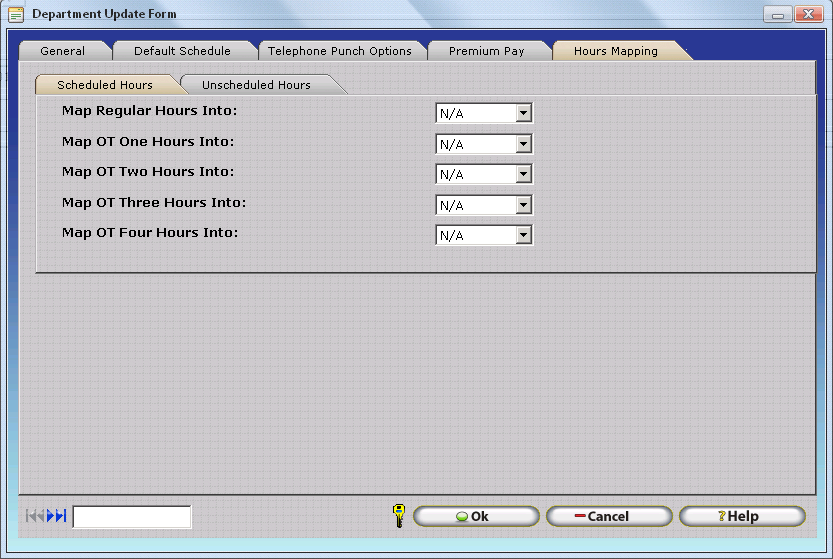

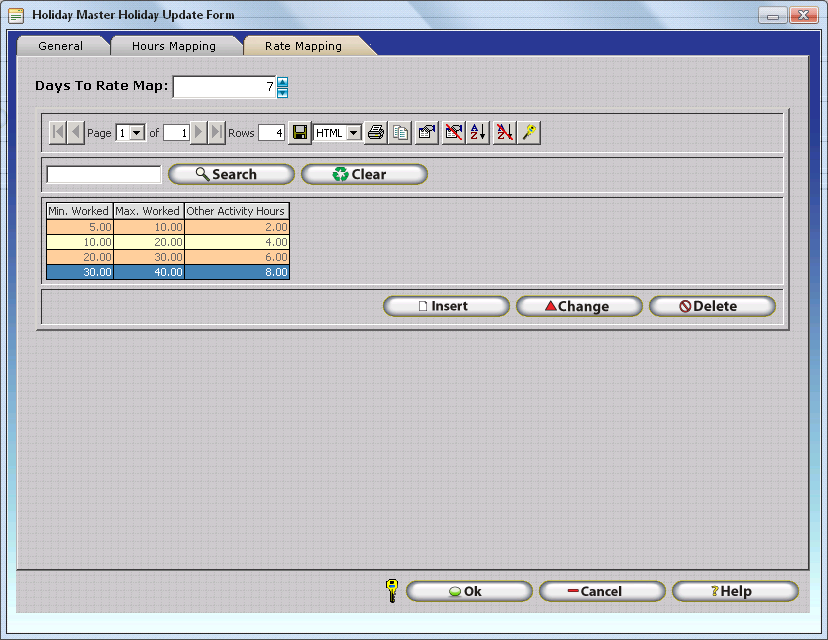

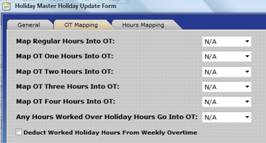

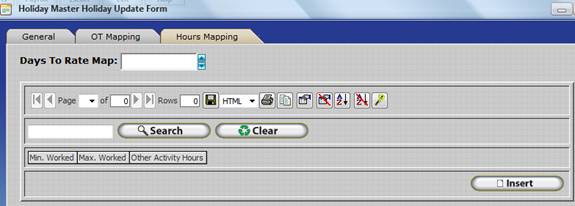

Hours Mapping permits employee hours worked in a given hours type to be mapped to a different hours type based on specific conditions such as:

Scheduled Hours worked on a specific Department

Scheduled Hours worked on a specific Job

Scheduled Hours worked on a specific Task

Scheduled Hours worked on a specific Other Activity Type

Unscheduled Hours worked on a specific Department

Unscheduled Hours worked on a specific Job

Unscheduled Hours worked on a specific Task

Unscheduled Hours worked on a specific Other Activity Type

The Hours Mapping Tab of the Department Update Form defines Hours Mapping settings for the respective department. Hours mapping settings configured for a department will be applied to employee scheduled and unscheduled hours. Hours Mapping is considered an advanced feature and is only required by approximately 30% of production InfiniTime Installations. Organizations with Labor Unions and specific hours costing or pay premium rules for scheduled vs unscheduled hours often find Hours Mapping to be required. Additional details on configuring and utilizing Hours Mapping can be found in the Hours Mapping Section of this document.

Configuring Jobs - Introduction

Jobs within InfiniTime are used as the second Job Costing Level. Jobs commonly relate to individual Jobs or Invoices under which tasks are performed though they may also be used for other types of information.

To Configure Jobs within InfiniTime for use with Job Costing:

1.) Identify the type of information which will be tracked in InfiniTime Jobs.

2.) It often helps to create a list all current items under the chosen type of information. For example if customers are to be used as the second Job Costing Level list all current customers and any related information. Depending on the information being tracked within InfiniTime the list should contain the following:

Information Type |

Job Description Field |

Job Cost Center Field |

Job Number Field |

Internal Departments |

Department Name |

Alphanumeric Code or other Payroll Identifier |

Department Number |

Customers / Jobs |

Customer or Job Name |

Alphanumeric Code or other Payroll Identifier |

Customer / Job Number |

Tasks |

Task Name |

Alphanumeric Code or other Payroll Identifier |

Task Number |

3.) Create one job for each listed item. Ensure the Cost Center and Department Numbers are configured appropriately.

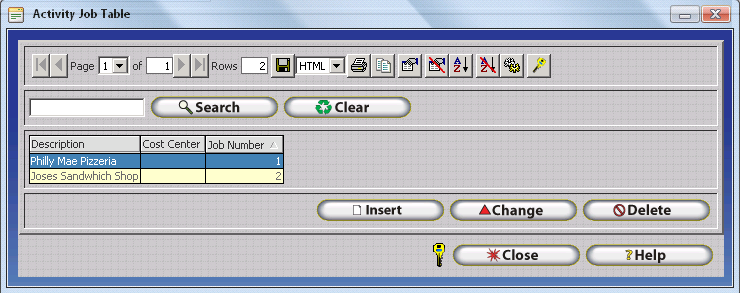

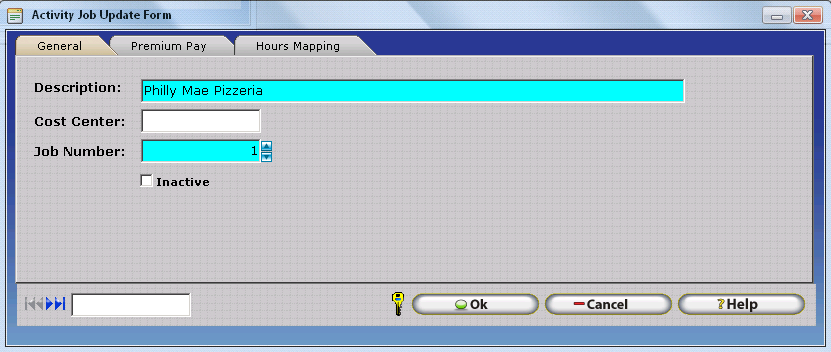

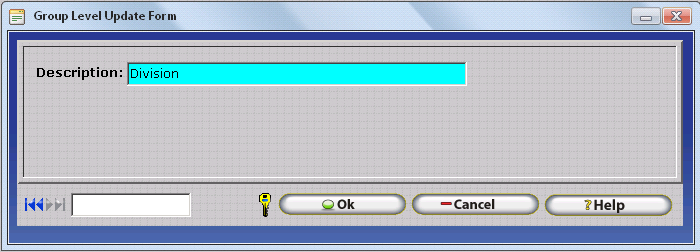

The Activity Job Table displays a list of all jobs configured in the software. Jobs are used alongside InfiniTime Departments to further categorize employee hours for job costing purposes. Employees can punch into and out of jobs in order to track hours worked for separate Jobs such as Philly Mae Pizzeria, Jose's Sandwich Shop, etc. Initially, it is important to understand the following concepts regarding InfiniTime Departments and Job Costing:

Insert - Clicking the Insert button opens the Activity Job Update Form to create a new Job. Add as many jobs as needed.

Change - Displays the Activity Job Update Form for the selected job. The InfiniTime Administrator may then make changes as desired.

Delete - Clicking the Delete button will remove the highlighted job from the list.

Description - Enter the given name of a Job within the organization.

Cost Center - Some Accounting Packages and Payroll Services require this field in order to import InfiniTime data. If it is not required, this field may be left blank. Your Inception Technologies Implementation Specialist can help you determine if the Job Cost Center field is required for any specific payroll export. Using the same cost center for multiple jobs will cause employee hours from all jobs with the same Job Cost Center to be lumped together into a single cost center when the hours are exported to payroll.

Job Number - Assign a job number as an additional identifier for jobs. No two jobs may have the same job number.

Inactive - Selecting this check box will cause the job not to appear as a selection in InfiniTime. Additionally, Inactive Jobs will not be sent to hardware terminals. Employees will no longer be able to transfer into or out of inactive jobs.

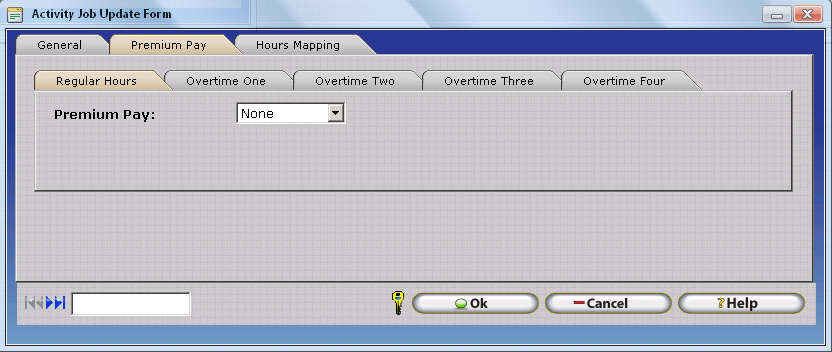

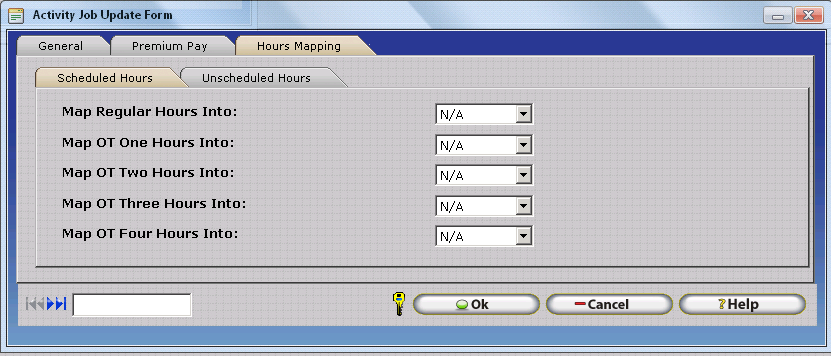

Premium Pay makes it possible to define Premiums, or bonuses in the form of an increased wage. Job pay premiums are paid when employees work in a given job which has premiums configured. Premiums can be configured separately for the Regular, Overtime One, Overtime Two, Overtime Three, and Overtime Four hour types. This flexibility makes it possible to meet the needs of a variety of special payment premiums. Refer to the Pay Premium Introduction section of this document for more information on how Pay Premiums are calculated and how to configure them.

Hours Mapping permits employee hours worked in a given hours type to be mapped to a different hours type based on specific conditions such as:

Scheduled Hours worked on a specific Department

Scheduled Hours worked on a specific Job

Scheduled Hours worked on a specific Task

Scheduled Hours worked on a specific Other Activity Type

Unscheduled Hours worked on a specific Department

Unscheduled Hours worked on a specific Job

Unscheduled Hours worked on a specific Task

Unscheduled Hours worked on a specific Other Activity Type

The Hours Mapping Tab of the Job Update Form defines Hours Mapping settings for the respective job. Hours mapping settings configured for a job will be applied to employee scheduled and unscheduled hours. Hours Mapping is considered an advanced feature and is only required by approximately 30% of production InfiniTime Installations. Organizations with Labor Unions and specific hours costing or pay premium rules for scheduled vs unscheduled hours often find Hours Mapping to be required. Additional details on configuring and utilizing Hours Mapping can be found in the Hours Mapping Section of this document.

Configuring Tasks - Introduction

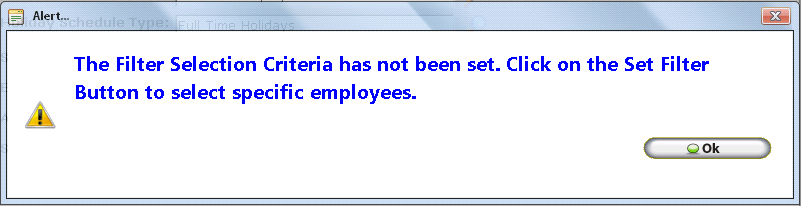

Tasks within InfiniTime are used as the third Job Costing Level. It should be noted that Jobs must exist within the InfiniTimeSoftware before Tasks can be configured. Attempting to insert a Task before configuring at least one job will result in a warning. At least one Job must be created before Tasks can be created. Tasks are the lowest Job Costing Level available in the InfiniTime software and are generally used to track various activities performed by employees though they may also be used for other types of information.

To Configure Tasks within InfiniTime for use with Job Costing:

1.) Identify the type of information which will be tracked in InfiniTime Tasks.

2.) It often helps to create a list all current items under the chosen type of information. For example if employees perform ten tasks on a regular basis for any given task then list all current tasks and any related information. Depending on the information being tracked within InfiniTime the list should contain the following:

Information Type |

Task Description Field |

Task Cost Center Field |

Task Number Field |

Internal Departments |

Department Name |

Alphanumeric Code or other Payroll Identifier |

Department Number |

Customers / Jobs |

Customer or Job Name |

Alphanumeric Code or other Payroll Identifier |

Customer / Job Number |

Tasks |

Task Name |

Alphanumeric Code or other Payroll Identifier |

Task Number |

3.) Create one task for each listed item. Ensure the Cost Center and Department Numbers are configured appropriately.

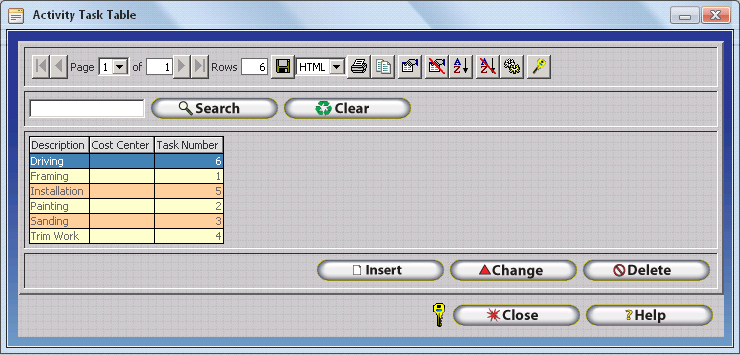

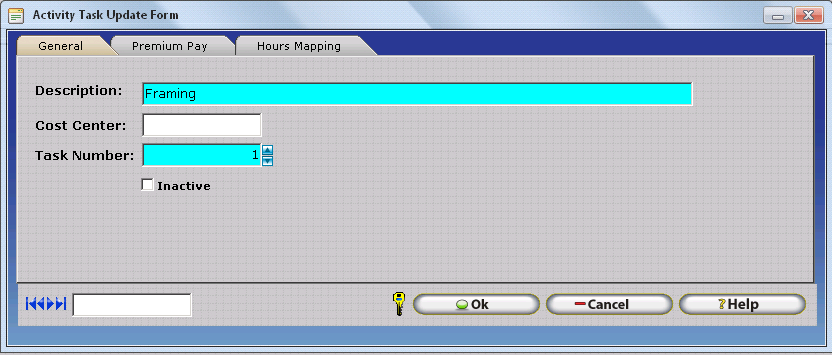

The Activity Task Table displays a list of all tasks configured in the software. Tasks are used alongside InfiniTime Departments and InfiniTime Jobs to further categorize employee hours for job costing purposes. Employees can punch into and out of activity tasks in order to track hours worked for separate tasks such as Framing, Painting, Sanding etc. Initially, it is important to understand the following concepts regarding InfiniTime Tasks and Job Costing:

Insert - Clicking the Insert button opens the Activity Task Update Form to create a new Task. Add as many tasks as needed.

Change - Displays the Activity Task Update Form for the selected task. The InfiniTime Administrator may then make changes as desired.

Delete - Clicking the Delete button will remove the highlighted task from the list.

Description - Enter the given name of a Task within the organization.

Cost Center - Some Accounting Packages and Payroll Services require this field in order to import InfiniTime data. If it is not required, this field may be left blank. Your Inception Technologies Implementation Specialist can help you determine if the Task Cost Center field is required for any specific payroll export. Using the same cost center for multiple tasks will cause employee hours from all tasks with the same Task Cost Center to be lumped together into a single cost center when the hours are exported to payroll.

Task Number - Assign a task number as an additional identifier for jobs. No two tasks may have the same job number.

Inactive - Selecting this check box will cause the task not to appear as a selection in InfiniTime. Additionally, Inactive Tasks will not be sent to hardware terminals. Employees will no longer be able to transfer into or out of inactive tasks.

Premium Pay makes it possible to define Premiums, or bonuses in the form of an increased wage. Task pay premiums are paid when employees work in a given task which has premiums configured. Premiums can be configured separately for the Regular, Overtime One, Overtime Two, Overtime Three, and Overtime Four hour types. This flexibility makes it possible to meet the needs of a variety of special payment premiums. Refer to the Pay Premium Introduction section of this document for more information on how Pay Premiums are calculated and how to configure them.

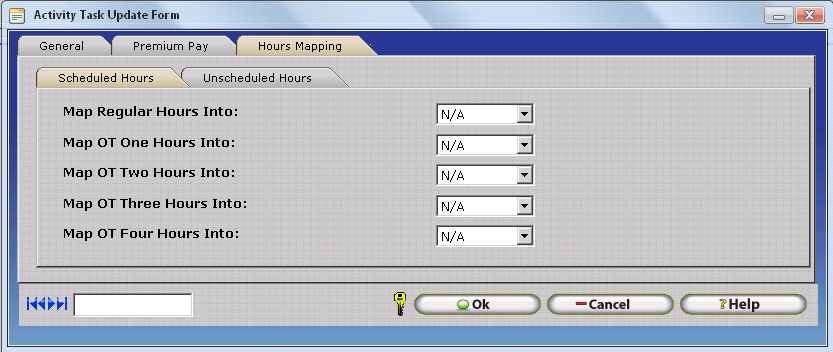

Hours Mapping permits employee hours worked in a given hours type to be mapped to a different hours type based on specific conditions such as:

Scheduled Hours worked on a specific Department

Scheduled Hours worked on a specific Job

Scheduled Hours worked on a specific Task

Scheduled Hours worked on a specific Other Activity Type

Unscheduled Hours worked on a specific Department

Unscheduled Hours worked on a specific Job

Unscheduled Hours worked on a specific Task

Unscheduled Hours worked on a specific Other Activity Type

The Hours Mapping Tab of the Task Update Form defines Hours Mapping settings for the respective task. Hours mapping settings configured for a task will be applied to employee scheduled and unscheduled hours. Hours Mapping is considered an advanced feature and is only required by approximately 30% of production InfiniTime Installations. Organizations with Labor Unions and specific hours costing or pay premium rules for scheduled vs unscheduled hours often find Hours Mapping to be required. Additional details on configuring and utilizing Hours Mapping can be found in the Hours Mapping Section of this document.

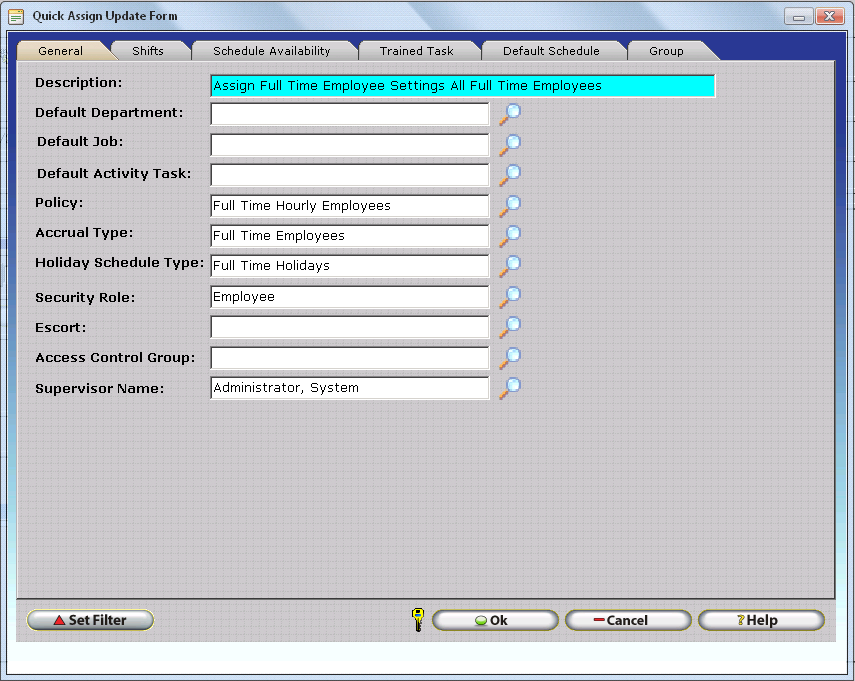

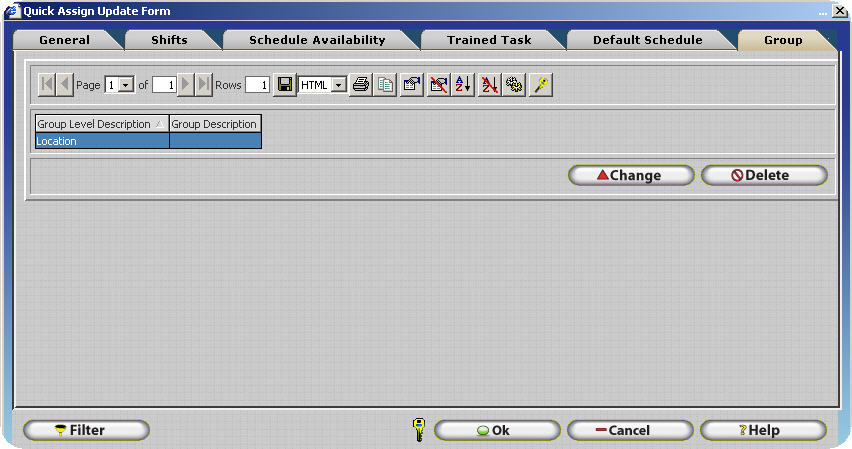

Employee's can be assigned to a Default Department, Job, and Task. In this way employee activity will be automatically associated with a specific Department, Job, and/or Task when they punch in. Employees can also use the Transfer Button or the Employee and Punch Modules to switch between Departments, Jobs and Tasks throughout the day. The transfer button varies in location and use for each hardware terminal. Please refer to the appropriate manual for your Hardware Device in the Hardware section of this document for additional information.

To Assign a Default Department, Job, or Task to an employee:

1.) Click on the Employee Button on the main toolbar to open the employee table.

2.) Select the employee you wish to configure Job Costing Settings for from the list and click change.

3.) Click on the Settings Tab.

4.) Select the Department, Job, or Task you would like to assign as the employee's default. It should be noted the Job and Task fields will not be displayed until at least one Job or Task is configured within InfiniTime. This simplifies the display of the Settings Tab for companies who do not utilize Job Costing.

Note: Only the Default Department is required. The Default Job and Default Task fields are not required as some companies may not wish all employees to have their activity associated with a Job or Task by default. In this way Office workers who simply work in a department.

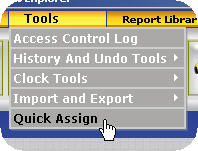

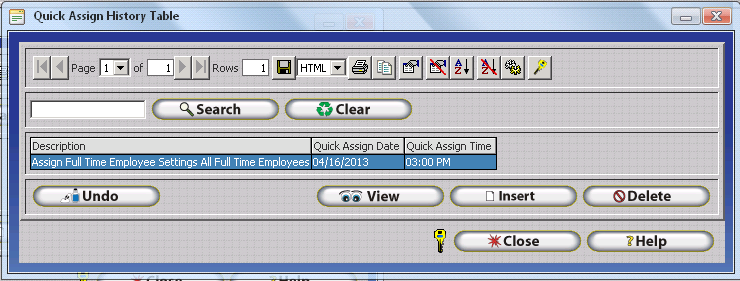

Displaying Job Costing information within the Company and Employee Specific Timecard Tables

Job Costing is disabled by default within the InfiniTime Application. As such Job Costing related fields such as Task and Job must be added to the grid in the Company Timecard Table and Employee Specific Timecard Table. It is only necessary to configure these settings once. The software will save any alterations made to the grid. It should be noted the grid configuration is a global setting which effects all users. Additional information on Grid Configuration can be found in the Customizing InfiniTime section of this document.

To add the Task and Job Fields to the Company Timecard Table:

1.) Click on the Timecard Button in the main toolbar to open the Company Timecard Table

2.) Click on the 'Select Grid Columns' button.

( ![]() )

)

3.) Locate the Task and Job Fields on the

'Available' list and click on ![]() to move them to the 'Selected' list.

to move them to the 'Selected' list.

4.) Use the ![]() and

and ![]() buttons to move the Task and Job Fields

up and down in the list to alter order columns will be displayed in.

buttons to move the Task and Job Fields

up and down in the list to alter order columns will be displayed in.

5.) Click Apply to confirm and save your changes.

6.) The Job and Task fields will be displayed in the Timecard Table.

It is not uncommon for employee wages to vary based upon the task, job, or department, where employees are working. Wages within InfiniTime can be allocated to a specific Job, Task, Department, or any combination thereof. Additional information on how to use wages with Job Costing can be found in the Job Costing - Wages section of this document.

To Configure Wages for use with Job Costing:

1.) Click on the Employee Button on the main toolbar to open the employee table.

2.) Select the employee you wish to configure Wages for from the list and click change.

3.) Click on the Wages Category.

4.) Click on Insert

5.) Choose a combination of Department, Job, or Task for which the wage will apply.

6.) Click OK to save the record.

Additional details on Job Costing and Wages can be found in the Job Costing and Employee Wages section of this document.

InfiniTime supports multiple sources for Employee Job Costing Activity. When choosing a time source for Employee Job Costing Activity it is important to understand any restrictions and configuration options associated with the solution in order to make the most of InfiniTime's Job Costing System. Each supported source and its Job Costing Properties are listed below.

Supported Levels - From 1 to 3 Levels

The InfiniTime Employee and Punch Modules support all three available Job Costing levels: Departments, Jobs, and Tasks.

Benefits

Omnipresence: The InfiniTime Employee and Punch Modules are available from anywhere the InfiniTime Application can be accessed. Employees can clock in and out for different Departments, Jobs, and Tasks from any computer with access to the InfiniTime application using their Login ID and Password. If the InfiniTime Software has been published to the Internet employees can access the software worldwide from any computer with internet access using their login credentials.

Customization: Through use of security roles and configuration the Employee and Punch Modules can be customized to permit or deny employees the ability to choose which Department, Job, or Tasks they are working in. In this way employees can be configured with a default Department and/or Job in such a way that they are only permitted to change the task they are punching into and out of.

Optional: The InfiniTime Employee and Punch Modules can also be made available to employees as an alternate method for punching in even if hardware terminals such as the Thor are available. Some companies may wish to disable the ability to use the InfiniTime Employee and Punch modules for punching in and out if hardware terminals are available. This can be accomplished by configuring security for the Employee Punch Information window and disabling access for the employee security role. Refer to the Security Roles Section of this document for more information.

Supported Levels - From 1 to 2 Levels

The Luna, Zephyr, Athena, and Juno support two of the three available Job Costing levels: Departments and Jobs.

Benefits

Mobility: Employees can punch in and out without access to a computer using hardware terminals.

Job Costing: Permits employees to choose between available Departments and Jobs assigned to the reader when punching in and out. Employees can also switch between departments and jobs as needed.

Available Departments & Jobs: A maximum of 100 Departments and 100 Jobs can be assigned to these readers. In this way the supervisor can configure multiple departments and jobs within the InfiniTime Application and only provide employees with the ability to punch into or out of a subset of Departments and Jobs. This feature is most suited for manufacturing or construction environments where specific jobs are performed in the area where the clock is located.

Supported Levels - From 1 to 3 Levels

The Thor supports all three available Job Costing levels: Departments, Jobs, and Tasks.

Benefits

Mobility: Employees can punch in and out without access to a computer using hardware terminals.

Job Costing: Permits employees to choose between available Department, Jobs and Tasks assigned to the reader when punching in and out. Employees can also switch between departments, jobs and tasks as needed.

Available Departments, Jobs, and Tasks: A maximum of 100 Departments, 100 Jobs, and 100 tasks can be assigned to these readers simultaneously. In this way the supervisor can configure multiple departments, jobs, and tasks within the InfiniTime Application and only provide employees with the ability to punch into or out of a subset of Departments, Jobs, and Tasks. This feature is most suited for manufacturing or construction environments where specific jobs and tasks are performed in the area where the clock is located.

Intelligent Transfer: If only a single Department, Job, or Task is assigned to the clock using the Available Departments, Jobs, or Tasks features the Thor will not ask for the employee to enter that item when using the Transfer Button. In this way employees will only be prompted to choose the Task they wish to work under when using the Transfer Button if a single Department and Job are assigned to the reader. This concept can be applied to Departments, Jobs, or Tasks - whereby employees will only have to choose one item be it Department, Job, or Task when using the Transfer Button.

Alternative Transfer - If only a single Department, Job, and Task is assigned to the clock using the Available Departments, Jobs, and Tasks features the Thor will not prompt the employee to enter their Department, Job, or Task when using the Transfer Button. The Thor will simply use the single department, job, and task that have been assigned to the clock. In this way two scenarios can easily be configured for the clock using the Default Department, Job, and Task Settings and the Transfer Button. When employees punch in their activity will automatically be associated with their default Department, Job, and Task. When using the transfer button their activity will be associated with the Department, Job, and Task assigned to the Thor through the Available Departments, Jobs, and Tasks feature.

External Wand: An external reader can be attached to the Thor which reads barcode badges for the purpose of Job Costing. InfiniTime can be configured to parse the number encoded on the badge to find Department, Job, and Task information. In this way employees can quickly swipe a badge to transfer between Departments, Jobs, or Tasks.

Transfer By Item Number: Both the Thor and Scout Terminals support Department, Job, and Task switching through use of item numbers. Each item has a unique numeric identifier which is sent to the clock. Employees can enter this unique identifier in order to select the Department, Job, or Task when punching in. Unique Identifiers for each Job Costing level are displayed below. Refer to the Job Costing Introduction: Job Transfer section of this document for more information.

Supported Levels - From 1 to 3 Levels

The Scout Terminals support all three available Job Costing levels: Departments, Jobs, and Tasks.

Benefits

Mobility: Employees can punch in and out without access to a computer using hardware terminals.

Job Costing: Permits employees to choose between available Department, Jobs and Tasks assigned to the reader when punching in and out. Employees can also switch between departments, jobs and tasks as needed.

Available Departments, Jobs, and Tasks: A maximum of 100 Departments, 100 Jobs, and 100 tasks can be assigned to these readers simultaneously. In this way the supervisor can configure multiple departments, jobs, and tasks within the InfiniTime Application and only provide employees with the ability to punch into or out of a subset of Departments, Jobs, and Tasks. This feature is most suited for manufacturing or construction environments where specific jobs and tasks are performed in the area where the clock is located.

Transfer By Item Number: Both the Thor and Scout Terminals support Department, Job, and Task switching through use of item numbers. Each item has a unique numeric identifier which is sent to the clock. Employees can enter this unique identifier in order to select the Department, Job, or Task when punching in. Unique Identifiers for each Job Costing level are displayed below. Refer to the Job Costing Introduction: Job Transfer section of this document for more information.

Item |

Unique Identifier |

Departments |

Department Number |

Jobs |

Job Number |

Tasks |

Task Number |

Note: The hardware terminals and software modules listed above are the only supported methods for tracking multi-level Job Costing information. A table listing supported Job Costing Levels for all InfiniTime Readers is provided below for quick reference.

Clock Model |

Supported Job Costing Levels |

Supported Information Types |

Apollo SY715 |

1 |

Department |

Athena |

2 |

Department, Job |

Atlas SY777 |

1 |

Department |

Juno |

2 |

Department, Job |

Luna |

2 |

Department, Job |

Omega SY755 |

1 |

Department |

Orion SY760 |

1 |

Department |

Odyssey SY780 |

1 |

Department |

Scout |

3 |

Department, Job, Task |

Thor |

3 |

Department, Job, Task |

Zephyr |

2 |

Department, Job |

It is not uncommon for employee wages to vary based upon the task, job, or department, where employees are working. Wages within InfiniTime can be allocated to a specific Job, Task, Department, or any combination thereof. This makes it possible to calculate gross totals based upon which Department, Job, or Task employees are working in. When using wages with Job Costing it is important to understand how InfiniTime identifies which wage to use for an employee. InfiniTime searches wage records for an employee attempting to match items between the wage record and where the employee is actively working according to the wage hierarchy below. Employees will be paid using the wage corresponding to the first match.

Wage Hierarchy

1.) Department, Job, and Task

2.) Department, Job

3.) Department, Task

4.) Job, Task

5.) Department

6.) Job

7.) Task

For example if an employee worked in the West Coast Marina Department, Job Number 117852, and the Painting Task InfiniTime would first search for a wage record matching all three items - West Coast Marina, 117852, and Painting. If a record was not found for this combination the software would search for a wage record matching Department and Job which in this example is West Coast Marina and 117852. If a wage record was not found for this combination the software would continue down the wage hierarchy searching for a matching wage record. If no match is found the employee's default wage is used.

Configuring a Wage for a specific combination of three items

A wage associated with a specific combination of Department, Job, and Task will take precedence over all other wages. For example if wages are configured as shown below the employee will receive the wage associated with the exact Department, Job, and Task combination worked by the employee rather than the wage associated with the Task the employee is working in. Referring to the Wage Hierarchy this occurs because InfiniTime will match a wage associated with Department, Job, and Task before a wage associated with just the Task. Additional examples are below. The highlighted wage record is the wage the employee will be paid.

Example 1

Working Department (Customer) |

Working Job (Job Number) |

Working Task (Task) |

West Coast Marina |

117852 |

Painting |

Example 2

Working Department (Customer) |

Working Job (Job Number) |

Working Task (Task) |

West Coast Marina |

117852 |

Painting |

The above examples illustrate how employees will receive the wage associated with the particular Department, Job, and Task they are working on even if another wage is defined for each individual item or a combination thereof.

Configuring a Wage for a specific combination of two items

A wage associated with a specific combination of two items should be used if employees receive a specific wage when working under two items such as a specific Department and Task or a specific Job and Task. For example if an employee receives $8 when working in the West Coast Marina Department and performing the Painting Task regardless of what Job they are working on a wage should be created and associated with the West Coast Marina Department and Painting Task as shown below. It is important to keep the Wage Hierarchy in mind when associating a wage with a combination of two items. In example 2 the employee would be paid $8 per hour rather than $10 because a wage matching the exact working Department, Job, and Task is present. This will be matched before the combination of Department and Task.

Example 1

Working Department (Customer) |

Working Job (Job Number) |

Working Task (Task) |

West Coast Marina |

117852 |

Painting |

Example 2

Working Department (Customer) |

Working Job (Job Number) |

Working Task (Task) |

West Coast Marina |

117876 |

Painting |

The above examples illustrate how the employee will receive the wage associated with their particular Task and Department regardless of what job they are working on unless a wage record exists that matches the Department, Job, and Task worked by the employee.

Configuring a Wage for a specific item

Wages should be configured for a specific item such as a Department, Job, or Task when employees have a set wage for the item. For example, if an employee was paid $10 per hour when painting regardless of what job or department he was painting under a wage should be created and associated with the Painting task only as shown below. In this way it would not matter what department or job the employee was working under as long as he was performing the painting task he would receive $10 per hour. It is important to keep the Wage Hierarchy in mind when associating a wage with a single item. In example 2 the employee would be paid $8 per hour rather than $10 because a wage matching the exact working Department, Job, and Task is present.

Example 1

Working Department (Customer) |

Working Job (Job Number) |

Working Task (Task) |

Ahbor Harbor |

117852 |

Painting |

In the example above even though there is a wage record for each item where the employee is working the Department record takes precedence as it is matched first due to the Wage Hierarchy.

Example 2

Working Department (Customer) |

Working Job (Job Number) |

Working Task (Task) |

West Coast Marina |

117876 |

Painting |

The above examples illustrate how the employee will receive the wage associated with a single item unless a different record is matched due to the Wage Hierarchy as in Example 2.

Other Activity Types permit InfiniTime administrators to define 'non-working' hours and earning types for items such as Paid Leave, Unpaid Leave, Tips, Commissions, and Bonuses. InfiniTime provides support for an unlimited number of Other Activity Types. Other Activity entries can be entered in hours, currency, or units depending on the requirements and capabilities of your payroll application. The Other Activity Table, as shown below, is used to Insert, Modify, and Delete Other Activity Types within InfiniTime. As part of the initial configuration of InfiniTime, one Other Activity Type should be created for each 'non-working' Hours / Earning Type tracked by your organization. Examples of typical Other Activity Types are provided in the Other Activity usage section below.

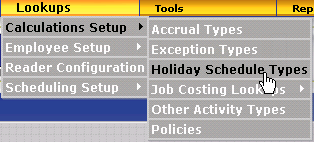

Accessing the Other Activity Types Table

.gif)

.gif)

Insert – Inserts a new record into the Other Activity Type Table. Opens the Other Activity Update Form.

Change – Opens the Other Activity Type Update form and permits editing of the selected record.

Delete – Removes the highlighted record from the Other Activity Table.

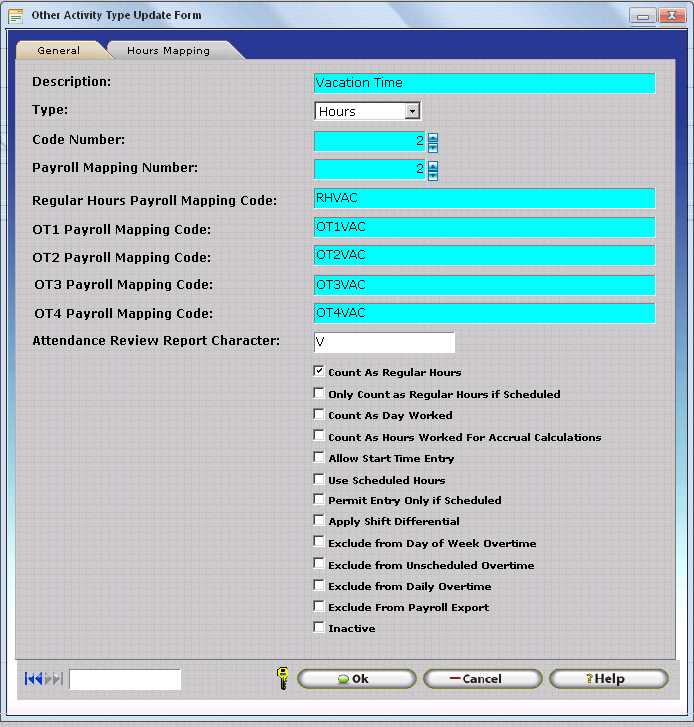

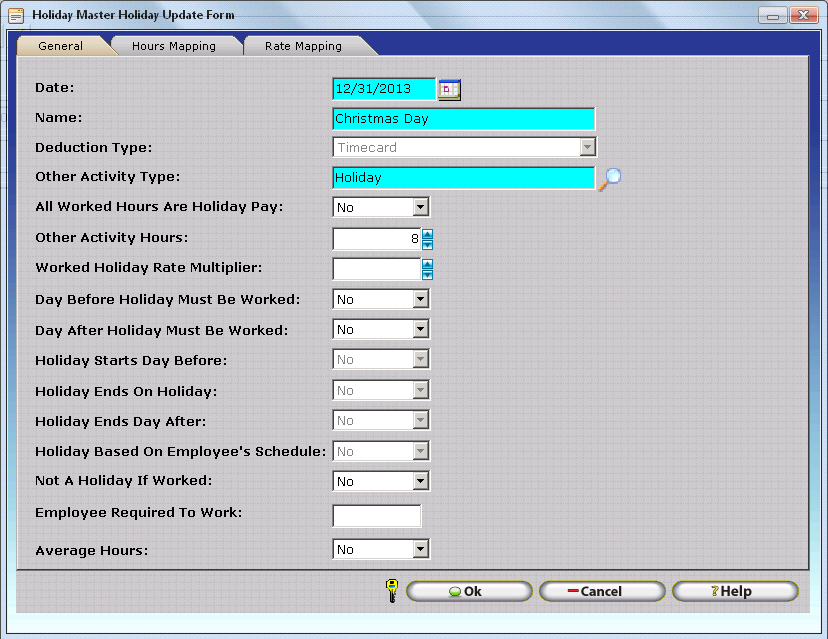

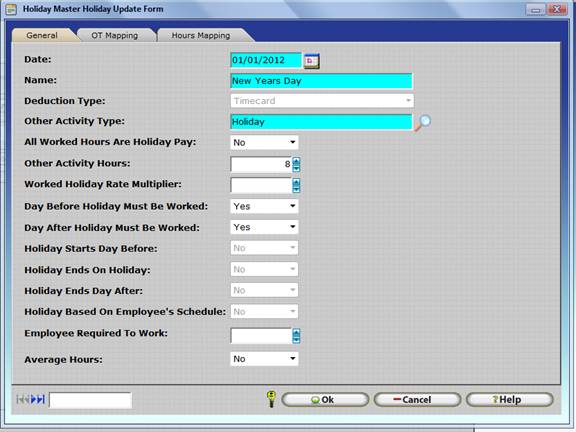

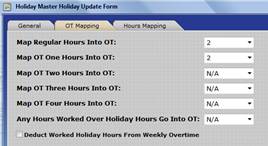

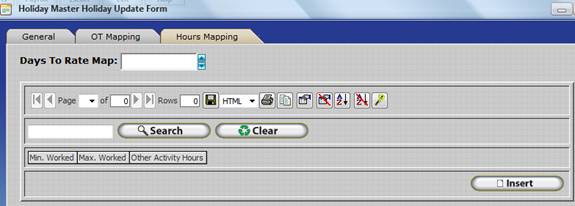

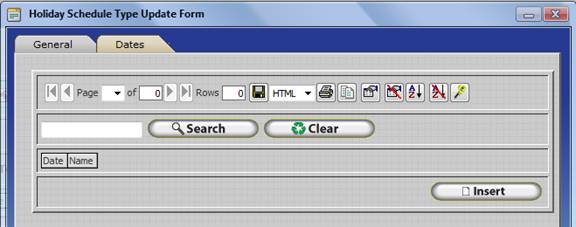

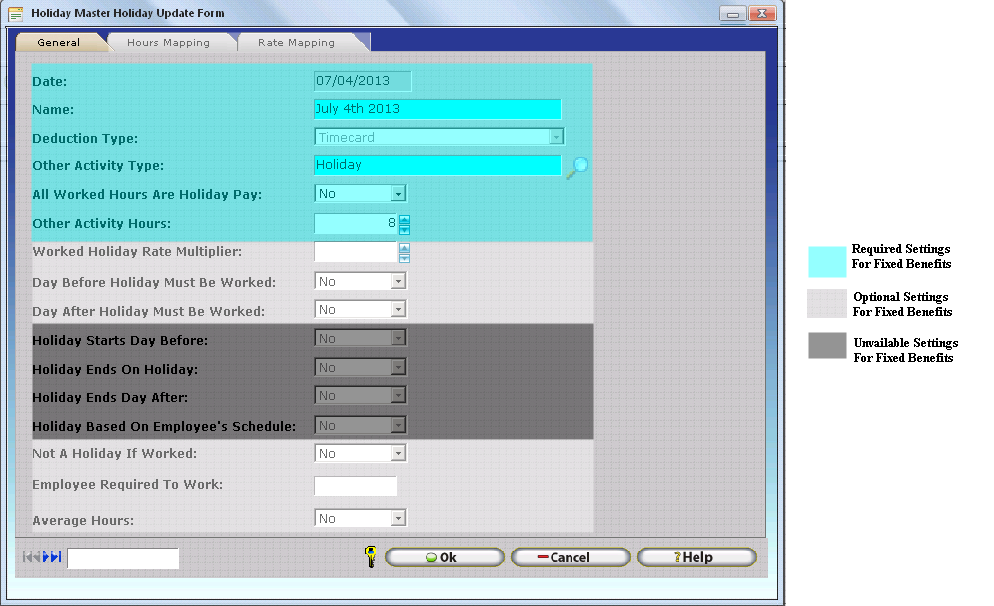

The Other Activity Update Form includes all options and settings related to Other Activity Types. Each option is outlined below.

Description – Type the name of the Other Activity Type.

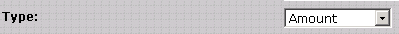

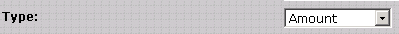

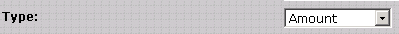

Type – Specify whether the Other Activity Type will track a dollar amount or hour amount.

Code Number – The Code Number is a unique identifier within the InfiniTime Database. Each other activity type must have a unique code number in order to set them apart. This code number is used on many hardware terminals to input other activity directly at the clock without accessing the software. All hardware terminals offered by Inception Technologies support this feature except for the Plus Scanner.

Payroll Mapping Number – Enter a mapping number. The payroll mapping number can be the same for multiple other activity types. This number specifies a column in a payroll export file where hours or amounts for the other activity type will be totaled. If more than one other activity type has the same payroll mapping number their values will be added together and totaled in the same column. Mapped Payroll Interfaces provide the customer with the ability to add additional other activity types and move their position within the payroll export on the fly.

The Compupay – Mapped Interface Format is one such payroll interface. An outline of the Compupay - Mapped interface format is provided below. The outline shows a row of headers which represent information that would be exported when performing a payroll export. The resulting export file can then be imported directly into the Compupay application. It is important to understand how Other Activity Types are automatically exported to the appropriate column according to their Payroll Mapping Number. Other Activity Types with Payroll Mapping Number 1 will be totaled in the column labeled Mapped Amount 1. Other Activity Types with Payroll Mapping Number 2 will be totaled in the column labeled Mapped Amount 2.

Employee ID |

Activity Dept Number |

Regular Hours |

Overtime Hours |

Mapped Amnt. 1 |

Mapped Amnt. 2 |

Mapped Amnt. 3 |

Payroll Mapping Codes are agreed upon by each company and the firm responsible for their payroll. With this in mind it is not surprising that Payroll Mapping Codes often vary from company to company. These codes are generally known to payroll personnel or the company responsible for your payroll. Additional details on the use of Payroll Codes and Payroll Mapping Codes can be found in the following sections of this document:

Payroll Export User Interface Overview - Payroll Codes Tab

Payroll Export - Payroll Interface Features & Related Configuration

Payroll Interface Layout Report

Regular Hours Payroll Mapping Code - Enter a Payroll Mapping Code to be used for Regular Hours and / or Other Hours on the respective Other Activity Type. Much like the Payroll Mapping Number, the Regular Hours Payroll Mapping Code can be the same for multiple other activity types, however it is generally used as a unique code to identify an Hours / Earnings Type.

OT1 Payroll Mapping Code - Enter a Payroll Mapping Code to be used for OT1 Hours on the respective Other Activity Type. This field is disabled unless 'Count as Regular Hours' or 'Only Count as Regular Hours if Scheduled' is checked for the respective other activity type. Much like the Payroll Mapping Number, the OT1 Payroll Mapping Code can be the same for multiple other activity types, however it is generally used as a unique code to identify an Hours / Earnings Type.

OT2 Payroll Mapping Code - Enter a Payroll Mapping Code to be used for OT2 Hours on the respective Other Activity Type. This field is disabled unless 'Count as Regular Hours' or 'Only Count as Regular Hours if Scheduled' is checked for the respective other activity type. Much like the Payroll Mapping Number, the OT2 Payroll Mapping Code can be the same for multiple other activity types, however it is generally used as a unique code to identify an Hours / Earnings Type.

OT3 Payroll Mapping Code - Enter a Payroll Mapping Code to be used for OT3 Hours on the respective Other Activity Type. This field is disabled unless 'Count as Regular Hours' or 'Only Count as Regular Hours if Scheduled' is checked for the respective other activity type. Much like the Payroll Mapping Number, the OT3 Payroll Mapping Code can be the same for multiple other activity types, however it is generally used as a unique code to identify an Hours / Earnings Type.

OT4 Payroll Mapping Code - Enter a Payroll Mapping Code to be used for OT4 Hours on the respective Other Activity Type. This field is disabled unless 'Count as Regular Hours' or 'Only Count as Regular Hours if Scheduled' is checked for the respective other activity type. Much like the Payroll Mapping Number, the OT4 Payroll Mapping Code can be the same for multiple other activity types, however it is generally used as a unique code to identify an Hours / Earnings Type.

Other Activity Type |

Example Payroll Mapping Codes |

Holiday Hours |

HOL, HOLIDAY |

Vacation Hours |

VAC, VACATION |

Sick Time Hours |

SICK, SIC, SIK |

Personal Time Hours |

PER, PERS, PERSONAL |

Attendance Review Report Character - Enter a single character to be displayed on the Attendance Review Report for dates with Hours and / or Other Amounts for the respective Other Activity Type. Refer to the Attendance Review Report section of the Report Library for additional details.

Count As Regular Hours - When this option is checked hours entered under this other activity type will count as regular hours and will be counted toward both daily, weekly, Day Of Week, and Unscheduled Overtime as configured within an employee's assigned policy. InfiniTime Administrators may choose to specifically exclude the respective Other Activity Type from certain types of Overtime by checking additional options as outlined below.

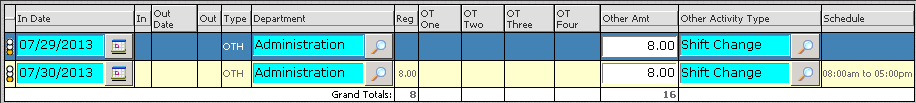

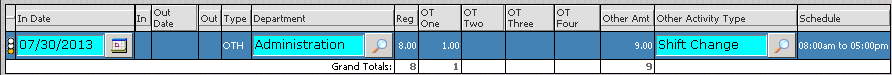

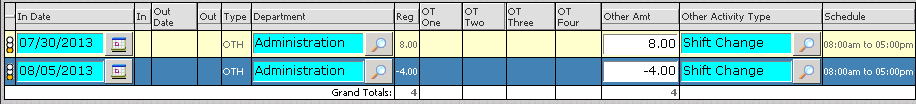

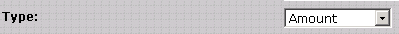

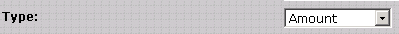

Only Count as Regular Hours if Scheduled - When this option is checked, hours entered under the respective Other Activity Type will only be counted as regular hours // totaled toward Daily, Weekly, Day Of Week, and Unscheduled Overtime on dates which an employee is scheduled. If the respective Other Activity Type should be inserted on a date where the employee is not scheduled, the hours will simply be paid as Other Hours under the Regular Hours Payroll Mapping Code. This concept is illustrated below. Notice how Other Hours for the Shift Change Other Activity Type are totaled in the regular column only on 7/30/13 where the employee was scheduled to work.

Count As Day Worked – When this check box is checked, the date on which the respective Other Activity Type is inserted will be counted as a Worked Day. This option is used for two purposes:

Count As Hours Worked for Accrual Calculations - When this option is checked, Other Activity Hours for the Other Activity Type will be counted toward the Accrue X Hours for Y Hour(s) Accrual Calculation. This makes it possible for employees to earn accrual hours based on Worked Hours (Regular, Overtime 1, Overtime 2, Overtime 3, Overtime 4) and Other Activity Types such as Vacation, Personal Time, Jury Duty, etc.

Allow Start Time Entry - When this option is checked, InfiniTime will prompt the user to enter the Start Time when inserting Other Hours for the respective Other Activity Type. In this way, the Other Activity Hours can be properly mapped according to Unscheduled Hours Mapping rules and Shift Differential Rules configured on an employee's policy. Allow Start Time Entry must be checked in order to check 'Apply Shift Differential' for a given Other Activity Type. Allow Start Time Entry is only available for Other Activity Types set to 'Count as Regular Hours' or 'Only Count as Regular Hours if Scheduled'.

Use Scheduled Hours - If this option is checked, InfiniTime will automatically set the Other Hours to match the duration of the employee's schedule on the respective date. When 'Use Scheduled Hours' is enabled, users may not directly enter or edit the Other Hours for a given date for the respective Activity Type. Additionally, the respective activity type cannot be inserted for an employee with no scheduled hours on a given date.

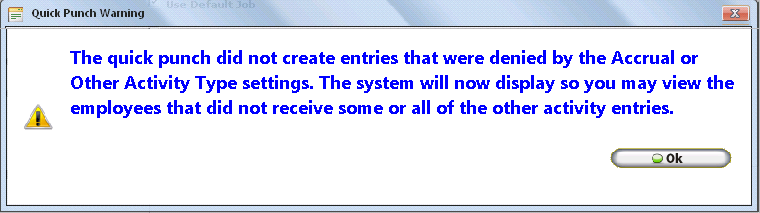

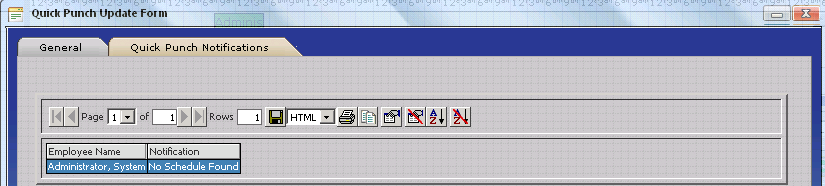

Permit Entry Only If Scheduled - If this option is checked, InfiniTime will only permit the respective Other Activity Type to be inserted on days where an employee has a Schedule. If an Other Activity Type with this option is entered via Other Activity Entry from a Hardware Terminal on a date where an employee does not have a schedule the Other Activity Entry will be ignored by the InfiniTime Software during the polling process and the Other Activity Hours will not be posted to the employee's timecard. The warnings below are displayed if a user should attempt to insert an Other Activity Type with 'Permit Entry Only if Scheduled' Checked on a date where an employee is not scheduled.

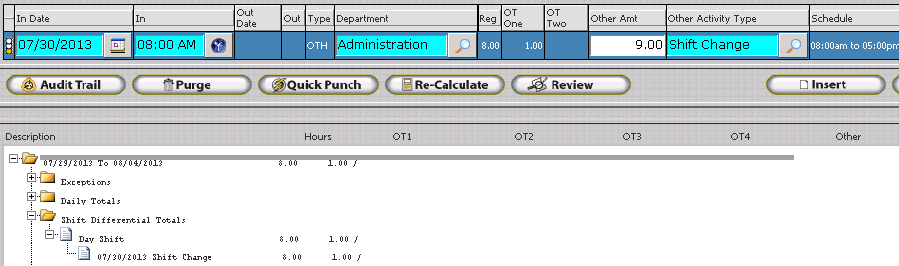

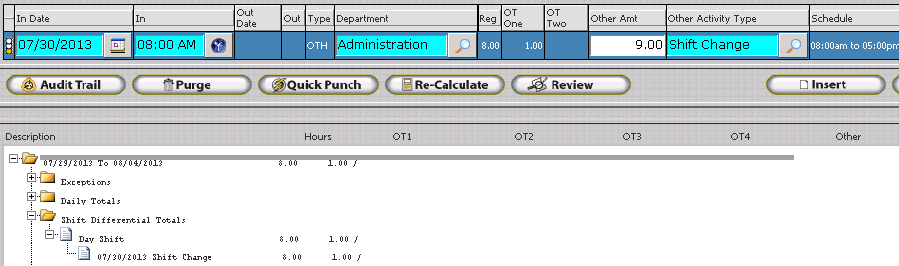

Apply Shift Differential - If this option is checked, Other Hours for the respective Other Activity Type will be counted toward Shift Differential Hours in accordance with the Shift Differential Pay Method and Shifts assigned to the employee's policy. 'Apply Shift Differential' is only available if 'Allow Start Time Entry' and 'Count as Regular Hours' or Only Count as Regular Hours if Scheduled' are checked. The example below shows Other Hours for the Other Activity Type Shift Change applied toward the Day Shift Differential from 8:00 AM to 5:00 PM.

Exclude From Day Of Week Overtime - If this option is checked, Hours for the respective Other Activity Type will not count toward Day of Week Overtime. 'Exclude from Day of Week Overtime' is only available for Other Activity Types with 'Count as Regular Hours' or Only Count as Regular Hours if Scheduled' checked. For example, if an employee were to have Vacation Time, which is set to Count as Regular Hours, on a Sunday where they would usually get Day of Week Overtime for worked hours and 'Exclude From Day Of Week Overtime' is checked, the employee would simply be paid their regular base rate for Vacation Time Hours on Sundays instead of the Day Of Week Overtime Rate.

Example: Company XYZ Excludes Vacation Time from Day of Week Overtime. Employees who are normally scheduled to work on Sunday must use their vacation time to take a day off. Vacation Time Hours are counted toward Weekly Overtime Hours and as such the Vacation Time Other Activity Type is set to count as regular hours. However, XYZ Company only pays Sunday Day Of Week Overtime on worked hours. Benefits such as Vacation Time are paid at base rate. The screenshots below show how Exclude from Day Of Week Overtime can be used to properly exclude Vacation Time from Day of Week Overtime.

Related Settings:

OT1 = Daily > 8 Hours

Sunday Day of Week Regular Hours -> OT2

Sunday Day of Week OT1 Hours -> OT2

Exclude From Day Of Week Overtime Unchecked:

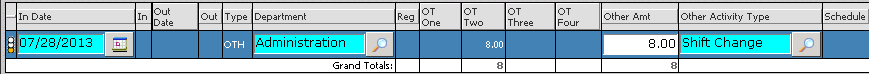

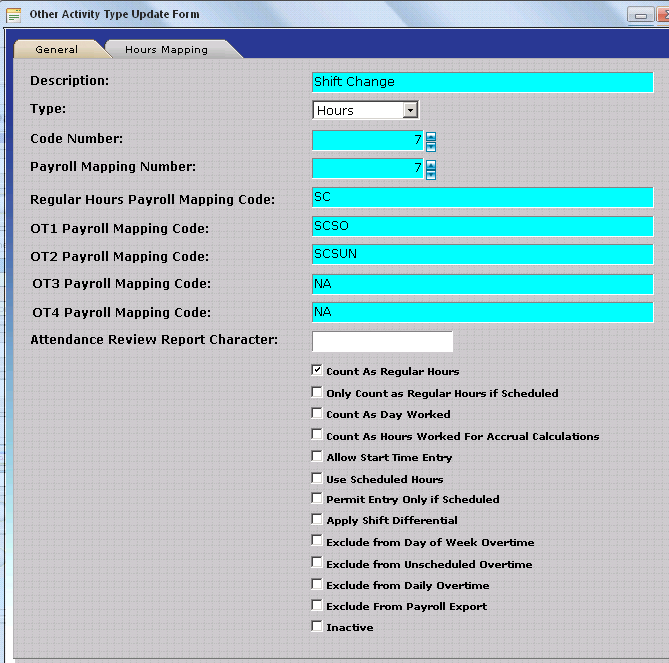

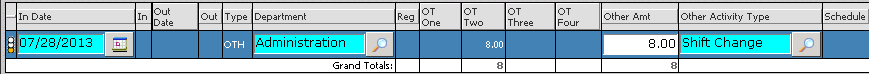

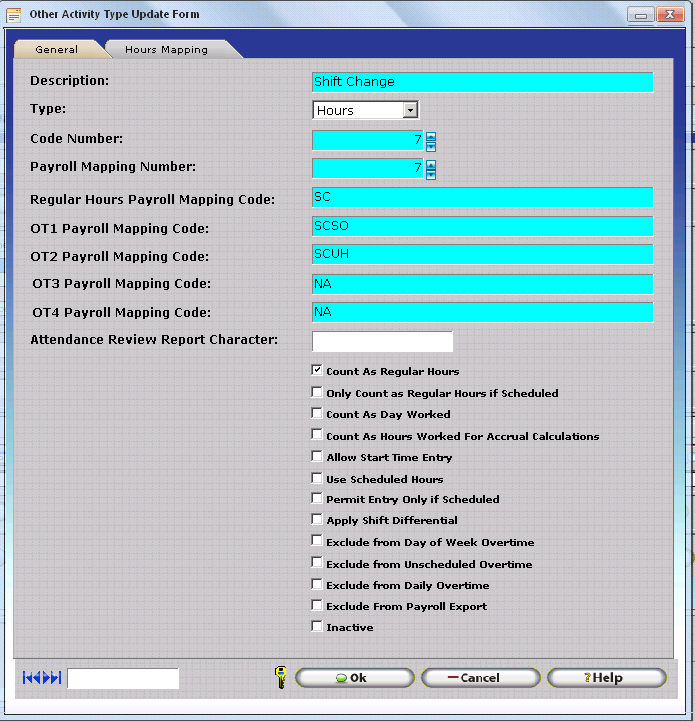

With 'Exclude From Day of Week Overtime' unchecked, hours for an other activity type set to Count as Regular Hours are subject to Day of Week Overtime Rules. Notice how all hours are posted to Overtime 2 in accordance with Sunday Day of Week Overtime settings. The Configuration for the Shift Change Other Activity Type in this scenario is shown below.

Exclude From Day of Week Overtime Checked:

With 'Exclude From Day of Week Overtime' unchecked, hours for an other activity type set to Count as Regular Hours are excluded from Day of Week Overtime Rules. Notice how all hours for the Shift Change Other Activity Type are paid as Regular Hours even though they fall on a Sunday. The Configuration for the Shift Change Other Activity Type in this scenario is shown below.

Exclude From Unscheduled Overtime - If this option is checked, Hours for the respective Other Activity Type will not count toward Unscheduled Overtime. 'Exclude from Unscheduled Overtime' is only available for Other Activity Types with 'Count as Regular Hours' or 'Only Count as Regular Hours if Scheduled' checked. For organizations who track Unscheduled Hours via Unscheduled Hours Mapping settings on the Schedule Settings / Rules Section of the Policy it is common for most Other Activity Types, especially Other Activity Types for Paid Time Off such as Vacation Time or Holiday Pay, to be excluded from Unscheduled Overtime.

Example: Company XYZ Excludes Holiday Pay from Unscheduled Overtime. If a Company Observed Holiday Date falls on a day the employee is not scheduled to work, XYZ Company pays the employee their base rate for the day. Employees not scheduled to work on a Holiday Date do not receive Unscheduled Overtime.

Related Settings:

OT1 = Daily > 8 Hours

Unscheduled Regular Hours -> OT2

Unscheduled OT1 Hours -> OT2

Exclude From Unscheduled Overtime Unchecked:

With 'Exclude From Unscheduled Overtime' unchecked, hours for an other activity type set to Count as Regular Hours are subject to Unscheduled Hours Mapping. Notice how all hours are posted to Overtime 2 in accordance with Unscheduled Hours Mapping settings. The Configuration for the Shift Change Other Activity Type in this scenario is shown below.

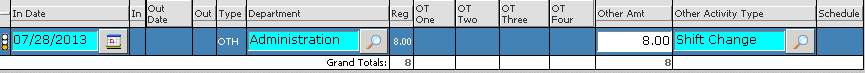

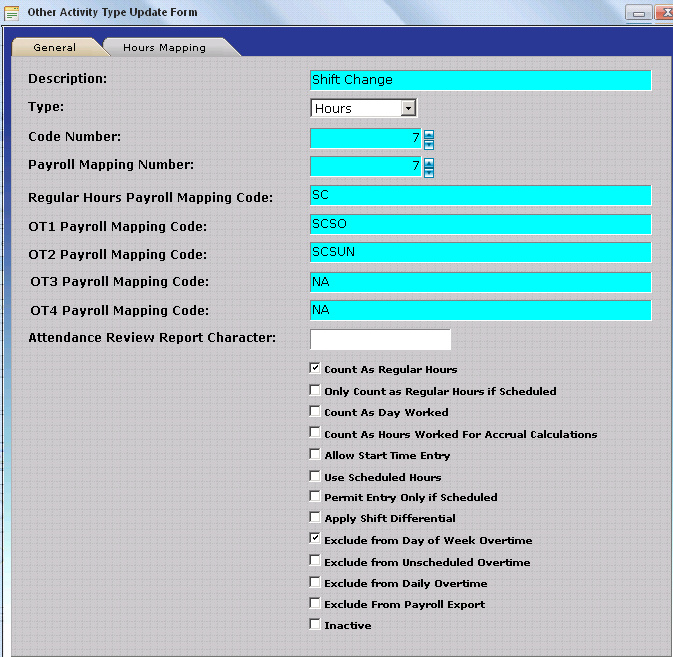

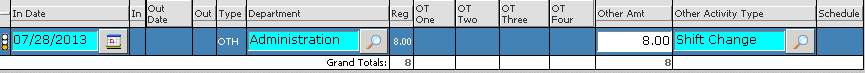

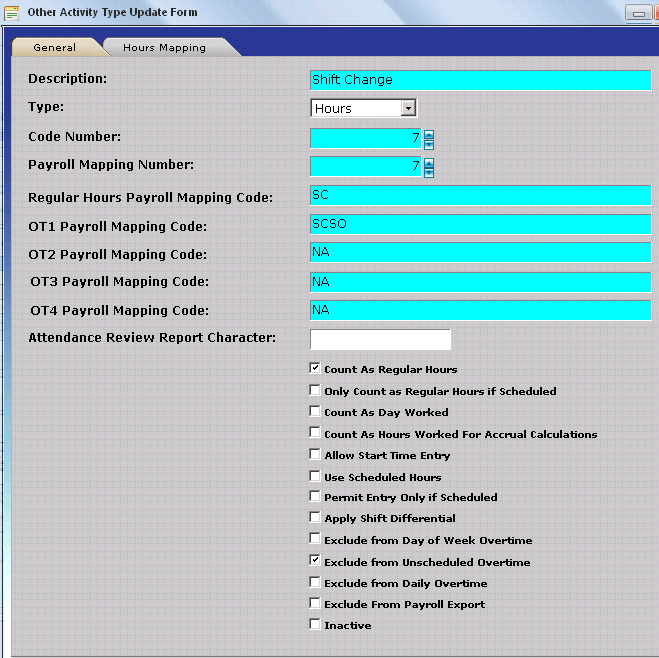

Exclude From Unscheduled Overtime Checked:

With 'Exclude From Unscheduled Overtime' checked, hours for an other activity type set to Count as Regular Hours are excluded from Unscheduled Hours Mapping. Notice how all hours for Shift Change are paid as regular hours even though the employee does not have a schedule on 7/28/2013. The Configuration for the Shift Change Other Activity Type in this scenario is shown below.

Exclude From Daily Overtime - If this option is checked, Hours for the respective Other Activity Type will not count toward Daily Overtime. 'Exclude from Daily Overtime' is only available for Other Activity Types with 'Count as Regular Hours' or 'Only Count as Regular Hours if Scheduled' checked.

Example: Company XYZ counts Jury Duty Hours toward Weekly Overtime but excludes Jury Duty Hours from Daily Overtime. If an employee is out of the office for Jury Duty, and they report to work on the same day for a different shift, the employee will not be eligible for Overtime Unless they work more than 8 hours on the respective date or if they have worked in excess of 40 Hours for the work week.

Related Settings:

OT1 = Daily > 8 Hours, Weekly > 40 Hours

Deduct Daily OT From Weekly OT = Checked

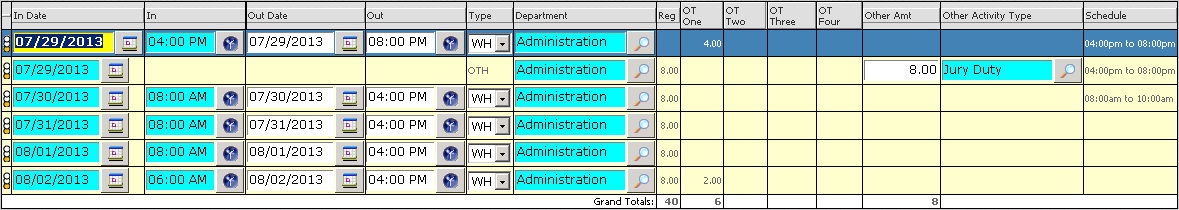

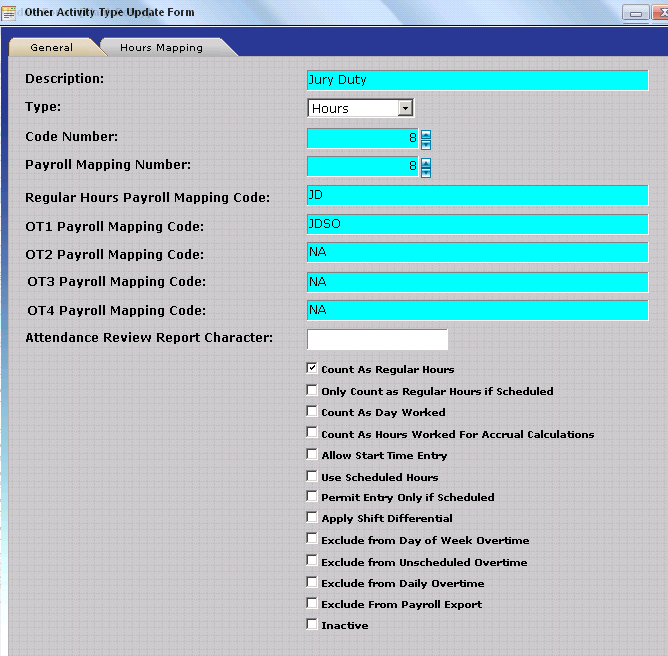

Exclude From Daily Overtime Unchecked:

With 'Exclude From Unscheduled Overtime' unchecked, hours for an other activity type set to Count as Regular Hours are subject to Daily Overtime Rules. Notice how worked hours from 4:00 PM to 8:00 PM on 7/29/13 are counted toward OT1. The Configuration for the Jury Duty Other Activity Type in this scenario is shown below.

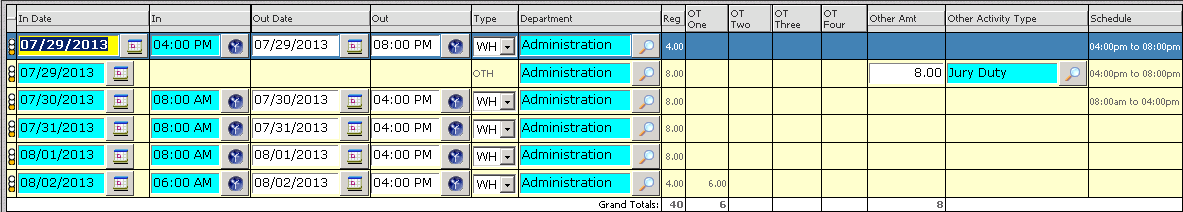

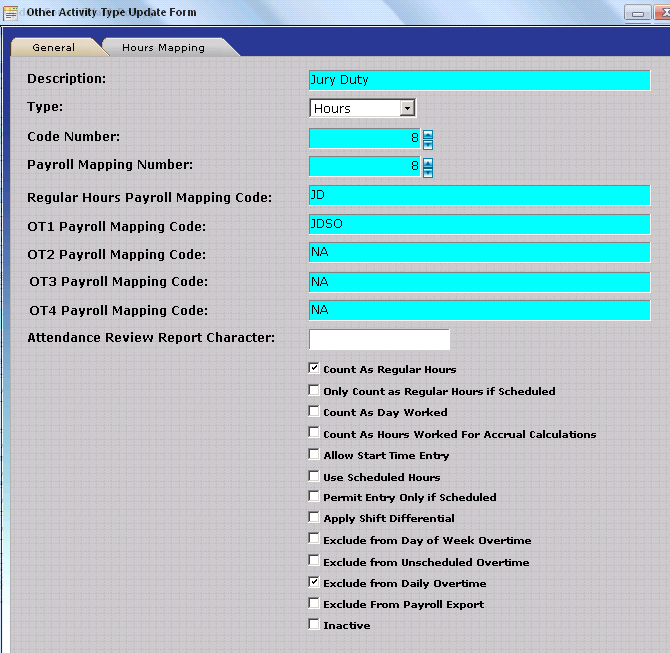

Exclude From Unscheduled Overtime Checked:

With 'Exclude From Unscheduled Overtime' checked, hours for an other activity type set to Count as Regular Hours are excluded from Daily Overtime Rules. Notice how worked hours on 7/29/13 from 4:00 PM to 8:00 PM resulting in a total of 12 Regular Hours on 7/29/2013. The employee then does not qualify for Overtime Hours until they work beyond the 40 Hours in the Work Week on 8/2/13. The Configuration for the Shift Change Other Activity Type in this scenario is shown below.

Exclude From Payroll Export – Placing a check in this box will allow the other activity to be excluded from the payroll export. This option should be checked for any Other Activity Types which are intended for use within the Time and Attendance System for tracking purposes only. Other Activity Records on Employee Timecards for Other Activity Types with this option checked will not be exported by the Payroll Export, though they will be displayed on reports within InfiniTime.

Inactive – Placing a check in this box will make the respective Other Activity Type Inactive. The respective Other Activity Type will no longer be available for selection when inserting an Other Activity via Quick Punch, Time Off Requests, or from Hardware Terminals such as the Thor.

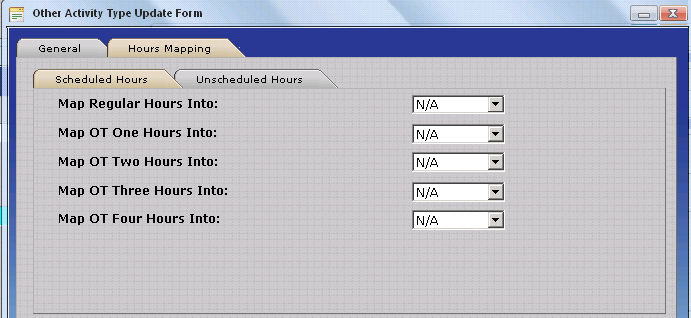

The Hours Mapping Tab of the Other Activity Update Form is only displayed if 'Count as Regular Hours' or 'Only Count as Regular Hours if Scheduled' are checked for an Other Activity Type. Hours Mapping permits employee hours worked in a given hours type to be mapped to a different hours type based on specific conditions such as:

Scheduled Hours worked on a specific Department

Scheduled Hours worked on a specific Job

Scheduled Hours worked on a specific Task

Scheduled Hours worked on a specific Other Activity Type

Unscheduled Hours worked on a specific Department

Unscheduled Hours worked on a specific Job

Unscheduled Hours worked on a specific Task

Unscheduled Hours worked on a specific Other Activity Type

The Hours Mapping Tab of the Other Activity Update Form defines Hours Mapping settings for the respective Other Activity Type. Hours mapping settings configured for an Other Activity Type will be applied to scheduled and unscheduled hours for the respective Other Activity Type. Hours Mapping is considered an advanced feature and is only required by approximately 30% of production InfiniTime Installations. Organizations with Labor Unions and specific hours costing or pay premium rules for scheduled vs unscheduled hours often find Hours Mapping to be required. Additional details on configuring and utilizing Hours Mapping can be found in the Hours Mapping Section of this document.

Other Activity Types are a highly versatile part of the InfiniTime Time and Attendance application. Other Activity Types can be configured to meet time and attendance and Human Resources policies for companies ranging in size with tens of employees and basic Time and Attendance Requirements to companies with thousands of employees and complex Union Based Labor Contracts. To meet the diverse needs of both small business and enterprise customers, InfiniTime offers several methods for entering Other Hours and / or Dollar Amounts for specific Other Activity Types. Additionally, Other Activity Types can be configured to track a variety of Hours and Earnings Types for specific usage purposes.

Other Activity Types are used within InfiniTime to track Hours and Earnings Types which such as Paid Leave, Unpaid Leave, Commissions, Bonuses, and Tips. With this in mind, inserting hours and / or Dollars for specific Other Activity Types as appropriate to show the benefits used and / or earned by an employee is an integral part of the recurring Employee Timecard Review and Editing process. Other Hours and Other Amount entries can be inserted in multiple ways as outlined in the table below.

Method of Entry |

Overview |

| Manually via Quick Punch | Other Activity Hours and / or Dollar Amounts can be entered manually using the Quick Punch Feature from the Company Timecard or Employee Timecard. This method is commonly used to insert hours for Other Activity Types whose occurrence cannot be anticipated such as Sick Time or Personal Time. |

| Manually via Approval of a Time Off Request | Other Activity Hours are inserted by InfiniTime

upon approval of a Time Off Request sent by an employee. This

feature is regularly used by organizations who do one or more

of the following:

|

| Manually via Function Keys at a Hardware Terminal (IE: Thor, Zephyr, Scout) | Other Activity Hours and / or Dollar Amounts can be entered manually via Function Keys at Hardware Terminals configured to communicate with the InfiniTime Software. This provides a convenient interface for entering Other Activity Hours immediately while at the Job Site and / or Work Area without accessing the InfiniTime Manager Module. |

| Manually via Telephone Punch Menu Prompts using Telephone Punch | Other Activity Hours and / or Dollar Amounts can be entered manually via Telephone Punch Menu Prompts by calling into the Telephone Punch Menu and selecting the appropriate menu options. This provides a convenient interface for entering Other Activity Hours and / or Dollars immediately while in the field without accessing the InfiniTime Manager Module. InfiniTime Telephone Punch is ideal for organizations with a high transaction volume. (IE: Thousands of Employees Punching multiple times per day over a wide geographic area). |

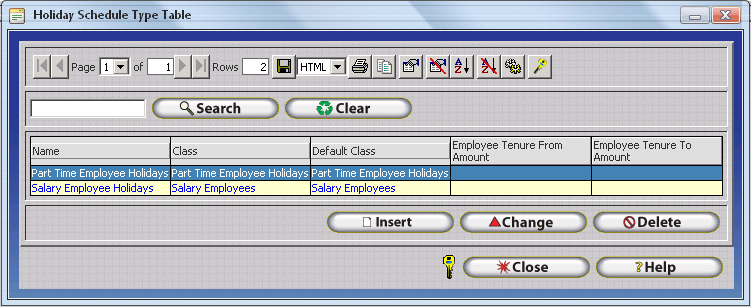

| Automatically via Holiday Dates for a Non-Working Holiday | InfiniTime Holiday Types permit specific Dates to be defined as Holidays. InfiniTime can then automatically insert Other Activity Hours, such as 'Holiday Time', for employees eligible for Paid Holidays. |

| Automatically via Holiday Dates for a Working Holiday | InfiniTime Holiday

Types permit specific Dates to be defined as Holidays. For organizations

with employees who receive different pay rates for working on

a Holiday Date, InfiniTime

can be configured to automatically separate and track hours paid

at different rates for eligible employees through use of one or

more of the following features as appropriate based on your organization's

rules:

|

| Automatically via Stand By Time | Stand by time is intended for use with on call employees. When Stand By Time is configured on a given policy, Other Hours are automatically inserted for a specific Other Activity Type for each Day Of Week configured for Stand By Time for all employees assigned to the policy. |

InfiniTime permits entry of both positive and negative values for Other Activity Types making it possible to enter adjustments to specific Hours and Earning Types. Specific purposes for Other Activity Types and common uses for each are listed below.

| Usage Purpose | Example(s) |

| Add Other Hours to be Paid to Employees | Add Jury Duty Hours |

Adjust Other Hours to be Paid to Employees |

Negate System Holiday Record |

| Add Other Amounts to be Paid to Employees | Add additional pretax earnings such as Sales Commission to an employee's timecard |

Adjust Other Amounts to be Paid to Employees |

Subtract additional pretax earnings such as Sales Commissions from an employee's timecard |

Add Taxable Earnings |

Add Tips to an Employee's Timecard |

Adjust Taxable Earnings |

Subtract Tips from an Employee's Timecard |

Add to Units Tracked |

Add Piece Counts to an Employee's Timecard |

Adjust Units Tracked |

Subtract Piece Counts from an Employee's Timecard |

Deduct Used Benefits from an Accrual Type |

Deduct Other Hours inserted for One or More Other Activity Types from an employee's Available Accrued Balance for an Accrual Type |

Other Hours are inserted for Other Activity Types to track hours for various categories of Paid and Unpaid Leave. Several examples of common types of Paid and Unpaid Leave tracked by InfiniTime Customers are provided below.

| Vacation Time | Sick Time | Personal Time |

| Jury Duty | Bereavement | Marriage |

Maternity Leave |

Paternity Leave | Family Leave |

Adding Other Hours to be paid to an employee with a Positive Entry

1. Ensure an Other Activity Type exists for each type of Other Hours tracked by your organization.

2. Other Activity Options, as outlined above, must be configured for each Other Activity Type as appropriate based on your organization's Time and Attendance & HR Rules.For Other Hours, the Other Activity Type must be set to the Hours Type as shown below.

3. Open the Company Timecard Table

4. Search for the employee you wish to insert Other Hours for.

5. Set the Date Range to include the date(s) you wish to insert Other Hours For.

6. Click on Quick Punch.

7. Set the Type to Other Activity.

8. Specify the previously created Other Activity Type for which you wish to insert Other Hours by typing the first several characters of the Other Activity Type's description or use the Lookup Button.

9. Enter the desired number of Other Activity Hours. Be sure to enter a positive value without a minus (-) sign. InfiniTime permits values of -24.00 Hours to 24.00 Hours to be inserted for Other Activity Types of the Hours Type.

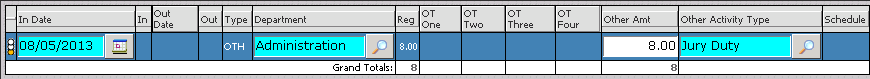

10. Click OK. The example below shows 8.00 Jury Duty Hours to be paid to an employee.

Adjusting Other Hours with a Negative Entry using the Same Other Activity Type

1. Ensure an Other Activity Type exists for each type of Other Hours tracked by your organization.

2. Other Activity Options, as outlined above, must be configured for each Other Activity Type as appropriate based on your organization's Time and Attendance & HR Rules. For Other Hours, the Other Activity Type must be set to the Hours Type as shown below.

3. Open the Company Timecard Table

4. Search for the employee you wish to Adjust Other Hours for.

5. Set the Date Range to include the date(s) you wish to Adjust Other Hours For.

6. Click on Quick Punch.

7. Set the Type to Other Activity.

8. Select the previously created Other Activity Type for which you wish to adjust Other Hours by typing the first several characters of the Other Activity Type's description or use the Lookup Button.

9. Enter the desired number of Other Activity Hours. Enter a negative value with a minus (-) sign.

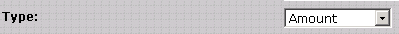

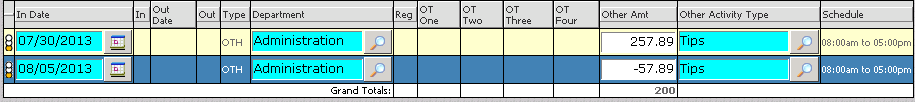

10. Click OK. The example below shows a Negative Other Activity Entry used to offset an overpayment of an Other Activity Type from a prior period. The negative value on 8/5/13 will be transferred to payroll and deducted from the employee's final gross pay.

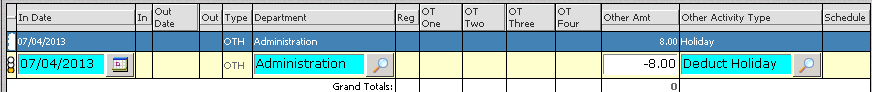

Adjusting Other Hours with a Negative Entry using a Different Other Activity Type

1. This method for adjusting Other Hours is specifically required to adjust a System Holiday Record created by InfiniTime for a Holiday Date, though it may also be used to adjust hours in other scenarios if desired. By creating a separate Other Activity Type for Adjustment Purposes Administrators can run reports with the Deduct Other Activity Type tagged to see only Adjustment Entries.

2. Create a second Other Activity Type with the same options, Payroll Mapping Number, and Payroll Mapping Codes as the original Other Activity Type you wish to adjust. For clarity, the Description of the new other Activity Type should be unique and should include 'Adjust' or 'Deduct' to clearly show the Other Activity Type is intended for adjustment purposes.

3. Open the Company Timecard Table

4. Search for the employee you wish to Adjust Other Hours for.

5. Set the Date Range to include the date(s) you wish to Adjust Other Hours For.

6. Click on Quick Punch.

7. Set the Type to Other Activity.

8. Select the previously created Other Activity Type by typing the first several characters of the Other Activity Type's description or use the Lookup Button.

9. Enter the desired number of Other Activity Hours. Enter a negative value with a minus (-) sign.

10. Click OK. The example below shows a Negative Other Activity Entry used to negate a system holiday record.

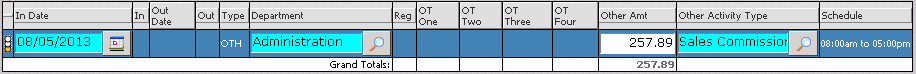

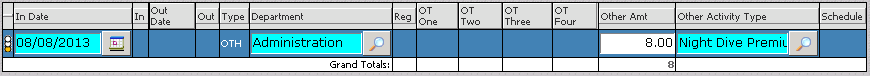

Other Amounts are inserted for Other Activity Types to track payable currency amounts for various categories of earnings. Several examples of common types of earnings tracked by InfiniTime Customers are provided below.

| Sales Commissions | Misc. Earnings |

Expense Reimbursements |

|

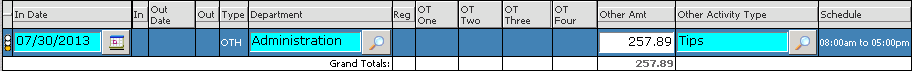

1. Ensure an Other Activity Type exists for each Other Amount // Earnings Type tracked by your organization.